Latest Version

2.11.6

December 08, 2024

First Citizens Bank & Trust

Finance

Android

1

Free

com.firstcitizens.commercial

Report a Problem

More About First Citizens Commercial Adv.

Unlocking Business Efficiency with First Citizens Commercial Advantage

In today's fast-paced business environment, having a reliable banking solution is crucial for success. First Citizens Commercial Advantage offers a comprehensive suite of features designed to streamline financial management for business customers. This article explores the key benefits and functionalities of this innovative banking platform, ensuring your business stays ahead of the competition.

Streamlined Account Management

First Citizens Commercial Advantage provides a user-friendly interface that allows business customers to easily view their accounts and transaction history. The streamlined navigation experience ensures that you can access vital information quickly, enabling you to make informed financial decisions.

Mobile Check Deposits

With the rise of mobile banking, the ability to deposit checks from your mobile device has become essential. First Citizens Commercial Advantage allows you to deposit checks anytime, anywhere, eliminating the need for physical trips to the bank. This feature enhances convenience and saves valuable time for busy business owners.

Real-Time Alerts for Enhanced Security

Staying informed about your account activity is crucial for maintaining security. First Citizens Commercial Advantage offers account and security alerts via text or email, ensuring you are always updated on your financial status. This proactive approach helps detect any unauthorized transactions early, providing peace of mind for business owners.

24/7 Access to Financial Statements

Accessing your financial statements should never be a hassle. With First Citizens Commercial Advantage, you can securely view your checking, savings, and credit card statements at any time. This feature allows for better financial planning and management, as you can monitor your business's financial health whenever needed.

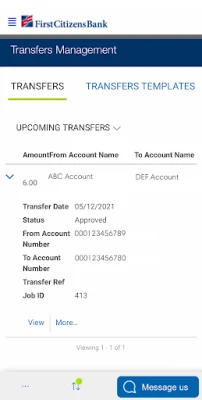

Efficient Transfers and Payments

Managing cash flow is vital for any business. First Citizens Commercial Advantage enables you to schedule one-time and recurring transfers and payments between your business accounts, including checking, savings, credit cards, lines of credit, and loans. This functionality simplifies your financial operations and ensures timely payments.

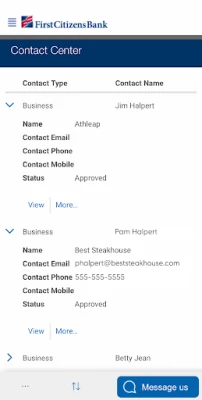

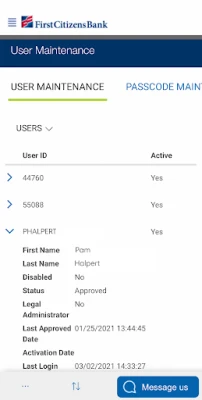

Multi-User Access for Enhanced Collaboration

Collaboration is key in managing a business's finances. First Citizens Commercial Advantage allows you to set up multi-user access, customizing and designating access levels for employees involved in financial management. Additionally, you can create Okta logins for secure access, ensuring that your financial data remains protected while allowing team members to contribute effectively.

Domestic and International Wire Transfers

In an increasingly global marketplace, the ability to send domestic and international wire transfers is essential. First Citizens Commercial Advantage simplifies this process, allowing you to manage your transactions efficiently and expand your business reach without the hassle of traditional banking methods.

Automated Payments via ACH

Automated Clearing House (ACH) payments are a convenient way to handle transactions. With First Citizens Commercial Advantage, you can send payments via ACH, streamlining your payment processes and reducing the time spent on manual transactions. This feature is particularly beneficial for businesses with recurring payments or payroll needs.

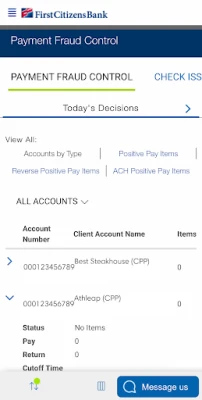

Fraud Detection and Prevention

Protecting your business from fraud is a top priority. First Citizens Commercial Advantage includes features like ACH Positive Pay and Positive Pay, which help detect and prevent fraudulent transactions. These tools provide an added layer of security, ensuring that your business finances remain safe.

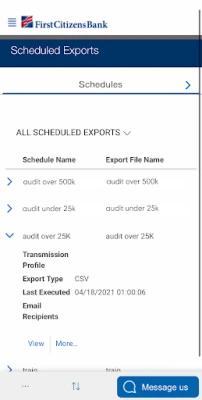

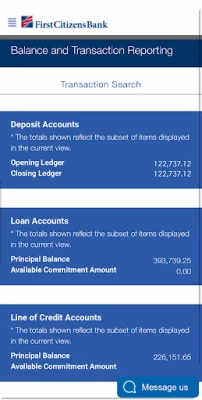

Real-Time Reporting and eStatement Preferences

Staying on top of your financial data is crucial for making informed decisions. First Citizens Commercial Advantage offers real-time reporting capabilities, allowing you to monitor your financial performance as it happens. Additionally, you can customize your eStatement preferences to receive the information you need in a format that works best for you.

Stop Payment and Cancellation Features

Sometimes, you may need to stop a payment for various reasons. First Citizens Commercial Advantage allows you to stop payments for up to one year and provides an option to cancel stop payments if necessary. This flexibility ensures that you have control over your transactions and can manage any issues that arise promptly.

Quick Troubleshooting with Message Us Feature

In the event of any issues or questions, First Citizens Commercial Advantage includes a "Message Us" feature for faster troubleshooting. This direct line of communication with customer support ensures that you receive timely assistance, allowing you to focus on running your business without unnecessary interruptions.

About First Citizens Bank

Founded in 1898 and headquartered in Raleigh, North Carolina, First Citizens Bank has a long-standing history of serving customers across more than 560 branches in 19 states. With a commitment to providing exceptional banking services, First Citizens Bank continues to innovate and adapt to meet the needs of its customers. For more information, visit firstcitizens.com.

First Citizens does not charge fees for downloading or accessing First Citizens Digital Banking Commercial Advantage, including the First Citizens Commercial Advantage app or First Citizens Text Banking. However, mobile carrier fees may apply for data and text message usage, so it’s advisable to check with your carrier for more information. Please note that fees may apply for certain services within First Citizens Digital Banking Commercial Advantage.

Copyright © 2021. First Citizens Bank. Member FDIC. Equal Housing Lender.

Rate the App

User Reviews

Popular Apps

Editor's Choice