Latest Version

April 29, 2025

Royal Bank of Canada

Finance

Android

2

Free

com.rbc.mobile.android

Report a Problem

More About RBC Mobile

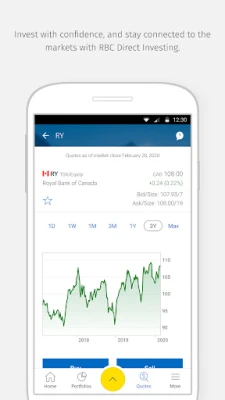

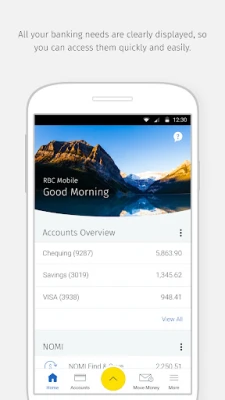

Unlock Your Financial Potential with the RBC Mobile App and NOMI Features

The RBC Mobile app is designed to enhance your banking experience, offering exclusive features that empower you to manage your finances effortlessly. At the heart of this app is NOMI, a powerful tool that provides personalized insights and savings solutions tailored to your spending habits. In this article, we will explore how NOMI can transform your financial management and ensure your banking experience is both secure and user-friendly.

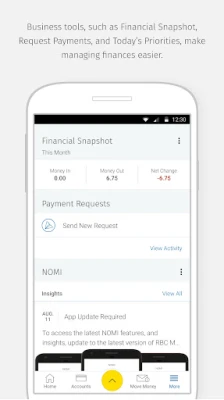

Discover NOMI Insights: Your Personal Finance Assistant

NOMI Insights is a standout feature of the RBC Mobile app, designed to help you take control of your day-to-day finances. By analyzing your spending patterns, NOMI offers personalized tips that guide you toward smarter financial decisions. Whether you’re looking to cut back on unnecessary expenses or find ways to optimize your budget, NOMI Insights provides actionable advice that aligns with your financial goals.

Effortless Saving with NOMI Find & Save

Saving money has never been easier, thanks to NOMI Find & Save. This innovative feature examines your spending habits to identify small amounts of money that can be set aside for savings. By automatically transferring these funds into your savings account, NOMI helps you build your savings without the hassle of manual tracking. This means you can focus on enjoying life while NOMI works behind the scenes to enhance your financial health.

Enhanced Security Features for Peace of Mind

Your security is a top priority when using the RBC Mobile app. From the moment you sign in, you benefit from cutting-edge biometric identification technology, including fingerprint recognition. This feature allows you to access your account securely without the need to remember complex passwords. Additionally, if you ever misplace your credit card, the app enables you to temporarily lock it, providing an extra layer of protection against unauthorized transactions.

Commitment to Privacy and Data Security

RBC is dedicated to safeguarding your personal information. The data you provide is collected, used, and disclosed in accordance with your account agreements and the RBC privacy policy. For more information on how your data is handled, you can review the privacy principles outlined on the RBC website. Understanding your privacy rights is essential, and RBC ensures transparency in its digital channels.

Accessing RBC Mobile App Features

The RBC Mobile app may require access to certain device services to enhance your experience, such as locating nearby RBC Royal Bank branches. For a comprehensive list of features and assistance with app removal, you can visit the RBC website or contact their support team. This ensures you have all the information you need to make the most of your banking experience.

Legal Considerations for RBC Mobile App Users

It’s important to note that RBC does not offer financial services or products outside of Canada through the app. If you are not an existing client of Royal Bank of Canada, RBC Direct Investing Inc., or RBC Dominion Securities Inc., you should refrain from accessing the app. By installing the RBC Mobile app, you consent to future updates and upgrades, which may be automatically installed based on your device settings.

Terms and Conditions: What You Need to Know

When you download the RBC Mobile app, you agree to the terms and conditions outlined on the RBC website. This includes various agreements relevant to your account type, such as the Electronic Access Agreement for personal clients and the Business Account Agreement for business clients. Familiarizing yourself with these terms ensures a smooth banking experience.

Contact Information for RBC Support

If you have any questions or need assistance with the RBC Mobile app, you can reach out to RBC through the following contact details:

- Royal Bank of Canada

10 York Mills Rd. 3rd Floor

Toronto, ON M2P 0A2

www.rbcroyalbank.com

1-800-769-2511

Email: mobile.feedback@rbc.com - RBC Direct Investing Inc.

Royal Bank Plaza

200 Bay Street, North Tower, P.O. Box 75

Toronto, ON, M5J 2Z5

www.rbcdirectinvesting.com - RBC Dominion Securities Inc.

155 Wellington Street West, 17th Floor

Toronto, ON, M5V 3K7

www.rbcwealthmanagement.com

In conclusion, the RBC Mobile app, with its innovative NOMI features, offers a comprehensive solution for managing your finances. From personalized insights to effortless savings and robust security measures, RBC ensures that your banking experience is both efficient and secure. Embrace the future of banking with the RBC Mobile app and take charge of your financial journey today.

Rate the App

User Reviews

Popular Apps

Editor's Choice