Latest Version

6.14.1

October 26, 2024

Greenlight Financial Technology, Inc.

Finance

Android

0

Free

me.greenlight

Report a Problem

More About Greenlight Kids & Teen Banking

Mastering Family Money Management: A Comprehensive Guide

In today's fast-paced world, effective family money management is essential for fostering financial literacy among children and teens. With innovative tools and resources, parents can empower their kids to understand the value of money, set savings goals, and make informed financial decisions. This article explores the various aspects of family money management, highlighting the benefits of using modern financial technology to teach children about money.

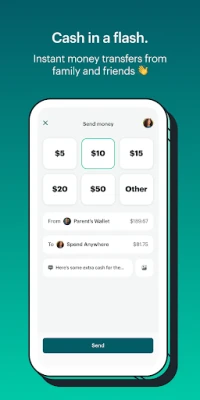

Instant Money Transfers and Direct Deposits

One of the most significant advantages of modern financial tools is the ability to send and receive money instantly. Parents can set up direct deposits for their working teens, ensuring they have quick access to their earnings. This feature not only simplifies the payment process but also teaches young individuals the importance of managing their income effectively.

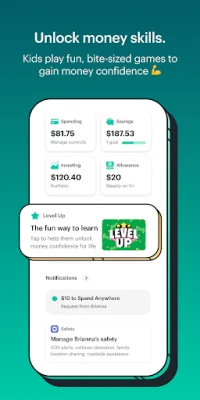

Banking Solutions for Kids and Teens

With dedicated kids banking and teen banking options, parents can maintain flexible controls while allowing their children to explore financial independence. These banking solutions come equipped with features that enable parents to monitor spending, set limits, and guide their children in making responsible financial choices.

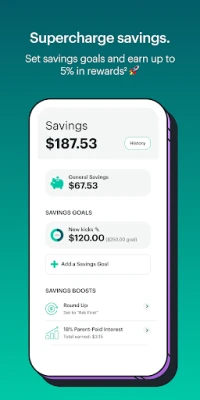

Setting Savings Goals and Earning Rewards

Encouraging children to set savings goals is a crucial aspect of financial education. Many financial apps offer rewards of up to 5% on savings, motivating kids to save more. By gamifying the savings process, children learn the importance of delayed gratification and the benefits of accumulating wealth over time.

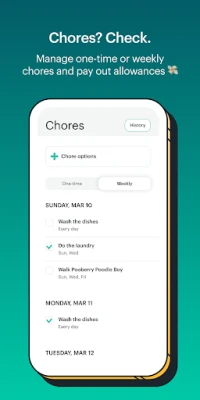

Automated Allowances and Chore Tracking

Managing allowances can be a hassle for busy parents. However, with automated systems, parents can easily track chores and pay allowances without the stress. This not only streamlines the process but also teaches children the value of hard work and responsibility in earning their money.

Investing Education for Kids and Teens

Financial literacy extends beyond saving and spending; it includes understanding investments. Many platforms allow kids and teens to learn about investing or even invest directly with parental approval. This hands-on experience can significantly enhance their understanding of how money can grow over time.

Real-Time Spending Notifications and Limits

With features like real-time spending notifications, parents can stay informed about their children's financial activities. Setting spending limits on debit cards designed for kids and teens helps instill responsible spending habits. This proactive approach to monitoring finances encourages open discussions about money management within the family.

Boosting Financial Literacy Through Games

Engaging children in financial education can be fun! The Level Up™ money game is an excellent tool for boosting financial literacy. By incorporating game mechanics, children can learn essential money management skills in an enjoyable and interactive way.

Comprehensive Protection Plans

Safety is paramount when it comes to family finances. Many financial platforms offer purchase protection, identity theft protection, and cell phone protection to safeguard your family's financial well-being. These features provide peace of mind, allowing families to focus on learning and growing their financial knowledge.

Safety Features for Families

Modern financial tools also prioritize family safety with features like location sharing, SOS alerts, and crash detection. These functionalities ensure that parents can keep track of their children's whereabouts and respond quickly in emergencies, enhancing overall family security.

Endorsements from Trusted Sources

Many reputable publications recognize the importance of financial education for children. The New York Times emphasizes that every conversation about money is a conversation about values, and products like Greenlight can inspire these discussions. Parents Magazine highlights how Greenlight fosters independence for kids and teens in managing their finances.

Testimonials from Satisfied Families

Over 6 million kids and parents have embraced these financial tools. Patricia A. shares, "My teen is learning to manage his own money. I wish Greenlight was around when I was a kid! I tell my friends and family about it all the time!" Samantha B., a mother of four, states, "I love Greenlight. It makes paying allowances and spending money for trips so easy." Shannon M. adds, "Traditional banks don't make it nearly as easy."

Flexible Plans for Every Family

Greenlight offers various plans tailored to meet the needs of different families:

- Greenlight Core: A debit card and educational app for kids and teens to earn, save, spend, and give, plus 2% on savings ($5.99/month).

- Greenlight Max: All features of Greenlight Core with 1% cash back on purchases and 3% on savings ($9.98/month).

- Greenlight Infinity: All features of Greenlight Max with 5% on savings, location sharing, crash detection, and more ($14.98/month).

To find the best plan for your family, visit Greenlight Plans.

24/7 Support for Your Family's Financial Journey

Greenlight is committed to providing support whenever you need it. For assistance and inquiries, visit Greenlight Help Center.

Your Privacy Matters

Greenlight respects your privacy. For information on your California privacy rights, visit California Privacy Rights. To opt-out of data sales, visit Do Not Sell My Information.

In conclusion, effective family money management is crucial for teaching children the value of financial responsibility. By leveraging modern financial tools, parents can create a supportive environment that fosters financial literacy, independence, and safety for their children.

Rate the App

User Reviews

Popular Apps

Editor's Choice