Latest Version

11.3.0

July 03, 2025

HDFC BANK

Finance

Android

0

Free

com.snapwork.hdfc

Report a Problem

More About HDFC Bank MobileBanking App

Unlock Seamless Banking: Your Guide to Effortless Financial Management

In today's fast-paced world, managing your finances should be as easy as a few taps on your smartphone. With advanced banking solutions, you can enjoy secure logins, quick transactions, and comprehensive account management—all at your fingertips. This article explores the features that make modern banking not just convenient but also secure and efficient.

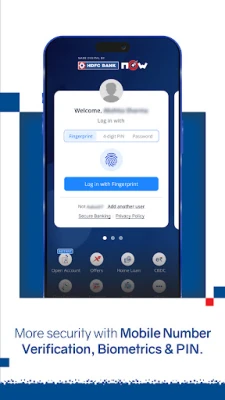

🔒 Hassle-Free Logins for Enhanced Security

Experience the ease of logging into your banking app with biometric options and a secure 4-digit PIN. These features ensure that your accounts remain protected while providing you with instant access. Biometric authentication, such as fingerprint or facial recognition, adds an extra layer of security, making unauthorized access nearly impossible.

💸 Effortless Transactions with Real-Time Fund Transfers

Say goodbye to long waiting times for fund transfers. With UPI (Unified Payments Interface), you can make quick and secure transactions in real-time. Additionally, safeguard your account against fraud by utilizing features that allow you to block debit services instantly. This proactive approach to security ensures that your funds remain safe at all times.

🔢 Simplified Banking Experience

Get a comprehensive view of your financial status with a user-friendly dashboard. Monitor your account balances, fixed and recurring deposits, credit card bills, and utility payments—all in one place. This consolidated view simplifies your financial management, allowing you to make informed decisions quickly.

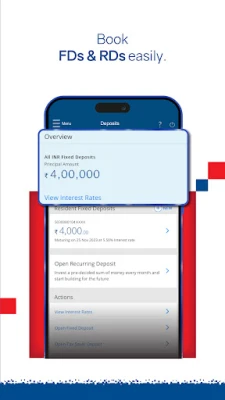

🏦 Easy Deposits for Smart Savings

Booking Fixed Deposits (FDs) and Recurring Deposits (RDs) has never been easier. With just a tap, you can start saving money anytime, anywhere. This feature not only encourages saving but also helps you grow your wealth effortlessly.

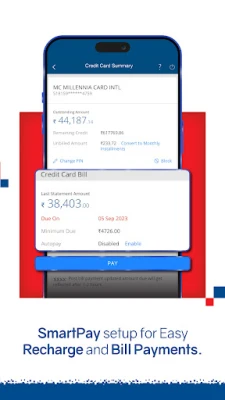

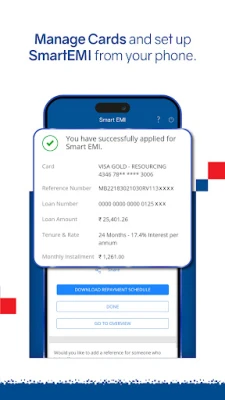

💳 Seamless Card Management

Managing your credit cards is a breeze with integrated features that allow you to apply for new cards, pay bills, and adjust card limits—all from a single platform. If you lose your card, you can quickly block or hotlist it, ensuring your financial security is never compromised.

📈 Effortless Investment Tracking

Keep tabs on your investments and demat accounts with ease. The app allows you to manage your portfolio and engage in mutual fund transactions without any hassle. This feature empowers you to make informed investment decisions and track your financial growth effectively.

📱 Convenient Bill Payments Anytime, Anywhere

Paying utility bills, DTH, electricity, gas, and mobile bills has never been more convenient. With the option to set up automated monthly payments, you can ensure that your bills are paid on time without any effort. This feature not only saves you time but also helps you avoid late fees.

🔄 Quick and Easy Money Transfers

Transfer funds effortlessly between HDFC Bank accounts or to other banks using IMPS, UPI, NEFT, and various payment methods. This flexibility allows you to manage your finances efficiently, whether you're sending money to friends or paying for services.

🔒 Enhanced Security Features for Your Peace of Mind

Your financial security is paramount. Continuous enhancements to security features protect your account and transactions. With Device Registration, you can log in from a single trusted device, while RASP (Runtime Application Security Protection) safeguards against fraud involving remote control apps, data leakage, and screen mirroring.

Additionally, the Mobile Number Verification feature ensures that only devices with your bank-registered mobile number can access your MobileBanking App. This significantly boosts protection against cyber fraud, enhancing your account's security.

To maximize your security, ensure that:

- Your bank-registered mobile number's SIM card is in your mobile device.

- You maintain an active SMS subscription for mobile number verification.

- You have your Debit Card details or NetBanking password ready for one-time verification.

👥 Smart Features for a Personalized Experience

Take advantage of innovative features designed to enhance your banking experience:

- One Touch Share: Effortlessly share payment receipts with friends and family.

- Set Up Favorites: Simplify frequent transactions by creating a favorites list.

- EVA ChatBot Support: Get instant query resolution by chatting with EVA, which accepts both text and voice inputs.

📌 Additional Services for Comprehensive Financial Management

Beyond basic banking, the app offers a range of additional services. Download e-TDS certificates, apply for loans, recharge your account, buy FAS Tags, open savings accounts, apply for credit cards, purchase insurance, and manage Forex cards—all from the convenience of your mobile device.

📥 Download Now & #BankTheWayYouLive

Stay updated with continuous app enhancements that ensure you have access to the latest features. Download the HDFC Bank MobileBanking App today and transform the way you manage your finances.

🔗 Important Disclosures

By downloading the HDFC Bank MobileBanking App:

- You consent to the installation of this app and its future updates and upgrades. You can withdraw your consent at any time by deleting the app from your device.

- You agree to have read and understood the privacy notice of HDFC Bank. To learn more about the privacy notice, please click here.

Embrace the future of banking with a secure, efficient, and user-friendly mobile banking experience. Your financial management journey starts now!

Rate the App

User Reviews

Popular Apps

Editor's Choice