Latest Version

2.59.6

December 20, 2025

Union Bank of the Philippines

Finance

Android

0

Free

com.unionbankph.online

Report a Problem

More About UnionBank Online

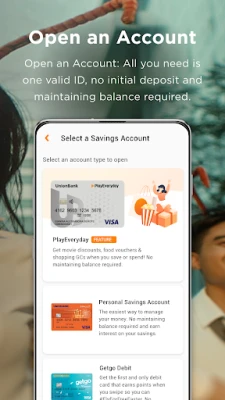

Unlock Seamless Banking: Open an Account with UnionBank Today

In today's fast-paced world, convenience is key, especially when it comes to managing your finances. UnionBank of the Philippines offers a revolutionary way to open a bank account directly through their user-friendly app, eliminating the need for branch visits. This article explores the myriad features and benefits of UnionBank's digital banking services, ensuring you have all the information you need to make the most of your banking experience.

Open Your Account Anytime, Anywhere

UnionBank is the first Philippine bank to allow customers to open accounts via a mobile application. This innovative approach means you can set up your banking needs without stepping foot in a branch. Choose from a variety of account options tailored to your lifestyle:

- Personal Savings Account

- PlayEveryday

- Savings+

- Lazada

- GetGo

Once your account is set up, enjoy the convenience of having a Visa debit card delivered straight to your home or office. Plus, you can immediately access a Lazada Virtual Debit card for all your online shopping needs.

Deposit Checks Anytime, Day or Night

With UnionBank, you can deposit checks 24/7. UnionBank checks clear within just two hours, even on weekends and holidays, ensuring your funds are available when you need them. For checks from other banks, the clearing process follows standard industry cut-off times, providing a reliable banking experience.

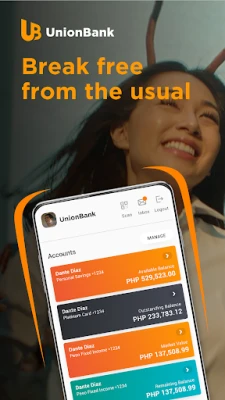

Securely Manage Your Finances

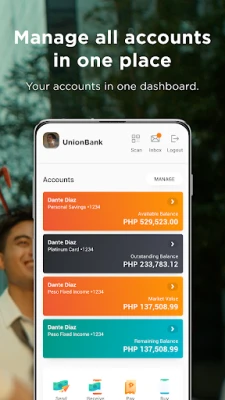

UnionBank's app allows you to manage all your accounts and credit card balances in one convenient location. Key features include:

- Real-time monitoring of your savings, checking, and debit/ATM card activities.

- Access to credit card spending, points, and statements.

- Control over your Visa credit cards, including the ability to lock/unlock and set transaction limits.

- Tracking of loan repayments.

- Secure access through OTP and biometric authentication.

- Self-service options for password resets and profile unblocking.

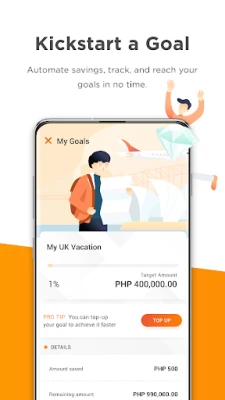

- Goal-setting features to help you save for investments, emergency funds, or personal aspirations.

Effortless Fund Transfers and Bill Payments

Transferring funds and paying bills has never been easier. With UnionBank, you can:

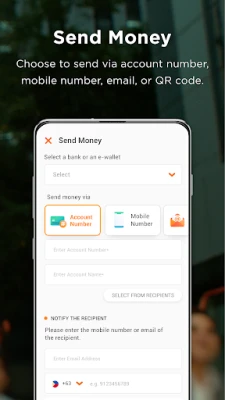

- Transfer funds to anyone, at any bank, without the need for enrollment or branch visits.

- Enjoy real-time crediting for transfers between your accounts or to other UnionBank accounts.

- Utilize PESONet for free transfers, with same or next business day crediting.

- Send up to Php 50,000.00 to anyone using InstaPay, with real-time crediting for just PHP10.

- Transfer US Dollars to local banks for only USD1 through PDDTS.

- Pay utility bills, phone bills, rent, school fees, and more without needing to enroll billers.

- Save frequently used accounts and bills for quick access.

- Schedule recurring transfers and bill payments to avoid missing due dates.

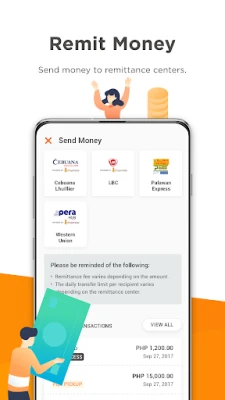

- Send money to partner remittance centers like Palawan Express, Cebuana Lhuillier, LBC, and PeraHub.

Request Payments and Split Bills with Ease

Say goodbye to complicated calculations and sharing account numbers. With UnionBank, you can:

- Send payment requests to other UnionBank Online users using just their mobile number.

- Effortlessly split bills with friends, eliminating the need for worksheets.

- Generate your own QR code for easy payments from friends.

Schedule Your Branch Visit

Need to visit a branch? UnionBank makes it easy to schedule your visit through the app. Enjoy the following benefits:

- Skip the queue by scheduling your appointment in advance.

- Complete transactions without the hassle of forms or signatures by entering your transaction details ahead of time.

- Use the built-in locator to find the nearest branch or ATM.

Explore Additional Features

UnionBank's app is packed with features designed to enhance your banking experience:

- Activate your new credit card with just a few taps.

- Redeem your credit card points for exciting rewards.

- Check for exclusive promos and discounts in the Voucher Wallet.

- Perform USD/PHP conversions and view real-time foreign exchange rates.

A Trusted Banking Partner

UnionBank of the Philippines has been recognized for its excellence in digital banking, winning several awards, including:

- 2018 Best Retail Mobile Banking Experience by The Asset Magazine

- 2018 Online Banking Initiative of the Year by Asian Banking and Finance

- 2018 Best Technology Implementation - Front End by Retail Banker International (Highly Commended)

As a regulated entity under the Bangko Sentral ng Pilipinas, UnionBank ensures the safety and security of your deposits. For inquiries, contact customer service at customer.service@unionbankph.com or call (+632) 841-8600. Remember, your maximum deposit insurance is P500,000, as a member of PDIC.

Experience the future of banking with UnionBank. Open your account today and enjoy the convenience of modern banking at your fingertips!

For more information, visit our web version at UnionBank Online.

Rate the App

User Reviews

Popular Apps

Editor's Choice