Latest Version

5.0.0

December 14, 2025

CIMB Bank (VN) Ltd.

Finance

Android

0

Free

vn.cimbbank.octo

Report a Problem

More About OCTO by CIMB

Unlock Seamless Banking with the CIMB VISA Card: Your Digital Banking Solution

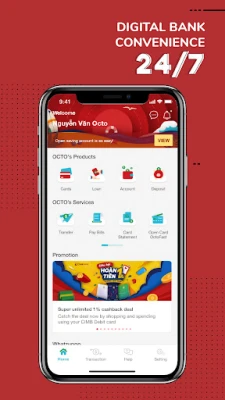

Experience the ultimate convenience of digital banking with the CIMB VISA card, available for sign-up directly through the app. Enjoy 24/7 access to your banking needs anytime and anywhere, making your financial management easier than ever.

1. Get Your VISA Card Anytime, Anywhere

Open your CIMB bank account or card entirely online using eKYC, the innovative online customer verification system. All you need to do is capture your ID card and take a selfie for seamless card and account registration, eliminating the need to visit a branch. This service is available to all Vietnamese customers nationwide.

- VISA Debit Card: The CIMB Visa Debit card linked to your CIMB bank account allows you to enjoy a variety of banking services without any fees.

- VISA Credit Card: The CIMB Visa Credit card enables you to shop globally while taking advantage of numerous attractive deals.

2. Enjoy Free Services with Your CIMB VISA Card

VISA Debit Card Benefits

- Free card issuance and account opening

- No minimum deposit required to open an account

- No minimum balance requirement

- Free domestic fast money transfers available 24/7

- Free domestic ATM withdrawals

- Free annual card and account management fees, subject to conditions

VISA Credit Card Benefits

- Free card issuance

- Free annual card management fees, subject to conditions

Personal Loan Benefits

- Free loan application processing

- Free loan management fees

3. Experience Digital Banking Convenience 24/7

VISA Debit Card Features

- Quick bill payments and mobile top-ups

- Fund your account directly through the app

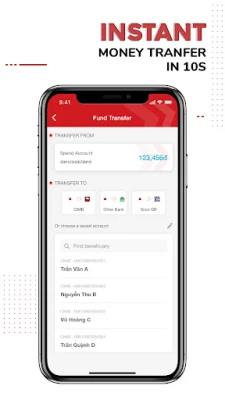

- Instant domestic money transfers available 24/7

- Manage your card settings, reset your PIN, and lock/unlock your card via the app

- Set spending limits up to 2 billion VND per day

- Make international and domestic online and POS purchases

VISA Credit Card Features

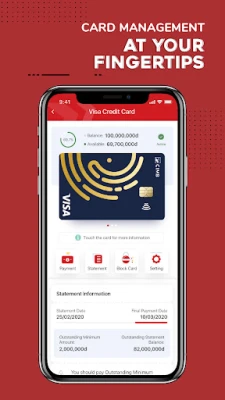

- Access card information and bank statements through the app

- Manage card settings, reset your PIN, and lock/unlock your card via the app

- Set spending limits conveniently through the app

Personal Loan Features

- Complete the loan application process entirely within the app, from application to disbursement

- Receive a quick loan offer within 4 working hours

- Track your application status transparently through the app

- No forms or signatures required until approval

- Sign your loan contract at your convenience

- Loan amounts range from 5 to 500 million VND

- Loan tenures available from 3 to 60 months

- Interest rates range from 1.3% to 3.75% per month on a reducing balance

- Minimum and maximum repayment periods: 12 to 60 months

- Maximum Annual Percentage Rate (APR): 24.5% per annum

- Example of total loan cost: For an outstanding balance of 100,000,000 VND over 60 months at an interest rate of 15.9% per year, the Equal Monthly Installment (EMI) is approximately 2,427,000 VND.

4. Robust Security Features for Peace of Mind

Secure Sign-In with OctoBio

- Sign in using biometrics, including facial recognition and fingerprint scanning

- Access your account easily without the need to remember passwords

Secure Transactions with OctoShield

- Activate OctoShield once via SMS OTP for enhanced security

- Simply slide to sign your transactions securely

- Your transactions are protected through tokenization and multi-layer authentication methods

Secure Online Purchases with 3D Secure

- Verify your online purchases with an OTP code sent to your registered mobile number and email

- The 3D Secure solution is provided by Visa for added protection

Contact Us for Support

If you need assistance, please reach out to CIMB Bank Vietnam:

Headquarters: Level 2, CornerStone Building, 16 Phan Chu Trinh, Hoan Kiem, Hanoi

HCM Branch: Ground Floor, VRG Building, 177 Hai Ba Trung, District 3, HCMC

Email: cimbcare@cimb.com

Hotline: 1900 96 96 96

Embrace the future of banking with the CIMB VISA card and enjoy unparalleled convenience, security, and a range of free services designed to enhance your financial experience.

Rate the App

User Reviews

Popular Apps

Editor's Choice