Latest Version

24.10.2

November 29, 2024

Lili App Inc.

Finance

Android

0

Free

lili.co

Report a Problem

More About Lili - Small Business Finances

Unlocking the Benefits of Business Banking: A Comprehensive Guide

In today's fast-paced business environment, having the right banking solutions is crucial for success. Business banking offers a range of services designed to streamline financial management, enhance cash flow, and provide essential tools for growth. This article explores the key features of business banking, focusing on accounts, software, tax preparation, invoicing, support, and security.

Business Checking Account: Your Financial Foundation

A business checking account serves as the cornerstone of your financial operations. With features tailored for entrepreneurs, it provides essential tools to manage your finances effectively. Here are some standout features:

- Lili Visa® Debit Card: Enjoy seamless transactions with the Lili Visa® Debit Card, accepted at millions of locations worldwide.

- Mobile Check Deposit: Deposit checks quickly and easily using your smartphone, saving you time and effort.

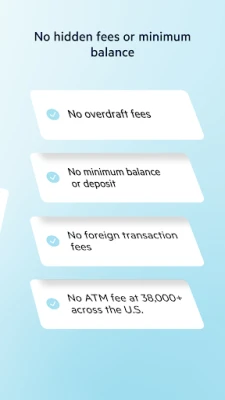

- Fee-Free ATM Withdrawals: Access your funds without incurring fees at over 38,000 ATMs nationwide.

- Cash Deposits: Make cash deposits at 90,000 participating retailers, providing flexibility for your business needs.

- Early Payments: Get paid up to two days early, improving your cash flow and financial planning.

- No Minimum Balance: Enjoy the freedom of no minimum balance or deposit requirements, allowing you to manage your funds without restrictions.

- No Hidden Fees: Transparency is key; rest assured there are no hidden fees to worry about.

- Automatic Savings: Set aside funds effortlessly with automatic savings features.

- Cashback Awards: Earn rewards on your spending, adding value to your business transactions.

- Fee-Free Overdraft: Access up to $200 in fee-free overdraft protection, providing peace of mind during cash flow fluctuations.

- Savings Account with Competitive APY: Benefit from a savings account offering a 3.65% APY, helping your money grow.

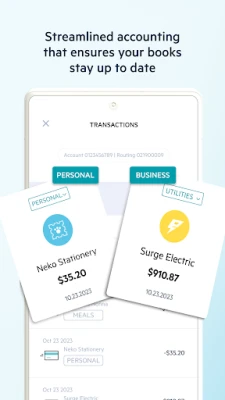

Streamlined Accounting Software for Business Efficiency

Effective financial management requires robust accounting software. With tools designed for expense management and reporting, you can gain valuable insights into your business's financial health:

- Expense Management Tools: Track and categorize expenses effortlessly, ensuring you stay on top of your financial obligations.

- Income & Expense Insights: Gain a clear understanding of your financial performance with detailed insights into income and expenses.

- Receipt Attachment: Simplify expense tracking by attaching receipts directly from your phone with a quick photo.

- On-Demand Reporting: Generate profit & loss statements and cash flow reports on demand, providing you with real-time financial data.

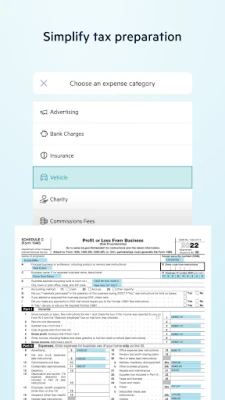

Efficient Tax Preparation Made Easy

Tax season can be daunting, but with the right tools, you can simplify the process:

- Automatic Transaction Labeling: Transactions are automatically categorized into tax categories, saving you time and reducing errors.

- Write-Off Tracker: Keep track of potential write-offs to maximize your tax savings.

- Automated Tax Savings: Benefit from automated features that help identify tax-saving opportunities.

- Pre-Filled Tax Forms: Access pre-filled business tax forms, including Forms 1065, 1120, and Schedule C, streamlining your filing process.

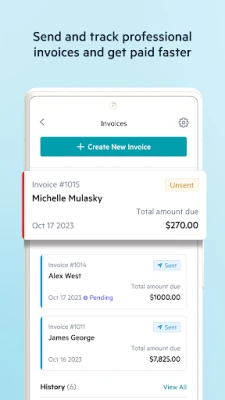

Invoicing Software: Get Paid Faster

Efficient invoicing is essential for maintaining cash flow. With advanced invoicing software, you can:

- Create Customized Invoices: Design and send personalized invoices that reflect your brand.

- Accept All Payment Methods: Provide flexibility to your clients by accepting various payment methods.

- Track Unpaid Invoices: Monitor outstanding invoices and send timely payment reminders to clients.

Comprehensive Support for Your Business

Running a small business comes with challenges, but you don’t have to face them alone. Access a wealth of resources to support your journey:

- Lili Academy: Explore videos and guides covering all aspects of small business management.

- Free Tools and Resources: Utilize downloadable resources, long-form guides, and informative blog articles.

- Partner Discounts: Take advantage of discounts on relevant tools from trusted partners.

- Curated Newsletters: Stay informed with newsletters featuring business-related content tailored to your needs.

Account Security You Can Trust

Security is paramount in business banking. Lili ensures that your accounts are protected with industry-leading measures:

- Insurance Coverage: All Lili accounts are insured up to $250,000 through our partner bank, Sunrise Banks, N.A., Member FDIC.

- Advanced Security Protocols: Benefit from top-notch encryption software and security protocols, including fraud monitoring and multi-factor authentication.

- Real-Time Alerts: Receive transaction alerts in real-time, keeping you informed of account activity.

- 24/7 Access: Access your account anytime from mobile or desktop, ensuring you stay connected to your finances.

- Instant Card Freezing: Instantly freeze your debit card if needed, providing an extra layer of security.

Legal Disclosures

It’s important to note that Lili operates as a financial technology company, not a bank. Banking services are provided by Sunrise Banks N.A., Member FDIC. The Lili Visa® Debit Card is issued by Sunrise Banks, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. Please refer to the back of your card for the issuing bank details. The card is accepted wherever Visa debit cards are used.

For account holders of Lili Pro, Lili Smart, and Lili Premium, additional features such as fee-free overdraft and advanced accounting tools are available, subject to applicable monthly account fees. The Annual Percentage Yield (APY) for the Lili

Rate the App

User Reviews

Popular Apps

Editor's Choice