Latest Version

1.28.5

October 23, 2025

Upgrade, Inc.

Finance

Android

0

Free

com.upgrademobile

Report a Problem

More About Upgrade

Unlock Financial Freedom with Upgrade: Your Go-To Financial Technology Solution

In today's fast-paced financial landscape, Upgrade stands out as a pioneering financial technology company, offering innovative solutions that empower consumers to take control of their finances. Unlike traditional banks, Upgrade provides a suite of services designed to enhance your financial well-being, from personal loans to cash back rewards. Let’s explore the various features and benefits that Upgrade has to offer.

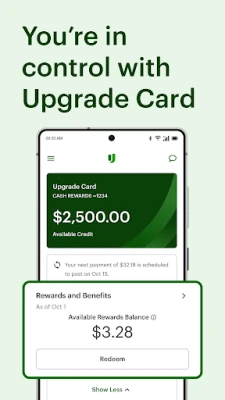

Maximize Your Rewards with Upgrade Card

With the Upgrade Card, you can earn cash back rewards on your purchases. This unique feature allows you to accumulate rewards as you spend, making every transaction more rewarding. Whether you're shopping for essentials or treating yourself, your spending can translate into real cash back, enhancing your overall financial experience.

Comprehensive Financial Management

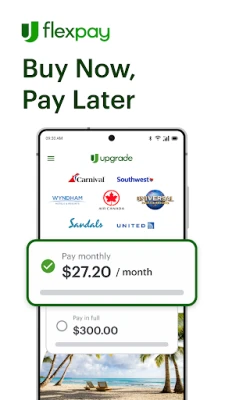

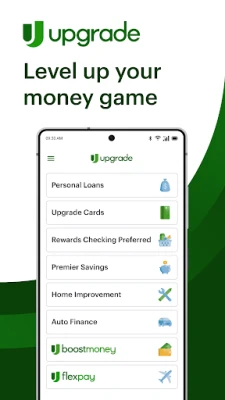

Upgrade provides a user-friendly platform where you can manage various financial products seamlessly. From the Upgrade Card to personal loans, Flex Pay buy now pay later options, auto finance, auto refinancing, and home improvement loans, everything is accessible through your Upgrade account. You can easily make payments, check your balance, and keep track of your financial activities all in one place.

Stay on Top of Your Credit Score

Understanding your credit score is crucial for making informed financial decisions. Upgrade offers tools to monitor your credit score, providing notifications of any changes. Additionally, the credit score simulator allows you to see how different actions may impact your score, helping you strategize for better financial health.

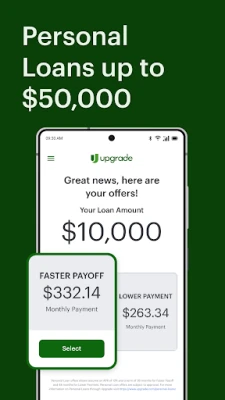

Personal Loans Tailored to Your Needs

Upgrade's personal loan offerings are designed with flexibility in mind. With an APR ranging from 7.74% to 35.99% and terms from 24 to 84 months, you can find a loan that fits your financial situation. For instance, if you secure a $10,000 unsecured loan with a 36-month term at a 17.59% APR, your monthly payment would be approximately $341.48. This transparency in loan terms ensures you know exactly what to expect, allowing for better financial planning.

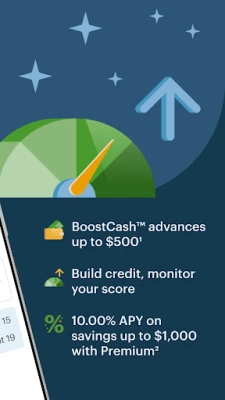

Boost Your Savings with Boost Money™

Upgrade's Boost Money™ Save accounts offer an attractive Annual Percentage Yield (APY) of up to 10.00% on balances up to $1,000, provided you have a Premium subscription. This feature encourages you to save more while earning competitive interest rates. Even without a Premium subscription, you can still enjoy a 1.50% APY on all balances, making it a smart choice for anyone looking to grow their savings.

Feedback and Support

Your experience matters to Upgrade. If you have any feedback or suggestions, you can easily share your thoughts by reaching out to mobile_app_feedback@upgrade.com. Upgrade values customer input and continuously strives to improve its services.

Understanding Fees and Terms

When considering personal loans, it's essential to be aware of the associated fees. Upgrade charges a one-time origination fee ranging from 1.85% to 9.99%, which is deducted from the loan proceeds. This means if you take out a $10,000 loan, you may receive less than the full amount due to this fee. Understanding these terms helps you make informed decisions about borrowing.

Conclusion: Upgrade Your Financial Future

Upgrade is not just a financial technology company; it’s a partner in your financial journey. With a range of products designed to help you manage your money effectively, earn rewards, and improve your credit score, Upgrade empowers you to take charge of your financial future. Explore the possibilities today and see how Upgrade can transform your financial landscape.

For more information on personal loans and other financial products, visit Upgrade's official website.

Rate the App

User Reviews

Popular Apps

Editor's Choice