Latest Version

1.4.8

July 23, 2025

Pigeon Loans, Inc.

Finance

Android

0

Free

com.pigeonloans.app

Report a Problem

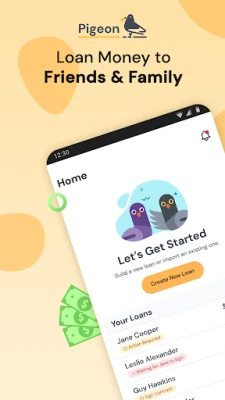

More About Pigeon: Lend Money Your Way

Effortless Money Lending: How Pigeon Simplifies Loans for Friends and Family

In today's fast-paced world, lending money to friends, family, and community members can often feel daunting. However, with Pigeon, you can lend money confidently and manage loans with ease. This innovative platform offers comprehensive loan tracking, management tools, and simple contracts that eliminate the stress associated with personal lending. Let’s explore how Pigeon can transform your lending experience.

Streamlined Loan Management with Pigeon

Pigeon provides a user-friendly interface that simplifies the process of lending money. Whether you’re assisting a friend in need or supporting a family member during a financial crunch, Pigeon’s tools ensure that both parties understand the loan terms clearly. This transparency helps to prevent misunderstandings and maintain healthy relationships.

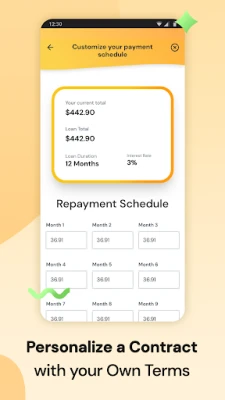

Customizable Loan Terms for Every Situation

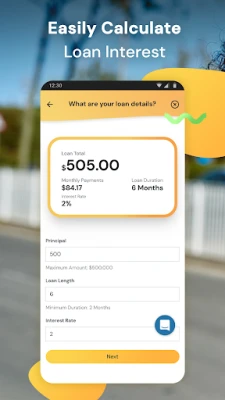

One of the standout features of Pigeon is its customizable loan options. You have the flexibility to set your own loan terms, including:

- Loan Length: Choose from a repayment period of 2 to 360 months.

- Principal Amount: Decide how much money you want to lend.

- Interest Rate: Set your own interest rate, with options up to 35% APR.

This level of customization allows you to tailor each loan to fit the specific needs of your situation, whether it’s covering a family emergency, supporting a new business venture, or assisting with a significant purchase.

Eliminate Awkwardness with Simple Contracts

Gone are the days of awkward IOUs and verbal agreements. Pigeon allows you to create formal loan contracts directly within the app. This feature not only provides peace of mind but also ensures that both parties are on the same page regarding repayment conditions and terms. You can sign contracts digitally, making the process quick and hassle-free.

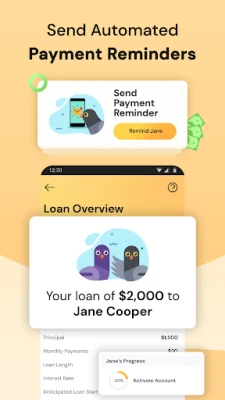

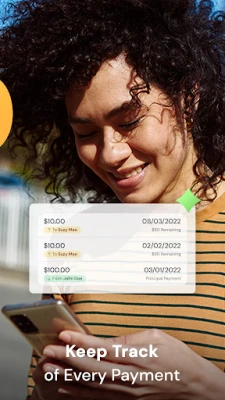

Automated Payment Tracking and Reminders

Managing loans can be challenging, especially when it comes to tracking payments. Pigeon’s loan tracker simplifies this process by sending automated payment reminders to your lendees. This feature helps keep everyone accountable and ensures that payments are made on time, reducing the need for awkward conversations about money.

Financial Education and Debt Payoff Tools

Pigeon goes beyond just lending money; it also offers valuable financial education resources. Users can access tips and tools designed to help them understand debt payoff strategies and improve their overall financial literacy. This commitment to education empowers users to make informed decisions about borrowing and lending.

Real-Life Example of Pigeon’s Loan Management

Let’s consider a practical example of how Pigeon works. Imagine you lend a friend $1,000 with the expectation of being repaid $100 a month over ten months, with a 1% interest rate. Pigeon will handle all the calculations for you. Your friend will repay you $101 each month until the total amount of $1,010 (principal plus interest) is paid off. This straightforward approach makes lending and repayment simple and stress-free.

Why Choose Pigeon for Your Lending Needs?

Pigeon stands out as the ultimate private money lending app for several reasons:

- Privacy: Keep your financial transactions discreet among friends and family.

- Ease of Use: The app’s intuitive design makes it easy to set up loans and manage repayments.

- Support: Pigeon is dedicated to helping you lend money without jeopardizing your relationships.

Download Pigeon Today for Hassle-Free Money Management

Ready to take control of your lending experience? Download Pigeon today and discover how easy it is to lend money to friends and family while maintaining healthy relationships. With Pigeon, you can manage loans confidently, knowing that you have the tools and support you need to succeed.

Disclaimer: Pigeon is not a money lender, nor does it match users with lenders. It is a platform designed to facilitate personal loans between individuals.

Rate the App

User Reviews

Popular Apps

Editor's Choice