Latest Version

3.0.7

July 29, 2025

Cream Tech Software

Finance

Android

0

Free

com.creamtech.pixmanager

Report a Problem

More About Pix: Chaves Pix e Pagamentos

Understanding the Different Types of PIX Keys for Seamless Transactions

The PIX payment system has revolutionized the way we conduct financial transactions in Brazil. With its user-friendly interface and instant transfer capabilities, it’s essential to understand the various types of PIX keys available. This article will delve into the different types of PIX keys, how to manage them effectively, and the benefits they offer for both personal and business transactions.

What Are PIX Keys?

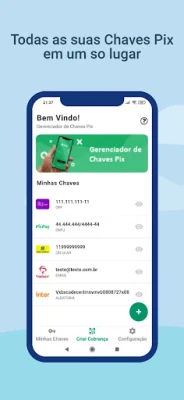

PIX keys serve as unique identifiers that facilitate the sending and receiving of money through the PIX system. They simplify the payment process by allowing users to link their bank accounts to easily recognizable identifiers. The main types of PIX keys include:

- CPF (Cadastro de Pessoas Físicas): This is the Brazilian individual taxpayer registry identification, commonly used for personal transactions.

- Cell Phone Number: Users can link their mobile numbers to their PIX accounts, making it convenient for quick transfers.

- Email Address: This option allows users to receive payments through their email, adding another layer of convenience.

- Random Key: A randomly generated key that offers an additional layer of security for transactions.

Managing Your PIX Keys with Ease

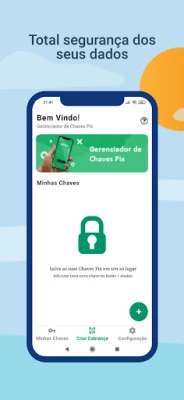

With the PIX application, users can efficiently manage their PIX keys. The app allows you to store multiple keys, making it easy to send and receive payments without hassle. Here’s how you can optimize your experience:

Storing and Generating Keys

Within the app, you can securely store your PIX keys and generate payment requests using QR codes. This feature not only enhances security but also streamlines the payment process. By simply scanning a QR code, users can complete transactions in seconds.

Adding Keys from Various Banks

The flexibility of the PIX system allows users to add keys from a variety of banks. Some of the most popular banks that support PIX keys include:

- Caixa Econômica Federal

- Bradesco

- Banco do Brasil

- Nubank

- And many others!

This wide range of options ensures that users can choose the bank that best suits their needs while enjoying the benefits of the PIX system.

Enhancing Efficiency with PIX

One of the standout features of the PIX system is its ability to enhance efficiency in financial transactions. Here’s how you can make the most of it:

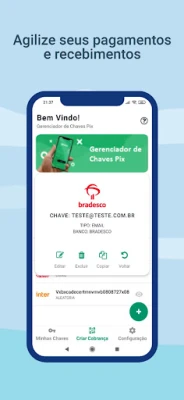

Quick Copy and Share Functionality

The PIX app includes a copy and share function that allows users to quickly share their payment information. This feature is particularly useful for businesses that need to send invoices or payment requests to clients. By simplifying the sharing process, you can save time and reduce the chances of errors in payment details.

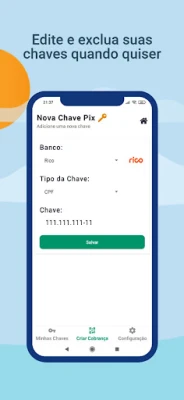

Creating QR Codes for Payments

Another innovative feature is the ability to create QR codes for new payment requests. This functionality allows users to edit and delete keys as needed, ensuring that your payment methods remain up-to-date and secure. Whether you’re a freelancer sending an invoice or a business owner collecting payments, QR codes make transactions seamless.

Your Data Privacy Matters

When using the PIX system, it’s crucial to know that your data privacy is a top priority. The application does not store any of your personal information on its servers. All data remains securely saved on your device, giving you peace of mind while conducting transactions.

Conclusion

Understanding the different types of PIX keys and how to manage them effectively can significantly enhance your transaction experience. With the ability to store multiple keys, generate QR codes, and ensure data privacy, the PIX system stands out as a modern solution for financial transactions in Brazil. Embrace the convenience and efficiency of PIX, and streamline your payment processes today!

Rate the App

User Reviews

Popular Apps

Editor's Choice