Latest Version

10.58.0

January 14, 2026

Bluevine Inc.

Finance

Android

0

Free

org.bluevine.depositapp

Report a Problem

More About Bluevine

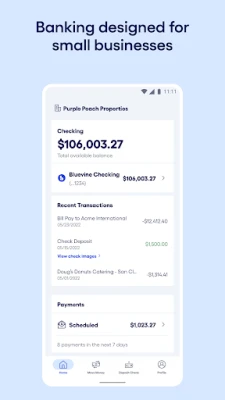

Maximize Your Business Banking Experience with Bluevine

In today's competitive financial landscape, small businesses need banking solutions that not only meet their needs but also help them thrive. Bluevine offers a range of features designed to enhance your banking experience, allowing you to earn more, save on fees, and manage your finances effectively. Here’s how Bluevine can transform your business banking.

Earn Competitive Interest Rates

With Bluevine's business checking plans, eligible customers can earn attractive interest rates on balances up to $3 million. This feature is particularly beneficial for businesses looking to maximize their earnings while maintaining liquidity. Whether you’re a startup or an established enterprise, your funds can work harder for you with Bluevine.

No Monthly Fees for Hassle-Free Banking

One of the standout features of Bluevine is the absence of monthly fees. You can make unlimited deposits and payments without worrying about transaction limits. This flexibility allows you to manage your cash flow without incurring additional costs. Plus, there are no overdraft fees or minimum balance requirements, making it easier for you to focus on growing your business.

Streamline Your Budget with Multiple Sub-Accounts

Effective budgeting is crucial for any business. Bluevine allows you to create up to 20 sub-accounts, each with its own designated account number. This feature enables you to allocate funds for specific purposes, such as taxes, payroll, or operational expenses. By organizing your finances in this way, you gain better control and visibility over your budget, making financial planning more straightforward.

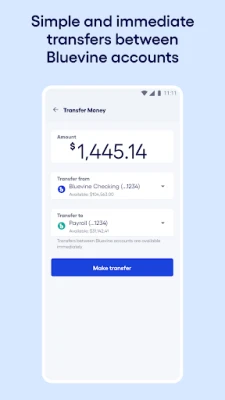

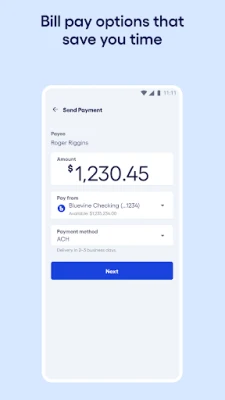

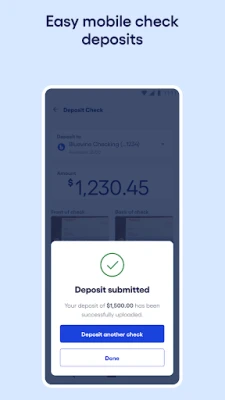

Banking at Your Fingertips

In an increasingly digital world, convenience is key. Bluevine offers robust mobile banking capabilities, allowing you to deposit checks, transfer funds, and pay bills directly from your mobile device. Additionally, you can access over 37,000 in-network MoneyPass locations nationwide for cash withdrawals and deposits, ensuring that you can manage your finances wherever you are.

Advanced Security for Peace of Mind

Your financial security is paramount. Bluevine accounts are FDIC insured up to $3 million per depositor through Coastal Community Bank, Member FDIC. The platform employs industry-leading security measures to protect your account. For instance, if you misplace your debit card, you can instantly lock it to prevent unauthorized transactions. This level of security allows you to bank with confidence, knowing your funds are safe.

Bluevine in the Spotlight

Bluevine is making waves in the financial technology sector. As noted by Banking Dive, “No one that we know is building or has built a bank designed and built specifically for small businesses. And that is what we’re doing.” This commitment to serving small businesses sets Bluevine apart from traditional banks, making it a go-to choice for entrepreneurs.

Legal Disclosures and Important Information

It’s essential to understand that Bluevine operates as a financial technology company, not a traditional bank. Banking services are provided by Coastal Community Bank, Member FDIC. FDIC insurance is available through pass-through insurance at Coastal Community Bank, provided certain conditions are met. Bluevine accounts are insured up to $3 million per depositor through Coastal Community Bank and its program banks.

The Bluevine Business Debit Mastercard® is issued by Coastal Community Bank and can be used wherever Mastercard is accepted. For more details on account eligibility and interest rates, refer to the Bluevine Business Checking Account Agreement.

Conclusion

Bluevine offers a comprehensive suite of banking solutions tailored for small businesses. With competitive interest rates, no monthly fees, and advanced budgeting tools, it empowers entrepreneurs to manage their finances effectively. Coupled with robust security measures and convenient mobile banking options, Bluevine stands out as a leader in business banking. Explore how Bluevine can elevate your banking experience today.

For more information, visit the Bluevine Privacy Policy and the Coastal Community Bank Privacy Policy.

Rate the App

User Reviews

Popular Apps

Editor's Choice