Latest Version

December 15, 2025

WINK Pay

Finance

Android

0

Free

com.credit.winkneo

Report a Problem

More About Wink NEO

Revolutionizing Money Transfers and Card Services: Your Ultimate Guide

In today's fast-paced digital world, efficient money transfers and robust card services are essential for both personal and business transactions. This comprehensive guide explores the innovative features and security measures that make modern financial services more accessible and user-friendly than ever before.

Seamless Money Transfers

Money transfers have evolved significantly, offering a variety of options to meet the needs of users worldwide. Here are some of the standout features:

- Global Card-to-Card Transfers: Effortlessly send money across borders using Visa and Mastercard, ensuring your funds reach their destination quickly and securely.

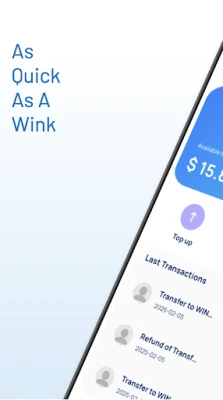

- Instant Wink-to-Wink Transfers: Experience the convenience of instant transfers between users, making it easier than ever to send money to friends and family.

- Cross-Border Bank Transfers: Navigate international transactions with ease, allowing you to send money directly to bank accounts in different countries.

- IBAN Transfers with Competitive FX Rates: Enjoy favorable foreign exchange rates when transferring funds using International Bank Account Numbers (IBAN).

- QR Code Payments & Agent Network Withdrawals: Simplify transactions with QR code payments and access cash through a vast network of agents.

- Detailed Transfer Tracking: Keep tabs on your transactions with comprehensive tracking features that categorize the purpose of each transfer.

Comprehensive Card Services

Card services have become a cornerstone of modern financial management. Here’s what you can expect:

- Virtual & Physical Card Creation: Create both virtual and physical cards tailored to your spending needs, providing flexibility and security.

- Global Card Top-Ups: Easily add funds to your card from anywhere in the world, ensuring you always have access to your money.

- Instant Card Freezing/Unfreezing: Protect your finances with the ability to freeze or unfreeze your card instantly in case of loss or theft.

- Cross-Border Spending with Auto-Conversion: Enjoy hassle-free spending abroad with automatic currency conversion, eliminating the need for manual exchanges.

Additional Features for Enhanced User Experience

Beyond basic services, many platforms offer additional features that enhance user experience:

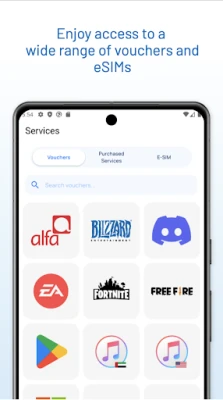

- eVouchers for Gifts & Shopping: Send eVouchers to friends and family, making gifting easier and more convenient.

- Travel Insurance & Ilzami Coverage: Protect yourself while traveling with comprehensive insurance options that cover unexpected events.

- eSIM Activation for Global Connectivity: Stay connected worldwide with eSIM technology, allowing you to switch networks without changing your SIM card.

- Multi-Currency Accounts: Manage your finances in multiple currencies, including USD, EUR, and GBP, simplifying international transactions.

- Cash Agent Network: Access cash easily through a network of over 5,000 locations, ensuring you can withdraw funds whenever needed.

- 24/7 WhatsApp Support & AI Chatbot: Get assistance anytime with round-the-clock support via WhatsApp and an intelligent AI chatbot.

- Spending Analytics: Gain insights into your spending habits with smart categorization, helping you manage your finances more effectively.

- Secure Document Vault: Safeguard your KYC materials in a secure document vault, ensuring your sensitive information is protected.

Unmatched Bank-Grade Security

Security is paramount in financial transactions. Here are the key security features that ensure your data and funds are protected:

- Biometric Authentication: Utilize advanced biometric authentication methods, such as Face ID and fingerprint recognition, for secure access to your accounts.

- Military-Grade Encryption: Benefit from top-tier encryption standards that protect your data from unauthorized access.

- Real-Time Transaction Monitoring: Stay informed with real-time monitoring of your transactions, allowing for immediate detection of any suspicious activity.

- Automated AML Checks & Fraud Prevention: Rely on automated Anti-Money Laundering (AML) checks and fraud prevention measures to keep your finances safe.

Global Accessibility and Support

In an increasingly interconnected world, accessibility is crucial. Here’s how modern financial services ensure global reach:

- Accepts Cards from 200+ Countries: Enjoy the convenience of using your card in over 200 countries, making international transactions seamless.

- Multi-Language Interface: Navigate the platform in your preferred language, enhancing user experience for a diverse audience.

- 24/5 Customer Support: Access dedicated customer support five days a week, ensuring assistance is always available when you need it.

- Competitive FX Rates: Take advantage of competitive foreign exchange rates, maximizing the value of your money during international transactions.

In conclusion, the landscape of money transfers and card services has transformed dramatically, offering users a plethora of features designed to enhance convenience, security, and accessibility. By leveraging these innovative solutions, individuals and businesses can navigate their financial needs with confidence and ease.

Rate the App

User Reviews

Popular Apps

Editor's Choice