Latest Version

2.139.0

July 22, 2025

Maya Philippines, Inc.

Finance

Android

0

Free

com.paymaya

Report a Problem

More About Maya – savings, loans, cards

Unlock Financial Freedom with Maya: Save, Shop, Invest, and Borrow

In today's fast-paced world, managing your finances efficiently is crucial. With Maya, you can take control of your financial future by saving, shopping, investing, and borrowing—all in one convenient platform. Discover how Maya can help you earn up to 15% interest annually, access loans quickly, and enjoy a seamless shopping experience.

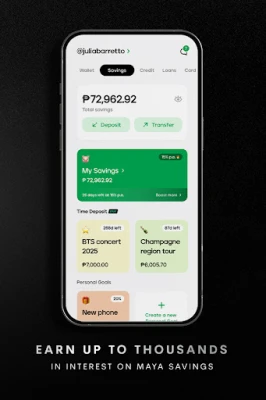

Maximize Your Savings with Maya

Why let your hard-earned money sit idle when you can earn substantial interest with Maya Savings? Start your banking journey with just one valid ID and enjoy an impressive interest rate of up to 15% per annum, credited to your account daily. This means you can accumulate free money every 24 hours, allowing your savings to grow effortlessly.

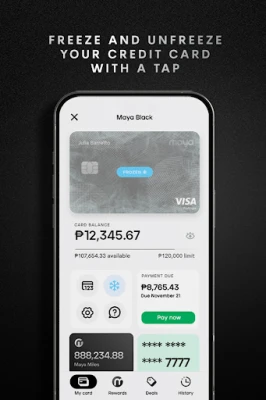

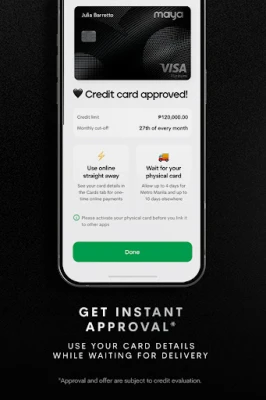

Experience Instant Rewards with Maya Credit Cards

Elevate your shopping experience with a Maya Credit Card. Enjoy instant rewards and enhanced security features that come with your card. Whether you opt for the Maya Black Credit Card, which allows you to earn Maya Miles for your next adventure, or the Landers Cashback Everywhere Credit Card, which offers up to 5% cashback at Landers Superstore, you’ll find a card that suits your lifestyle. Remember, credit card applications and offers are subject to approval.

Shop and Pay with Ease

Maya provides all the wallet features you need to manage your finances effortlessly. With the Maya Card, you can shop globally or pay at your favorite local stores by scanning any QR Ph code. This convenient payment method allows you to handle transactions quickly and securely, making your shopping experience enjoyable.

Invest in Your Future with Maya

Explore the potential of your money through investments in cryptocurrencies and funds. With Maya, you can buy, sell, and trade popular cryptocurrencies like Bitcoin and Ethereum for as little as P1. Additionally, you can invest in renowned companies through Maya Funds starting at just P50. This flexibility allows you to diversify your investment portfolio and grow your wealth over time.

Borrow Smartly with Maya Personal Loans

When life calls for significant upgrades, Maya offers personal loans of up to P250,000 instantly. Alternatively, you can utilize Maya Easy Credit to borrow up to P30,000, providing a boost to your everyday budget. Keep in mind that loan applications are subject to credit evaluation. Here are some key loan terms:

- Credit limit: P15,000 - P250,000

- Monthly add-on interest rate: 0.77% - 2.57%

- Monthly effective interest rate: 1.4% - 4.25%

- Tenure: 6 - 24 months

- Max. annual APR: 30.78%

- Applicable DST and other fees: Waived

- Late fee (daily) on overdue principal: 0.17%

Sample Loan Computation

For instance, if you take a loan of P25,000 with a monthly add-on interest rate of 0.83% over a tenure of 6 months, your monthly installment would be approximately P4,374.17. The total repayment amount would be P26,239.19, with a daily penalty of 0.17% for any overdue payments.

Trust in Maya's Security and Reliability

Maya is a licensed bank regulated by the Bangko Sentral ng Pilipinas, ensuring that your deposits are safe and secure. Your funds are insured by the Philippine Deposit Insurance Corporation (PDIC) up to P1,000,000 per depositor. Terms and conditions apply, so be sure to review them carefully.

24/7 Customer Support

For any inquiries or assistance, Maya offers 24/7 support through the Help Center on the Maya app. You can also reach out via phone from 8 AM to 7 PM daily at (+632) 8845 7788 or toll-free at 1800 1084 57788.

Visit Us

Our office is located at Launchpad Building, Sheridan St., Mandaluyong, Metro Manila, Philippines. Experience the future of banking with Maya and unlock a world of financial possibilities today!

With Maya, you can save, shop, invest, and borrow—all while enjoying the benefits of modern banking. Don’t miss out on the opportunity to enhance your financial journey!

Rate the App

User Reviews

Popular Apps

Editor's Choice