Latest Version

4018.1.1

December 16, 2025

Educators Credit Union

Finance

Android

0

Free

com.alkamitech.educators

Report a Problem

More About Educators CU Mobile Banking

Unlock the Power of Online Banking: Your Comprehensive Guide

In today's fast-paced digital world, managing your finances has never been easier. If you're already utilizing Online Banking, logging in is a breeze—simply enter your user ID and password. If you haven't set up your credentials yet, click the registration button to embark on your financial journey.

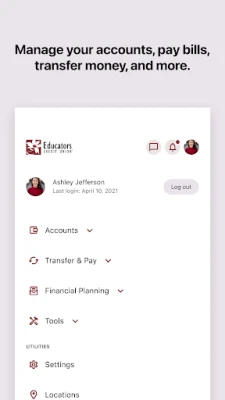

Streamlined Account Management

Online Banking offers a suite of features designed to simplify your financial management. Here’s what you can do:

- Monitor Your Accounts: Effortlessly review and manage your account balances and transaction history across all your Educators accounts and loans.

- Quick Check Deposits: Deposit checks with just two pictures, saving you time and effort.

- Invest in Bitcoin: Buy, sell, and hold Bitcoin seamlessly, powered by NYDIG.

- Card Replacement: Easily replace a damaged debit or credit card without the hassle of visiting a branch.

- Account Setup: Quickly add new accounts and apply for loans from the comfort of your home.

- Card Customization: Personalize your debit and credit cards to reflect your unique style.

- Secure Messaging: Communicate directly with Educators Credit Union through secure messaging for any inquiries or assistance.

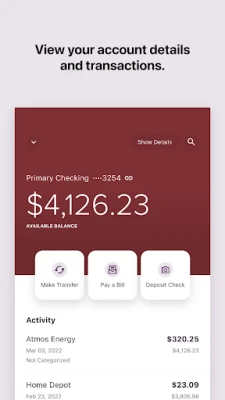

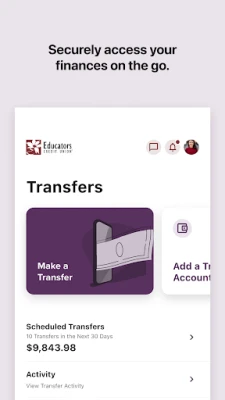

Effortless Money Transfers

Managing your finances extends beyond just monitoring your accounts. With Online Banking, you can:

- Pay Bills: Easily pay and manage your monthly bills, ensuring you never miss a due date.

- Fund Transfers: Transfer funds between your Educators accounts and other financial institutions with ease.

- Zelle® Integration: Send and receive money with friends and family instantly using Zelle®.

- Loan Payments: Schedule payments on your Educators loans to stay on top of your financial commitments.

Enhancing Your Financial Wellness

Online Banking is not just about transactions; it’s also about empowering you to take control of your financial health. Here’s how:

- Credit Score Monitoring: Regularly check and monitor your credit score to stay informed about your financial standing.

- Spending Insights: Analyze your spending habits to identify areas for improvement and savings.

- Set Financial Goals: Establish savings goals and budgets to help you achieve your financial aspirations.

- Financial Wellness Assessment: Evaluate your overall financial health with the Financial Wellness Assessment and receive guidance from Coach Lea.

Conclusion: Embrace the Future of Banking

Online Banking is revolutionizing the way we manage our finances. With its user-friendly features, secure transactions, and tools for financial wellness, it empowers you to take charge of your financial future. Whether you’re monitoring your accounts, transferring money, or setting financial goals, Online Banking provides the resources you need to succeed. Don’t wait—log in today and unlock the full potential of your financial management experience!

Rate the App

User Reviews

Popular Apps

Editor's Choice