Latest Version

5.42

December 15, 2025

EnerBank USA

Finance

Android

0

Free

com.enerbank.loan_application

Report a Problem

More About Regions Contractor SalesPro

Unlocking Home Improvement Financing: Key Features You Need to Know

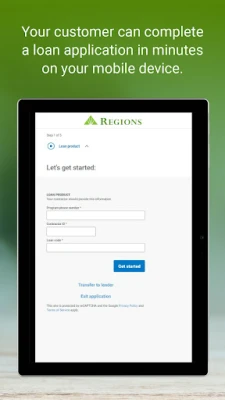

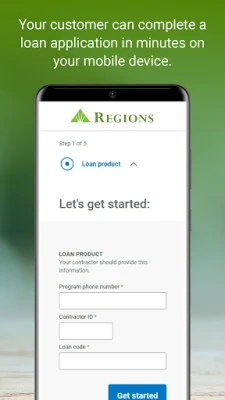

In the competitive world of home improvement, having the right financing options can make all the difference. With a robust suite of loan products, Regions Bank offers innovative solutions designed to enhance your business's cash flow and increase customer engagement. Below, we explore the key features that set Regions Bank apart in the home improvement financing landscape.

Comprehensive Training for Your Team

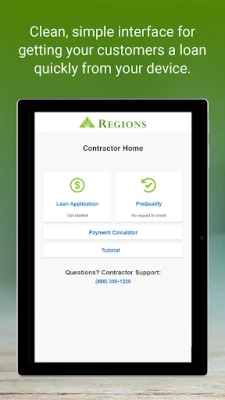

One of the standout features of Regions Bank's financing solutions is the built-in training program. This tutorial equips you and your team with the knowledge and skills necessary to navigate the financing process effectively. By understanding the ins and outs of the loan products, your team can provide exceptional service to customers, ensuring a seamless experience from start to finish.

Customizable Loan Templates for Efficiency

Regions Bank allows you to create and save custom loan templates tailored to your most popular financing options. This feature streamlines the application process, enabling you to quickly generate quotes and proposals for your customers. By having reusable templates at your fingertips, you can save time and focus on what truly matters—growing your business.

Accurate Payment Estimation Tools

Understanding the financial implications of a loan is crucial for customers. With Regions Bank's payment estimator, you can provide accurate monthly payment estimates using an intuitive payment calculator. This transparency helps customers make informed decisions, ultimately leading to higher satisfaction and increased sales.

Prequalification Without Credit Impact

Starting the financing process can be daunting for customers, especially when it comes to credit checks. Regions Bank offers a prequalification option that allows potential borrowers to explore their financing options without impacting their credit score. This feature encourages more customers to engage with your services, as they can assess their eligibility without the fear of a hard credit inquiry.

Swift Loan Decisions to Keep Projects Moving

Time is of the essence in home improvement projects. Regions Bank understands this and provides quick loan decisions to ensure that your projects keep moving forward. Fast approvals mean that you can secure funding when you need it most, allowing you to focus on delivering quality work to your clients.

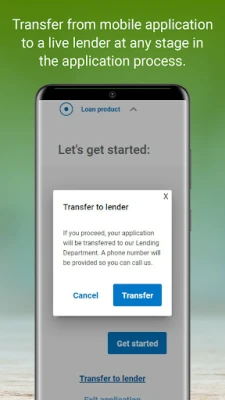

Direct Access to Lending Professionals

When questions arise, having immediate access to a lending professional can be invaluable. Regions Bank offers a live lender transfer feature, connecting you directly with a lending expert via phone. This ensures that you receive the support you need, when you need it, enhancing the overall customer experience.

Financing Solutions for Every Customer

With Regions Bank, you can confidently offer financing solutions to 100% of your customers, 100% of the time. By providing a choice between Same-As-Cash options and low monthly payment loans, you can significantly boost your close rates. This flexibility not only increases average project sizes but also helps eliminate project discounting and reduce cancellations.

Partnering with a Trusted Financial Institution

Regions Bank, recognized as one of the nation's top banks, brings experience and stability to the table. Their comprehensive suite of home improvement loan products is designed to help your business improve cash flow and generate more leads. By partnering with Regions Bank, you can leverage their expertise to enhance your service offerings and drive growth.

Visit Regions Bank for More Information

To explore the full range of home improvement financing options available, visit Regions.com/homeimprovement. Discover how their innovative solutions can transform your business and provide your customers with the financing they need to make their home improvement dreams a reality.

Important Disclaimers

It’s important to note that while there is no hard credit pull during the prequalification process, a hard credit inquiry will occur if a prequalified applicant chooses to apply for a loan. This ensures that all parties are aware of the implications of moving forward with a loan application.

©2024 Regions Bank. All Rights Reserved. Member FDIC. Equal Housing Lender.

Regions, the Regions logo, and EnerBank are registered trademarks of Regions Bank. The LifeGreen color is a trademark of Regions Bank.

Rate the App

User Reviews

Popular Apps

Editor's Choice