Latest Version

2.48.0

October 20, 2024

Green Dot Corporation

Finance

Android

0

Free

com.gobank

Report a Problem

More About GoBank – Mobile Banking

Discover GoBank: The Ultimate Mobile Checking Account for the Modern User

In today's fast-paced world, traditional banking often feels cumbersome and laden with hidden fees. Enter GoBank, a revolutionary checking account designed specifically for those who seek a hassle-free banking experience. With a focus on mobile accessibility, GoBank offers a range of features that make managing your finances easier than ever. Let’s explore why GoBank is the ideal choice for anyone tired of big banks and their excessive charges.

Why Choose GoBank?

GoBank stands out in the crowded banking landscape for several compelling reasons. Here’s a closer look at what makes it a preferred option for many users.

No Surprise Fees

One of the most attractive features of GoBank is its commitment to transparency. With GoBank, you won’t encounter unexpected fees that can catch you off guard. For more details, visit GoBank.com/NoWorries to learn about their fee structure.

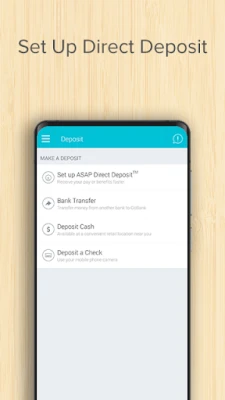

Get Paid Faster with ASAP Direct Deposit™

With GoBank’s ASAP Direct Deposit™, you can receive your paycheck up to two days earlier than with traditional banks. This feature is dependent on your employer’s payment instructions, but it can significantly enhance your cash flow. Ensure that your name and Social Security number match those on your GoBank account to avoid any issues with deposits.

Easy Direct Deposit Setup

If you’re not eligible for ASAP Direct Deposit™, you can still set up direct deposit to receive your payments faster than waiting for a paper check. This feature streamlines your banking experience and ensures you have access to your funds when you need them.

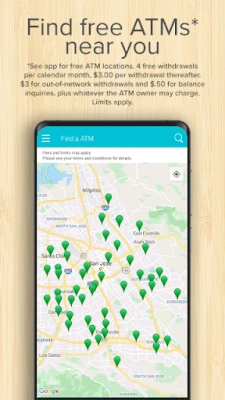

Access to Free ATMs

GoBank provides access to a network of free ATMs, allowing you to withdraw cash without incurring fees. Users can make up to four free withdrawals per calendar month, with a nominal fee of $3.00 for each additional withdrawal. For out-of-network ATMs, a fee of $3.00 applies, along with any charges from the ATM owner. Check the GoBank app for a list of free ATM locations.

Pay Your Bills with Ease

Managing your bills is a breeze with the GoBank app or website. Whether you need to pay rent or any other bills, GoBank allows you to do so effortlessly. If you need to send a check to your landlord or anyone else, GoBank will mail it for free, saving you time and hassle.

Send Money Instantly

Need to send money to friends, family, or even your dog groomer? GoBank makes it simple to transfer funds quickly to anyone with a GoBank account. Notifications are sent via email or text message, ensuring your recipients are informed immediately.

Deposit Cash Conveniently

Depositing cash into your GoBank account is straightforward. Just visit any participating retail location, swipe your GoBank debit card, and hand over your cash. The funds will be deposited into your account automatically, although fees may apply.

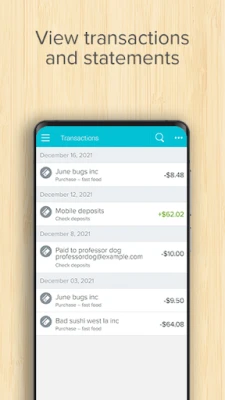

Mobile Deposits Made Simple

Your nearest bank branch is now in your pocket! With GoBank, you can use your smartphone to scan checks and deposit them directly into your account. For security purposes, you may be asked to upload your ID during this process.

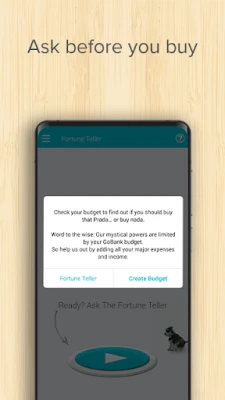

Budgeting Assistance with Fortune Teller™

GoBank offers a unique feature called Fortune Teller™, which helps you manage your budget effectively. Simply input the cost of an item, and Fortune Teller™ will provide a quick assessment of whether it fits within your budget. This tool is invaluable for those looking to maintain financial discipline.

Customer Support and Engagement

Have questions about your GoBank account? Customer support is available 24/7. You can call the number on the back of your card or log in to gobank.com to email the support team through the Contact Us page. GoBank also encourages users to stay connected via social media. Follow them on Twitter @GoBank, Instagram @GoBankOfficial, and like their Facebook page at Facebook.com/GoBank for updates and assistance.

Conclusion: A Modern Banking Solution

GoBank is more than just a checking account; it’s a comprehensive banking solution tailored for the modern user. With no surprise fees, fast direct deposits, and a suite of user-friendly features, GoBank empowers you to take control of your finances. Whether you’re looking to pay bills, send money, or manage your budget, GoBank has you covered. Experience the future of banking today with GoBank!

GoBank is a brand of Green Dot Bank, Member FDIC. Deposits are insured under a single FDIC-insured bank, Green Dot Bank, and are aggregated for deposit insurance coverage.

For more information, please review the Terms of Use and Privacy Policy.

Rate the App

User Reviews

Popular Apps

Editor's Choice