Latest Version

9.16.3

February 12, 2026

CCE Federal Credit Union

Finance

Android

0

Free

com.malauzai.DH21370

Report a Problem

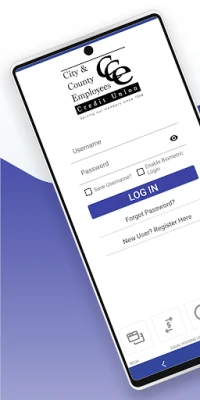

More About CCEFCU Fargo Mobile App

Maximize Your Banking Experience: Essential Features to Manage Your Account

In today's fast-paced world, managing your finances efficiently is crucial. With the right tools at your disposal, you can easily keep track of your account balances, monitor transactions, and ensure your financial security. This article explores essential features that enhance your banking experience, allowing you to take control of your finances with ease.

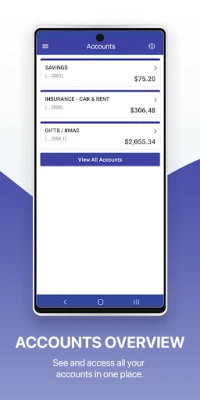

Check Your Account Balances Instantly

One of the primary functions of online banking is the ability to view your account balances in real-time. Whether you have multiple accounts or just one, accessing your balance is straightforward. This feature allows you to:

- Stay informed about your financial status.

- Make informed spending decisions.

- Plan for upcoming expenses effectively.

By regularly checking your balances, you can avoid overdraft fees and ensure that you are on track with your financial goals.

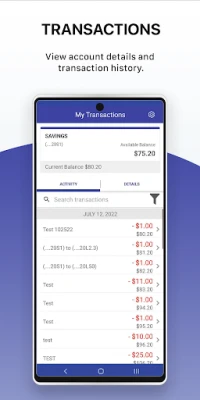

Monitor Recent Transactions for Better Financial Management

Keeping an eye on your recent transactions is vital for maintaining a healthy financial life. This feature enables you to:

- Track your spending habits.

- Identify unauthorized transactions quickly.

- Reconcile your accounts with ease.

By reviewing your transactions regularly, you can gain insights into your spending patterns and make necessary adjustments to your budget.

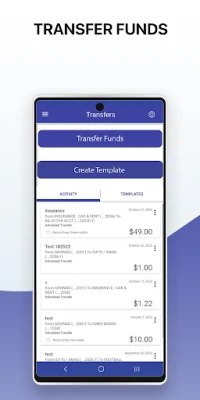

Effortlessly Transfer Funds Internally

Transferring funds between your accounts should be a seamless process. With the internal fund transfer feature, you can:

- Move money between checking and savings accounts instantly.

- Set up recurring transfers for regular savings.

- Manage your finances without visiting a bank branch.

This convenience allows you to maintain liquidity and ensure that your funds are allocated where they are needed most.

Set Up Account Alerts for Enhanced Security

Staying informed about your account activity is essential for preventing fraud. By setting up account alerts, you can:

- Receive notifications for large transactions.

- Get alerts for low balances.

- Stay updated on any changes to your account settings.

These alerts empower you to take immediate action if you notice any suspicious activity, enhancing your overall financial security.

Customize Your Account Settings

Your banking experience should be tailored to your needs. The account settings feature allows you to:

- Update personal information easily.

- Change your password and security questions.

- Manage linked accounts and payment methods.

By customizing your account settings, you can ensure that your banking experience is both secure and user-friendly.

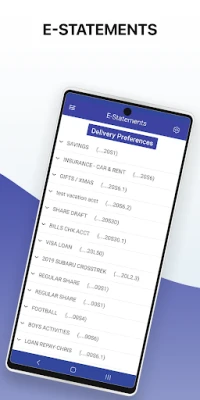

Access Electronic Statements Anytime

Gone are the days of waiting for paper statements to arrive in the mail. With electronic statements, you can:

- Access your financial statements anytime, anywhere.

- Reduce paper clutter and contribute to environmental sustainability.

- Download and save statements for easy record-keeping.

This feature not only saves you time but also helps you stay organized and environmentally conscious.

Contact Us for Personalized Support

Sometimes, you may need assistance with your banking needs. The contact us feature provides you with:

- Access to customer support via phone, email, or chat.

- Guidance on resolving account issues.

- Information on banking products and services.

Having reliable support at your fingertips ensures that you can address any concerns promptly and effectively.

Conclusion

Managing your finances has never been easier with the array of features available through online banking. By utilizing tools to check your account balances, monitor transactions, transfer funds, set alerts, customize settings, access electronic statements, and contact support, you can take charge of your financial health. Embrace these features to enhance your banking experience and achieve your financial goals with confidence.

Rate the App

User Reviews

Popular Apps

Editor's Choice