Latest Version

8.41

January 15, 2026

IDBI BANK

Finance

Android

0

Free

com.idbibank.abhay_card

Report a Problem

More About Abhay by IDBI Bank Ltd

Unlocking the Power of Your Cards: Key Features and Functionality

In today's fast-paced financial landscape, managing your debit and credit cards efficiently is crucial. With advanced features and functionalities, you can take control of your finances like never before. This article delves into the essential features that empower you to manage your cards effectively, ensuring a seamless banking experience.

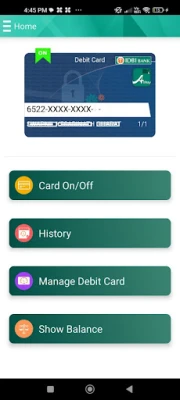

1. Comprehensive Card Details at Your Fingertips

One of the standout features of modern banking apps is the ability to view detailed information about your debit and credit cards. This includes card numbers, expiration dates, and other essential details, allowing you to keep track of your financial assets effortlessly.

2. Independent Control Over Each Card

Managing multiple cards can be challenging, but with independent control over each card, you can customize settings according to your needs. Whether you have a primary debit card and several credit cards, you can manage them all from a single platform, ensuring convenience and efficiency.

3. Temporary Activation and Deactivation

Need to take a break from spending? The ability to switch your card on or off temporarily is a game-changer. This feature allows you to deactivate your card when not in use, providing an added layer of security against unauthorized transactions.

4. Set Daily Transaction Limits for Enhanced Security

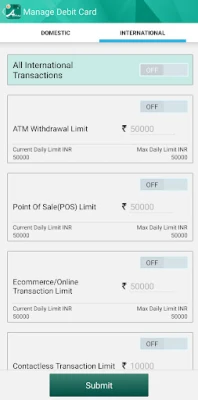

Control your spending by setting daily transaction limits on your debit card. This feature is particularly useful for ATM withdrawals and Point of Sale (PoS) or e-commerce transactions. By establishing a limit, you can prevent overspending and maintain better control over your finances.

5. Flexible Card Limits for Credit Transactions

Adjusting your credit card limits has never been easier. Whether you need to increase or decrease your limits for various transaction channels, such as ATM, PoS, or e-commerce, this feature provides the flexibility you need to manage your credit responsibly.

6. Track Your Recent Transactions

Stay informed about your spending habits by viewing the last ten transactions linked to your card. This feature not only provides descriptions of each transaction but also helps you monitor your financial activity, making it easier to spot any discrepancies.

7. Accumulate and View Loyalty Points

Many credit and debit cards offer loyalty programs that reward you for your spending. With the ability to view your accumulated loyalty points, you can keep track of your rewards and make the most of your purchases, turning everyday spending into valuable benefits.

8. Control Over International Transactions

Traveling abroad? You can enable or disable international transactions with ease. This feature ensures that your card is secure while you’re away, allowing you to manage your spending and avoid unexpected charges.

9. Emergency Hot-listing of Your Card

In case of loss or theft, the ability to hot-list your card provides peace of mind. This feature allows for the permanent deactivation of your card, protecting you from unauthorized use and ensuring your financial security.

10. Check Your Available Balance Instantly

Knowing your available balance is essential for effective financial management. With the option to view your primary account or credit card balance, you can make informed decisions about your spending and budgeting.

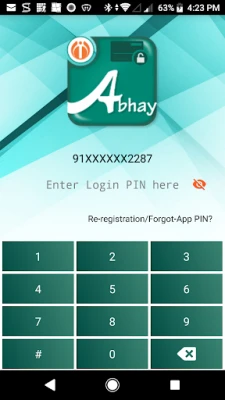

11. Language Preference for User Convenience

To enhance user experience, many banking apps allow you to set your preferred language option, whether it’s Hindi or English. This feature ensures that you can navigate your financial tools comfortably, making banking accessible to everyone.

Conclusion: Empower Your Financial Journey

With these key features and functionalities, managing your debit and credit cards has never been easier. From independent control and transaction limits to emergency hot-listing and loyalty point tracking, these tools empower you to take charge of your financial journey. Embrace the convenience and security that modern banking offers, and make the most of your financial resources today.

Rate the App

User Reviews

Popular Apps

Editor's Choice