Latest Version

2.0.673

April 13, 2025

U.S. Bank Mobile

Finance

Android

0

Free

com.usbank.spendmanagement

Report a Problem

More About U.S. Bank Spend Management

Master Your Business Spending: Unleash the Power of Analytics and Custom Card Solutions

In today's fast-paced business environment, understanding your spending is crucial for sustainable growth. With advanced analytics, you can gain a comprehensive view of your business expenditures, allowing you to make informed financial decisions. This article explores how to optimize your spending management through tailored solutions and effective organizational strategies.

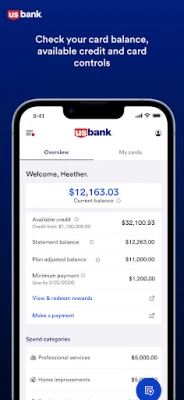

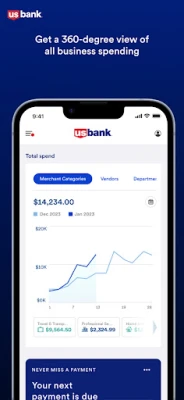

Unlock Insights with Advanced Spending Analytics

To truly grasp your business's financial health, you need more than just basic reports. Advanced analytics provide deep insights into your spending patterns, helping you identify trends and areas for improvement. By leveraging these insights, you can:

- Identify unnecessary expenses and eliminate waste.

- Allocate resources more effectively across departments.

- Make data-driven decisions that align with your business goals.

Utilizing analytics tools allows you to visualize your spending data, making it easier to spot anomalies and adjust your strategies accordingly. This proactive approach not only enhances your financial oversight but also empowers your team to make smarter purchasing decisions.

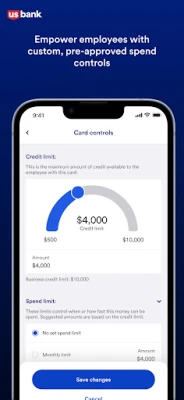

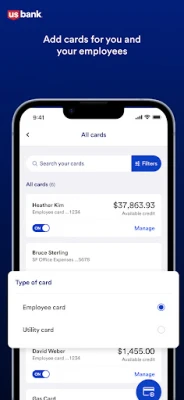

Custom Cards: Empower Your Employees While Maintaining Control

One of the most effective ways to manage business spending is through the use of custom cards. These cards can be tailored specifically for your employees, providing them with the flexibility to make authorized purchases while ensuring you maintain control over expenditures. Here’s how custom cards can benefit your organization:

- Set Spending Limits: Define specific spending limits for each card, ensuring that employees can only make purchases within their designated budgets.

- Streamlined Processes: Eliminate the need for cumbersome approval or reimbursement workflows, allowing your team to focus on their core responsibilities.

- Enhanced Accountability: With each card linked to an employee, tracking spending becomes straightforward, fostering a culture of responsibility.

By implementing custom cards, you empower your employees to make decisions while safeguarding your business's financial integrity.

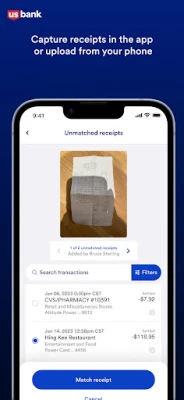

Organize Transactions with Ease

Keeping track of transactions can be a daunting task, especially as your business scales. However, with the right tools, you can simplify this process significantly. Here are some strategies to keep your transactions organized:

- Add Receipts, Tags, and Notes: Encourage employees to attach receipts and add relevant tags and notes to each transaction. This practice not only aids in record-keeping but also provides context for future reference.

- Auto-Categorization Rules: Set up rules that automatically categorize expenses, saving you valuable time during monthly bookkeeping. This automation reduces the risk of human error and ensures consistency in your financial records.

By implementing these organizational strategies, you can maintain a clear overview of your business's financial activities, making it easier to analyze spending trends and prepare for audits.

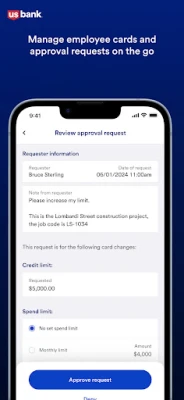

Establish Clear Expense Policies

As your business grows, so does the complexity of managing expenses. Establishing clear expense policies is essential for maintaining order and accountability. Here’s how to create effective policies:

- Define Acceptable Expenses: Clearly outline what constitutes an acceptable expense, ensuring that all employees understand the guidelines.

- Organize Employees into Departments: Group employees by department to streamline expense management. This structure allows for better oversight and tailored policies that meet the unique needs of each team.

- Delegate Responsibilities: Appoint department leads and administrators to oversee spending within their teams. This delegation fosters a sense of ownership and accountability among employees.

By establishing comprehensive expense policies, you create a framework that supports your business's growth while ensuring financial discipline.

Scalable Spend Management Solutions

As your business expands, your spend management solutions should evolve alongside it. Investing in scalable tools and strategies ensures that you can adapt to changing needs without compromising control over your finances. Here are some key considerations:

- Flexible Card Solutions: Choose card solutions that can easily be adjusted as your team grows, allowing you to add or modify spending limits as needed.

- Integration with Financial Software: Ensure that your spend management tools integrate seamlessly with your existing financial software, providing a holistic view of your financial landscape.

- Continuous Training and Support: Provide ongoing training for employees on best practices for spending and expense reporting, fostering a culture of financial awareness.

By prioritizing scalability in your spend management approach, you position your business for long-term success and financial stability.

Conclusion: Take Control of Your Business Spending Today

Understanding and managing your business spending is essential for achieving financial success. By leveraging advanced analytics, implementing custom card solutions, organizing transactions effectively, and establishing clear expense policies, you can take charge of your financial future. As your business grows, ensure that your spend management strategies evolve to meet new challenges. Start today, and empower your team to make informed purchasing decisions while maintaining control over your finances.

Rate the App

User Reviews

Popular Apps

Editor's Choice