Latest Version

6.71.0

July 04, 2025

Beyond Finance, LLC

Finance

Android

0

Free

com.beyond

Report a Problem

More About Beyond Finance

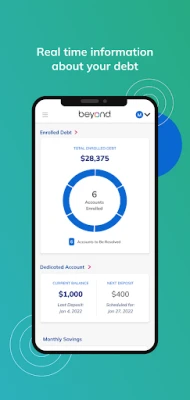

Comprehensive Guide to Managing Your Enrolled Debts

Understanding your financial obligations is crucial for effective money management. This article provides an in-depth look at how to view and manage your enrolled debts, track your trust account history, and stay informed about upcoming scheduled activities.

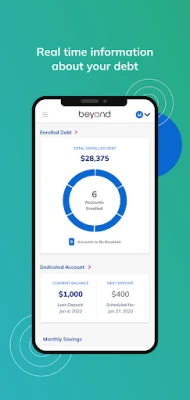

Understanding Enrolled Debts

Enrolled debts refer to the financial obligations that you have formally agreed to pay. These can include loans, credit card debts, and other financial commitments. Keeping track of these debts is essential for maintaining a healthy financial status.

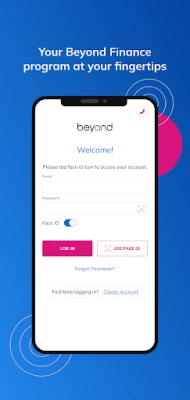

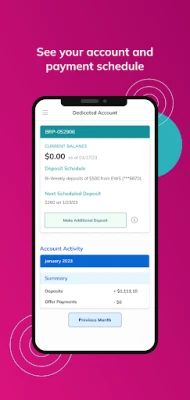

Accessing Your Trust Account History

Your trust account history is a vital resource that provides a detailed overview of your financial transactions. To access this information, follow these steps:

- Log into your financial management platform.

- Navigate to the 'Trust Account' section.

- Review the history of transactions, including payments made and outstanding balances.

By regularly reviewing your trust account history, you can gain insights into your spending habits and identify areas where you can cut back.

Scheduled Activities: What to Expect

Staying informed about your scheduled activities is key to managing your debts effectively. Scheduled activities may include upcoming payments, due dates, and any changes to your financial obligations. Here’s how to keep track:

- Set reminders for payment due dates to avoid late fees.

- Review your scheduled activities weekly to stay ahead of your financial commitments.

- Adjust your budget accordingly to accommodate upcoming payments.

Strategies for Managing Your Debts

Effective debt management requires a proactive approach. Here are some strategies to help you stay on top of your enrolled debts:

Create a Budget

Establishing a budget is the first step toward effective debt management. A well-structured budget allows you to allocate funds for debt repayment while ensuring you cover your essential living expenses.

Prioritize Your Debts

Not all debts are created equal. Prioritize your debts based on interest rates and payment terms. Focus on paying off high-interest debts first to save money in the long run.

Consider Debt Consolidation

If you have multiple debts, consider consolidating them into a single loan with a lower interest rate. This can simplify your payments and potentially reduce your overall interest costs.

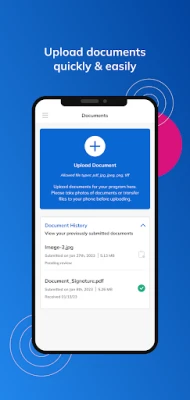

Utilizing Financial Tools

Take advantage of financial tools and apps designed to help you manage your debts. These tools can provide reminders, track your spending, and even offer personalized advice based on your financial situation.

Conclusion

Managing your enrolled debts effectively requires diligence and organization. By regularly reviewing your trust account history and staying informed about your scheduled activities, you can take control of your financial future. Implementing a solid budget, prioritizing your debts, and utilizing financial tools will empower you to achieve your financial goals.

Stay proactive, and remember that understanding your financial obligations is the key to successful debt management.

Rate the App

User Reviews

Popular Apps

Editor's Choice