Latest Version

4016.2.2

July 21, 2025

Municipal Credit Union

Finance

Android

0

Free

com.nymfcu.nymfcu

Report a Problem

More About NYMCU Mobile Banking

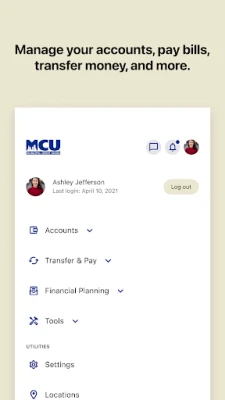

Maximize Your Banking Experience: Essential Online Banking Features

In today's fast-paced digital world, online banking has revolutionized the way we manage our finances. With just a few clicks, you can access a plethora of services that enhance your banking experience. This article explores the essential features of online banking that empower you to take control of your finances efficiently.

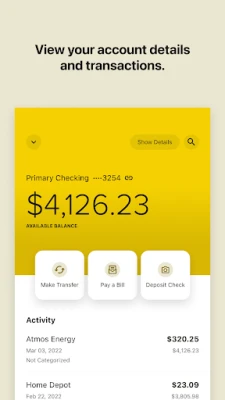

1. Effortless Deposits

Making deposits has never been easier. With online banking, you can deposit checks directly from your smartphone or computer. Simply take a picture of the check, enter the amount, and submit it. This feature not only saves you time but also eliminates the need to visit a physical bank branch. Additionally, you can set up direct deposits for your salary, ensuring that your funds are available immediately without any hassle.

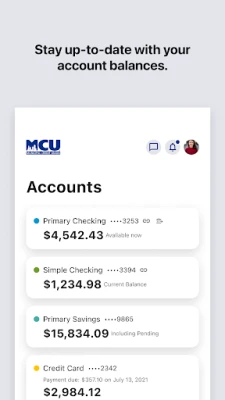

2. Instant Balance Checks

Keeping track of your finances is crucial, and online banking allows you to check your account balances in real-time. Whether you’re at home or on the go, you can quickly access your account information to monitor your spending and ensure you stay within your budget. This feature helps you make informed financial decisions and avoid overdraft fees.

3. Comprehensive Account Details

Online banking provides a detailed overview of your account information. You can easily view your account details, including account numbers, types, and interest rates. This transparency allows you to understand your financial standing better and make strategic decisions regarding savings and investments. Additionally, you can update your personal information, ensuring that your bank has the most current data.

4. Transaction History at Your Fingertips

Reviewing your account transactions and history is a breeze with online banking. You can access a comprehensive list of your recent transactions, including deposits, withdrawals, and purchases. This feature is invaluable for budgeting and tracking your spending habits. By analyzing your transaction history, you can identify areas where you can cut back and save more effectively.

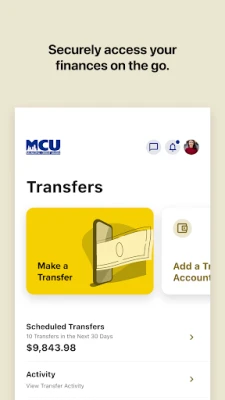

5. Seamless Fund Transfers

Transferring funds between accounts is a straightforward process with online banking. Whether you need to move money from your checking to savings account or send funds to a friend, the process is quick and secure. Most banks offer instant transfers, allowing you to manage your finances without delays. This feature is particularly useful for those who need to allocate funds for specific purposes or pay bills promptly.

6. Stay Informed with Messages and Alerts

Receiving messages and alerts is an essential aspect of online banking that keeps you informed about your account activity. You can set up notifications for various events, such as low balances, large transactions, or upcoming bill payments. These alerts help you stay on top of your finances and prevent any unexpected surprises. Additionally, many banks offer secure messaging systems, allowing you to communicate directly with customer service for any inquiries or issues.

Conclusion

Online banking has transformed the way we manage our finances, offering a range of features that enhance convenience and control. From making deposits and checking balances to reviewing transaction history and transferring funds, these tools empower you to take charge of your financial well-being. By leveraging these online banking features, you can streamline your financial management and make informed decisions that lead to a more secure financial future.

Rate the App

User Reviews

Popular Apps

Editor's Choice