Latest Version

2.0.0

May 01, 2025

United Bank for Africa Plc

Tools

Android

0

Free

com.ubagroup.securepass

Report a Problem

More About UBA Secure Pass

Revolutionizing Banking: The DIY App Activation Model

In today's fast-paced digital world, convenience is key. The banking sector has embraced this shift by introducing innovative solutions that empower users. One such advancement is the do-it-yourself (DIY) app activation model, which enables customers to activate their banking applications independently, eliminating the need to visit a physical branch.

The Rise of DIY Banking Solutions

As technology continues to evolve, traditional banking methods are becoming increasingly outdated. Customers now seek seamless experiences that fit their busy lifestyles. The DIY app activation model addresses this demand by allowing users to take control of their banking needs from the comfort of their homes.

Benefits of Self-Activation

Self-activation of banking apps offers numerous advantages:

- Time-Saving: Users can activate their apps at their convenience, avoiding long queues and waiting times at bank branches.

- Enhanced Accessibility: This model caters to individuals who may have mobility issues or live in remote areas, providing them with easy access to banking services.

- Increased Security: By allowing users to manage their app activation, banks can reduce the risk of fraud associated with in-person activations.

- User Empowerment: Customers gain a sense of control over their banking experience, fostering a more positive relationship with their financial institution.

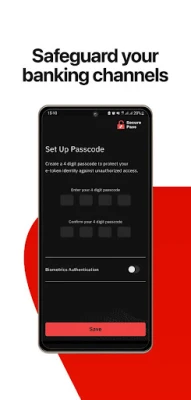

How the DIY Activation Process Works

The DIY app activation process is designed to be user-friendly and straightforward. Here’s a step-by-step guide:

- Download the App: Users begin by downloading the banking app from their device's app store.

- Registration: After installation, users create an account by providing necessary personal information.

- Verification: The app prompts users to verify their identity through secure methods, such as OTP (One-Time Password) or biometric authentication.

- Activation: Once verified, users can activate their app, gaining immediate access to their banking services.

Challenges and Considerations

While the DIY app activation model offers significant benefits, it is not without its challenges:

- Technical Issues: Users may encounter technical difficulties during the activation process, which can lead to frustration.

- Security Concerns: Although self-activation enhances security, it also places the onus on users to protect their personal information.

- Digital Literacy: Some customers may struggle with the technology, highlighting the need for user-friendly interfaces and support.

The Future of Banking with DIY Models

The DIY app activation model represents a significant shift in how banking services are delivered. As more customers embrace digital solutions, banks must continue to innovate and enhance their offerings. Future developments may include:

- AI Integration: Artificial intelligence can streamline the activation process, providing personalized assistance and troubleshooting.

- Enhanced Security Features: Continuous improvements in security protocols will help protect users from emerging threats.

- Broader Accessibility: Expanding services to cater to diverse customer needs will ensure that everyone can benefit from DIY banking solutions.

Conclusion

The DIY app activation model is transforming the banking landscape, offering users a convenient and efficient way to manage their finances. By embracing this innovative approach, banks can enhance customer satisfaction and foster loyalty. As technology continues to advance, the future of banking looks promising, with DIY solutions leading the charge toward a more accessible and user-centric financial experience.

Rate the App

User Reviews

Popular Apps

Editor's Choice