Latest Version

25.1.30

December 22, 2025

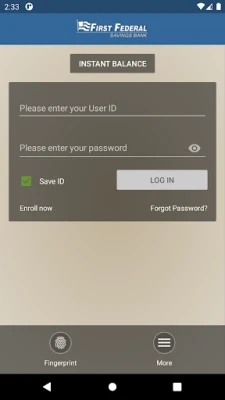

FIRST FEDERAL SAVINGS BANK

Finance

Android

1

Free

com.ffsb.mobile

Report a Problem

More About FFSB MOBILE

Maximize Your Banking Experience with Custom Alerts

In today's fast-paced financial landscape, staying informed about your banking activities is crucial. Setting up alerts can help you manage your finances more effectively, ensuring you never miss a beat. Here’s how you can leverage alerts for deposits, withdrawals, and account balance levels to enhance your banking experience.

Stay Updated with Deposit Alerts

One of the most beneficial features of modern banking is the ability to receive alerts for deposits. Whether it's your paycheck, a tax refund, or any other incoming funds, being notified instantly allows you to manage your finances proactively. With First Federal Savings Bank, you can set up alerts that notify you as soon as a deposit is made to your account. This feature not only keeps you informed but also helps you plan your spending and savings more effectively.

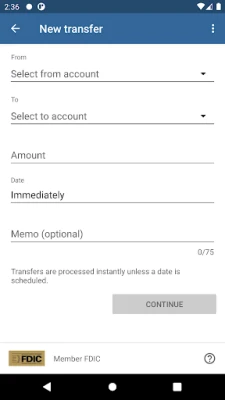

Monitor Withdrawals and Check Clearing

Keeping track of your withdrawals and check clearings is essential for maintaining a healthy financial status. Setting up alerts for these transactions ensures that you are always aware of your account activity. You can receive notifications whenever a withdrawal is made or when a check you’ve written clears. This level of awareness helps prevent overdrafts and allows you to manage your budget with confidence.

Account Balance Level Alerts

Understanding your account balance is vital for effective financial management. With balance level alerts, you can set thresholds that notify you when your account balance falls below a certain amount. This feature is particularly useful for avoiding unexpected fees and ensuring you have enough funds for upcoming expenses. By staying informed about your balance, you can make timely decisions regarding your spending and saving habits.

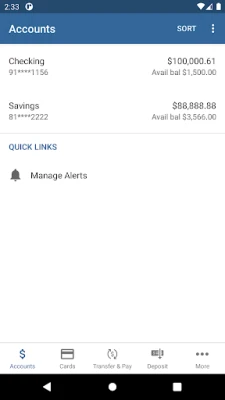

Understanding Your Account Balance

When reviewing your account balance, it’s important to remember that it may not always reflect all recent transactions. For instance, debit card purchases or checks that you have written may not be immediately deducted from your balance. Therefore, it’s wise to keep track of your spending and account activity regularly. Utilizing alerts can help bridge this gap, providing you with real-time updates on your financial status.

First Federal Savings Bank: Your Trusted Banking Partner

First Federal Savings Bank is a mutual bank dedicated to serving the financial needs of residents in north central Illinois. With multiple branch locations, including:

- Ottawa (2 locations, including our flagship office)

- Amboy

- Elgin

- LaSalle

- Mendota

- Morris

- Peru

- Rock Falls

- Shorewood

- Streator

- Walnut

We are committed to providing personalized banking solutions that cater to your unique financial needs.

Important Disclosure

It’s essential to note that some features, including alerts, are available only to eligible customers and accounts. Always check with your bank to understand the specific terms and conditions that apply to your account.

Stay Connected with Technology

In our digital age, staying connected is easier than ever. While First Federal Savings Bank does not charge for alert services, be aware that message and data rates may apply from your communication service provider. Factors such as service outages, technology failures, and system capacity limitations may cause delays in the delivery of alerts. Always ensure that your contact information is up to date to receive timely notifications.

Conclusion: Take Control of Your Finances

Setting up alerts for deposits, withdrawals, and account balance levels is a smart way to take control of your finances. By staying informed about your banking activities, you can make better financial decisions and avoid unnecessary fees. First Federal Savings Bank is here to support you in your financial journey, providing the tools and resources you need to succeed. Start utilizing alerts today and experience the peace of mind that comes with being in control of your finances.

Rate the App

User Reviews

Popular Apps

Editor's Choice