Latest Version

6.15.2

January 13, 2026

Kiva Microfunds

Finance

Android

0

Free

org.kiva.lending

Report a Problem

More About Kiva - Lend for Good

Unlocking Financial Opportunities: How Kiva Empowers Entrepreneurs Worldwide

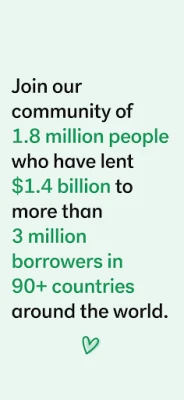

In a world where over 1.7 billion individuals lack access to essential financial services, Kiva stands as a beacon of hope. Founded in 2005 in San Francisco, this international nonprofit organization is dedicated to expanding financial access and empowering underserved communities. By leveraging the power of crowdfunding, Kiva enables individuals to make a significant impact on the lives of entrepreneurs across the globe. Here’s a closer look at how Kiva operates and how you can contribute to this transformative mission.

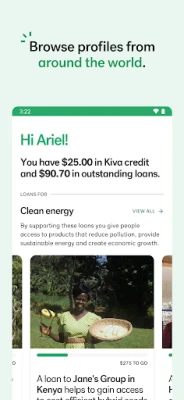

1. Discover Your Borrower: Choose with Purpose

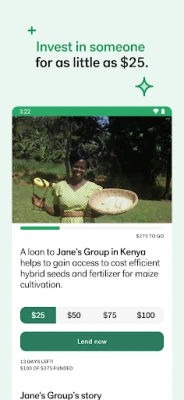

At Kiva, the journey begins with you selecting a borrower. The platform allows you to browse through various categories, making it easy to find an entrepreneur whose story resonates with you. Whether you’re interested in supporting a local artisan, a farmer, or a small business owner, Kiva provides a diverse array of options. This personalized approach not only enhances your lending experience but also fosters a deeper connection with the individuals you choose to support.

2. Make a Meaningful Loan: Start with Just $25

One of the most remarkable aspects of Kiva is its accessibility. You can help fund a loan with as little as $25. This low entry point democratizes lending, allowing anyone to participate in the global effort to alleviate poverty and promote economic growth. Your contribution, no matter how small, plays a crucial role in providing entrepreneurs with the capital they need to thrive.

3. Experience the Joy of Repayment: A 96% Success Rate

When you lend through Kiva, you can feel confident in your investment. Historically, Kiva borrowers have maintained an impressive 96% repayment rate. This high level of repayment not only reflects the commitment of borrowers to honor their loans but also underscores the effectiveness of Kiva’s model. As borrowers repay their loans, you have the opportunity to relend your funds or withdraw them, creating a sustainable cycle of giving.

4. Repeat the Cycle: Empower More Lives

Once you receive repayments, the cycle continues. You can choose to reinvest your funds into new loans, thereby amplifying your impact. This model of lending fosters a sense of community and shared purpose, allowing you to touch more lives with the same dollar. By participating in Kiva, you become part of a larger movement aimed at creating economic and social good.

5. A Vision for Financial Inclusion

Kiva envisions a world where everyone has the power to improve their financial situation. By addressing the barriers to financial access, Kiva helps students pay for tuition, women launch businesses, farmers invest in equipment, and families afford emergency care. Your involvement in Kiva not only supports individual borrowers but also contributes to the broader goal of financial inclusion.

6. The Power of Partnership: It’s a Loan, Not a Donation

Unlike traditional charitable donations, Kiva operates on a loan model. This approach fosters a partnership of mutual dignity between lenders and borrowers. By lending alongside thousands of others, you contribute to a sustainable solution that empowers individuals to take charge of their financial futures. Fund a loan, receive repayments, and fund another—this cycle creates lasting change.

7. Make an Impact Anywhere: Choose Your Cause

Kiva allows you to lend to individuals in your local community or across the globe. This flexibility enables you to play a unique role in someone else's story, regardless of geographical boundaries. Each loan represents a connection, a relationship, and an opportunity to make a difference in the world.

8. Innovating for the Future: Pushing the Boundaries of Lending

Since its inception, Kiva has been at the forefront of innovation in crowdfunding. The organization continually seeks to meet the diverse needs of borrowers by reinventing microfinance with flexible terms, supporting community-wide projects, and reducing costs for borrowers. This commitment to testing and learning ensures that Kiva remains a relevant and effective platform for both lenders and borrowers.

9. The Ripple Effect: Lifting One to Lift Many

When a Kiva loan enables an entrepreneur to grow their business, the benefits extend far beyond the individual. This ripple effect can create opportunities for families and entire communities. By investing in one person, you contribute to a larger movement of economic empowerment that can transform lives and uplift communities.

Join the Movement: Learn More About Kiva

Are you ready to make a difference? By lending through Kiva, you can be part of a global community dedicated to fostering financial inclusion and empowering entrepreneurs. To learn more about how Kiva works and how you can get involved, visit Kiva's official website.

Disclaimer: The Kiva app does not provide personal loans to users. For more information about Kiva loans, please visit Kiva Help.

Rate the App

User Reviews

Popular Apps

Editor's Choice