Latest Version

November 16, 2025

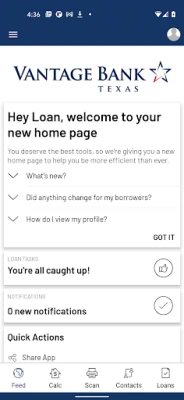

Vantage.Bank

Finance

Android

0

Free

com.simplenexus.loans.client.s__71272

Report a Problem

More About Vantage Bank Mortgage

Maximize Your Mortgage: A Comprehensive Guide to Loan Programs and Refinancing

In today's dynamic financial landscape, understanding your mortgage options is crucial for making informed decisions. This article will explore various lending scenarios, calculate potential savings from refinancing, assess homeownership affordability, and streamline the loan approval process. Additionally, we will provide tips on staying informed about industry changes that could affect your mortgage. Let’s dive in!

Comparing Loan Programs: Finding the Right Fit

When considering a mortgage, it’s essential to compare different lending scenarios. Various loan programs cater to diverse financial situations, and understanding these options can help you determine the best product for your needs. Here are some common types of loans:

- Fixed-Rate Mortgages: These loans offer a consistent interest rate throughout the loan term, providing stability in monthly payments.

- Adjustable-Rate Mortgages (ARMs): ARMs typically start with lower rates that adjust after a set period, which can lead to lower initial payments but potential increases later.

- FHA Loans: Backed by the Federal Housing Administration, these loans are ideal for first-time homebuyers with lower credit scores and smaller down payments.

- VA Loans: Available to veterans and active-duty military members, VA loans offer favorable terms, including no down payment and no private mortgage insurance (PMI).

By evaluating these options, you can identify which loan program aligns with your financial goals and circumstances.

Calculating Refinancing Savings: Is It Worth It?

Refinancing your mortgage can lead to significant savings, but it’s essential to calculate the potential costs and benefits. Here’s how to assess whether refinancing is a smart financial move:

- Assess Current Interest Rates: Compare your existing mortgage rate with current market rates. If rates have dropped significantly, refinancing may be advantageous.

- Calculate Break-Even Point: Determine how long it will take to recoup the costs of refinancing through lower monthly payments. This is known as the break-even point.

- Consider Loan Terms: Evaluate whether a shorter loan term could save you money on interest over the life of the loan, even if it results in higher monthly payments.

By carefully analyzing these factors, you can make an informed decision about whether refinancing is the right choice for you.

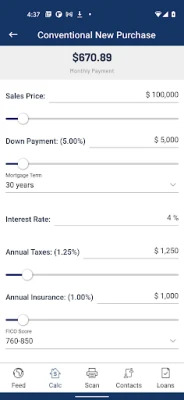

Assessing Homeownership Affordability

Before diving into homeownership, it’s crucial to determine if it fits within your financial framework. Here are key considerations to evaluate:

- Income Analysis: Review your current income and ensure it can support mortgage payments, property taxes, insurance, and maintenance costs.

- Monthly Expenses: Create a detailed budget that includes all monthly expenses. This will help you understand how much you can allocate toward a mortgage.

- Debt-to-Income Ratio: Lenders typically prefer a debt-to-income ratio below 43%. Calculate this ratio to gauge your borrowing capacity.

By conducting a thorough assessment, you can determine if homeownership is a feasible and sustainable option for you.

Streamlining the Loan Approval Process

In today’s fast-paced world, efficiency is key. Here are some tips to expedite the loan approval process:

- Document Preparation: Scan required documents using your smartphone and upload them promptly. This includes pay stubs, tax returns, and bank statements.

- Stay Organized: Keep all necessary paperwork in one place to avoid delays during the approval process.

- Communicate with Your Loan Officer: Maintain open lines of communication with your Vantage Bank Loan Officer to address any questions or concerns quickly.

By following these steps, you can streamline the approval process and move closer to securing your mortgage.

Staying Informed: The Importance of Industry News

Staying updated on industry news is vital for homeowners and prospective buyers alike. Changes in mortgage interest rates and other economic factors can significantly impact your loan. Here’s how to stay informed:

- Subscribe to Newsletters: Sign up for financial newsletters that provide insights into mortgage trends and market conditions.

- Follow Industry Experts: Engage with real estate and financial experts on social media platforms to gain valuable perspectives.

- Attend Workshops and Webinars: Participate in educational events that cover mortgage-related topics and current market trends.

By keeping abreast of industry developments, you can make proactive decisions regarding your mortgage and financial future.

Conclusion: Empowering Your Mortgage Journey

Understanding your mortgage options, calculating refinancing savings, assessing affordability, streamlining the approval process, and staying informed about industry news are all critical components of a successful homeownership journey. By taking these steps, you can empower yourself to make informed decisions that align with your financial goals. Whether you’re a first-time buyer or looking to refinance, knowledge is your greatest asset in navigating the mortgage landscape.

Rate the App

User Reviews

Popular Apps

Editor's Choice