Latest Version

2.0.2

July 30, 2025

Continuum App

Finance

Android

0

Free

com.continuum.sip.calculator

Report a Problem

More About SIP Calculator

Maximize Your Investments: The Ultimate Guide to SIP Calculators and Planners

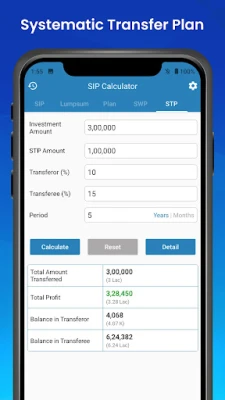

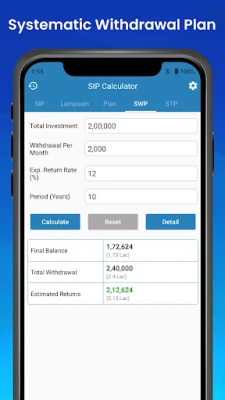

In the world of investing, understanding your potential returns is crucial. A SIP Calculator and SIP Planner are essential tools that help you estimate the benefits of investing in equity and debt funds. These tools allow you to determine how much you should invest each month to achieve your financial goals by the end of your investment period.

Understanding Systematic Investment Plans (SIPs)

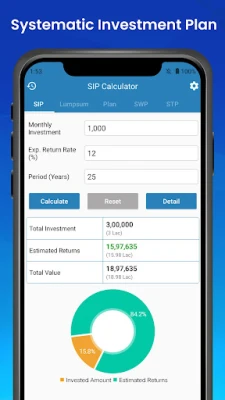

A Systematic Investment Plan (SIP) is an investment scheme offered by mutual fund companies that enables you to invest a fixed amount regularly, typically on a monthly basis. This method is particularly appealing to salaried individuals who prefer a disciplined approach to investing. By using a SIP calculator, you can easily calculate the expected profit and returns from your monthly investments, providing you with a rough estimate of the maturity amount based on projected annual return rates.

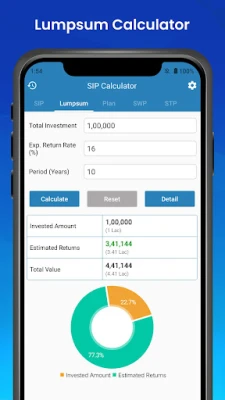

What is a SIP Calculator?

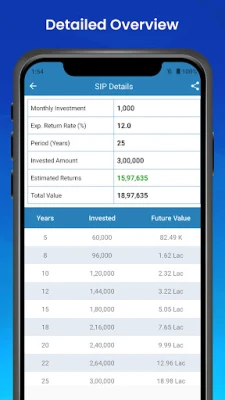

A SIP Calculator, also known as a mutual fund calculator, savings calculator, or goal planner, is a user-friendly tool designed to help investors assess their potential returns. By inputting your monthly investment amount, the expected rate of return, and the investment duration, the calculator provides an estimate of the total amount you can expect at maturity. This feature is invaluable for planning your financial future.

Key Features of a SIP Calculator

- Quick and Easy Calculations: The SIP calculator offers a fast and efficient way to compute your potential returns, allowing you to make informed investment decisions.

- Investment History Tracking: Maintain a record of different investment plans and easily access them whenever needed.

- Shareable Reports: Save and share your SIP details in PDF format via SMS, email, or other platforms, making it convenient to discuss your plans with financial advisors or family members.

Benefits of Investing Through SIPs

Investing through a SIP offers numerous advantages that make it an attractive option for many individuals:

- Low Initial Investment: You can start investing with a small amount, making it accessible for everyone, regardless of their financial situation.

- Reduced Market Risk: SIPs help mitigate market volatility through a process known as rupee cost averaging. By investing regularly, you buy more units when prices are low and fewer units when prices are high, averaging out your investment cost.

- Compounding Benefits: The power of compounding allows your investments to grow exponentially over time, leading to potentially higher returns.

- Tax Benefits: Certain SIPs, particularly those in tax-saving mutual funds, can help you save on income tax, making them a smart choice for tax-conscious investors.

How to Use a SIP Planner Effectively

To make the most of a SIP planner, follow these steps:

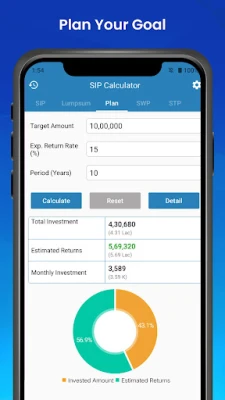

- Define Your Financial Goals: Determine what you want to achieve with your investments, whether it's saving for retirement, a child's education, or a dream vacation.

- Choose the Right Amount: Use the SIP calculator to find out how much you need to invest monthly to reach your target amount within your desired timeframe.

- Select the Right Funds: Research and choose mutual funds that align with your risk tolerance and investment goals. Consider factors such as past performance, fund manager reputation, and expense ratios.

- Monitor Your Investments: Regularly review your SIP investments to ensure they are on track to meet your goals. Adjust your contributions or fund selections as necessary.

Conclusion

Utilizing a SIP calculator and planner can significantly enhance your investment strategy. By understanding how much to invest and the potential returns, you can make informed decisions that align with your financial goals. Whether you are a seasoned investor or just starting, SIPs offer a flexible and effective way to grow your wealth over time. Start planning today and take the first step towards a secure financial future!

Rate the App

User Reviews

Popular Apps

Editor's Choice