Latest Version

January 14, 2026

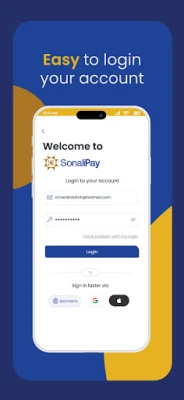

Sonali Pay UK

Finance

Android

0

Free

com.sonalipay.uk

Report a Problem

More About SonaliPay

Streamlining Cash Collection and Bank Account Management

In today's fast-paced financial landscape, effective cash collection and efficient bank account management are crucial for businesses of all sizes. This article explores innovative strategies and best practices to enhance your cash flow and optimize your banking operations.

Understanding the Importance of Cash Collection

Cash collection is the lifeblood of any business. It ensures that you have the necessary funds to operate, invest, and grow. A robust cash collection process not only improves liquidity but also strengthens relationships with clients and suppliers. Here are some key aspects to consider:

1. Establish Clear Payment Terms

Setting clear payment terms is essential for effective cash collection. Clearly communicate your payment policies to clients, including due dates, accepted payment methods, and any penalties for late payments. This transparency helps manage expectations and encourages timely payments.

2. Utilize Invoicing Software

Investing in invoicing software can significantly streamline your cash collection process. These tools automate invoice generation, send reminders, and track payments, allowing you to focus on other critical aspects of your business. Look for software that integrates seamlessly with your accounting system for maximum efficiency.

Optimizing Bank Account Management

Effective bank account management is equally important for maintaining a healthy cash flow. Here are some strategies to optimize your banking operations:

1. Choose the Right Bank Account

Selecting the right bank account is vital for managing your finances. Consider factors such as fees, interest rates, and the availability of online banking services. A business account with low fees and convenient access can save you money and time.

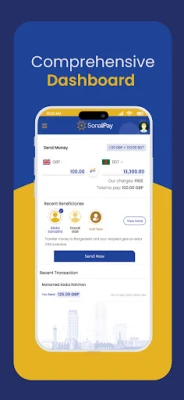

2. Monitor Your Transactions Regularly

Regularly monitoring your bank transactions helps you stay on top of your finances. Set aside time each week to review your account statements, track expenses, and identify any discrepancies. This proactive approach can prevent costly mistakes and ensure that your cash flow remains healthy.

Implementing Effective Cash Flow Management Techniques

To further enhance your cash collection and bank account management, consider implementing these cash flow management techniques:

1. Forecast Your Cash Flow

Creating a cash flow forecast allows you to anticipate future cash needs and plan accordingly. Analyze historical data, consider seasonal fluctuations, and account for expected expenses. This foresight enables you to make informed decisions and avoid cash shortages.

2. Encourage Early Payments

Incentivizing early payments can significantly improve your cash collection process. Offer discounts or other benefits to clients who pay their invoices ahead of schedule. This not only boosts your cash flow but also fosters goodwill among your customers.

Leveraging Technology for Cash Collection and Banking

Technology plays a pivotal role in modern cash collection and bank account management. Here are some tools and technologies to consider:

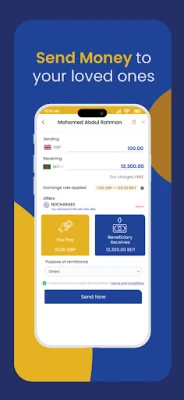

1. Mobile Payment Solutions

With the rise of mobile payment solutions, businesses can now accept payments on-the-go. Implementing mobile payment options can enhance customer convenience and speed up the cash collection process. Ensure that your payment system is secure and user-friendly to encourage adoption.

2. Cloud-Based Accounting Software

Cloud-based accounting software offers real-time access to your financial data, making it easier to manage cash flow and bank accounts. These platforms often include features such as automated invoicing, expense tracking, and financial reporting, providing you with valuable insights into your business's financial health.

Conclusion: Achieving Financial Success Through Effective Management

In conclusion, streamlining cash collection and optimizing bank account management are essential for achieving financial success. By implementing clear payment terms, utilizing technology, and adopting effective cash flow management techniques, businesses can enhance their cash flow and ensure long-term stability. Take the time to assess your current processes and make necessary adjustments to position your business for growth and success.

Rate the App

User Reviews

Popular Apps

Editor's Choice