Latest Version

4.092624 (build 4.092624.1)

October 25, 2024

Empower Retirement, LLC

Finance

Android

1

Free

com.empower.retirement.android.JPM.Mobile

Report a Problem

More About J.P. Morgan Retirement Link

Maximize Your Retirement Savings: A Comprehensive Guide

Planning for retirement is a crucial step in ensuring financial security in your later years. With the right tools and resources, you can effectively manage your retirement plan and make informed decisions. This article will guide you through the essential actions you can take using your device to enhance your retirement savings and investment strategies.

Register and Access Your Retirement Plan

Start your retirement journey by registering, enrolling, and logging into your retirement plan. This initial step is vital as it allows you to access all the features and tools necessary for effective retirement planning. Once logged in, you can easily navigate through your account and explore various options tailored to your financial goals.

Boost Your Savings with Interactive Tools

Utilize our interactive contribution and age sliders to estimate your monthly post-retirement income. These tools help you visualize how different contribution rates can impact your overall savings. By adjusting the sliders, you can see how increasing your contributions can significantly enhance your retirement fund, ensuring you have the financial resources you need when you retire.

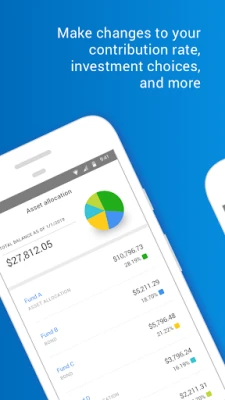

Make Informed Investment Decisions

Investing wisely is key to growing your retirement savings. You can modify your contribution rates, asset allocations, and beneficiaries directly through your account. This flexibility allows you to tailor your investment strategy according to your risk tolerance and financial objectives. Regularly reviewing and adjusting your investments can lead to better returns and a more secure retirement.

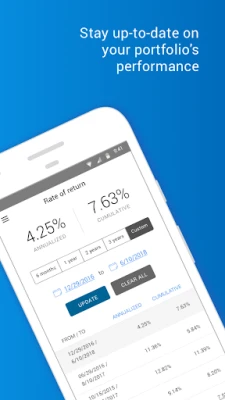

Monitor Your Account Balances

Stay on top of your retirement goals by regularly checking your account balances. Understanding how close you are to achieving your retirement target is essential for making necessary adjustments. By keeping track of your progress, you can identify areas where you may need to increase contributions or alter your investment strategy to stay on course.

Estimate Your Health Care Costs in Retirement

Health care can be one of the most significant expenses during retirement. It’s crucial to understand your estimated health care costs as you plan your finances. Use the resources available in your retirement account to gain insights into potential medical expenses and incorporate these estimates into your overall retirement budget.

Compare Your Savings with Peers

One effective way to gauge your retirement readiness is to learn how your savings compare to your peers. Many retirement platforms offer benchmarking tools that allow you to see where you stand relative to others in similar situations. This information can motivate you to increase your savings or adjust your investment strategies to ensure you are on track.

Explore Important Retirement Topics and Resources

Education is a powerful tool in retirement planning. Take the time to learn more about important retirement topics and resources available through your retirement plan. Whether it’s understanding different investment options, tax implications, or withdrawal strategies, being informed will empower you to make better decisions for your future.

Conclusion

In conclusion, leveraging your device to manage your retirement plan effectively can lead to significant improvements in your financial future. By registering and accessing your account, utilizing interactive tools, making informed investment decisions, monitoring your progress, estimating health care costs, comparing your savings, and exploring educational resources, you can take control of your retirement planning. Start today to ensure a secure and fulfilling retirement.

Rate the App

User Reviews

Popular Apps

Editor's Choice