Latest Version

9.1.2

July 08, 2025

RBL BANK LIMITED

Finance

Android

0

Free

com.rblbank.mobank

Report a Problem

More About RBL MyBank (Prev. RBL MoBank)

Experience Seamless Banking with RBL MyBank: Your Ultimate Mobile Banking Solution

RBL MyBank has undergone a remarkable transformation, offering users an enhanced mobile banking experience that allows for effortless management of RBL Bank accounts. Whether you need to send money, pay bills, or access various banking services, everything is now conveniently available at your fingertips through your smartphone.

Key Features of RBL MyBank

Secure and Easy Login

Access your account with confidence using secure login options such as MPIN, fingerprint recognition, or Face ID. RBL MyBank prioritizes your security with advanced encryption and multi-layered protection. If your debit card is lost, you can easily disable it to safeguard your finances.

Comprehensive Account Overview

Stay informed about your finances by checking your savings or current account balance, viewing mini statements, and monitoring transactions in real-time. RBL MyBank provides a clear and concise overview of your financial status.

Instant Fund Transfers

Transfer money effortlessly using IMPS, NEFT, RTGS, or UPI with just a few taps. RBL MyBank ensures that sending and receiving funds is quick and hassle-free.

UPI Payments Made Easy

Create and manage your RBL UPI ID to make payments to anyone, anytime. With the ability to scan QR codes and make merchant payments, managing your transactions has never been simpler.

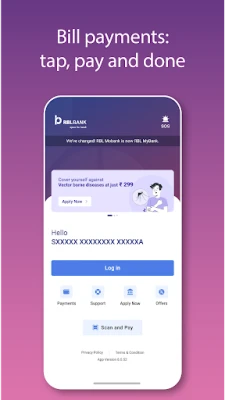

Effortless Bill Payments and Recharges

Recharge your mobile or DTH services and pay utility bills such as electricity, gas, and broadband instantly. RBL MyBank streamlines your payment processes, saving you time and effort.

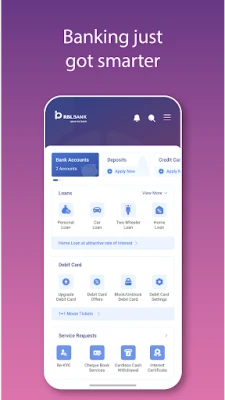

Credit Card Management at Your Fingertips

Apply for a new RBL Bank credit card, view your card details, pay bills, check rewards, and manage your credit limits all within the app. RBL MyBank simplifies credit card management for your convenience.

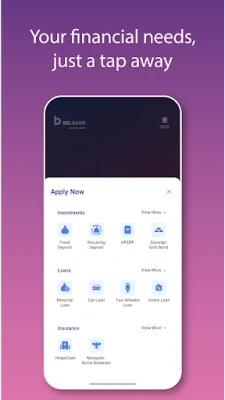

Fixed and Recurring Deposits

Easily open and manage Fixed Deposits (FDs) or Recurring Deposits (RDs) directly from the app, allowing you to grow your savings effortlessly.

Request Cheque Books and Manage Services

Need a cheque book? You can apply for one, stop cheques, block cards, and update your personal details in just a few simple steps.

Loan Services Made Simple

Apply for loans, track your loan status, and manage your EMIs directly within the app. RBL MyBank makes it easy to handle your borrowing needs.

Investment Management

Buy and redeem mutual funds with ease and stay updated on your investment portfolio, ensuring you make informed financial decisions.

Accessible Customer Support

Need assistance? Access one-touch calling to our contact center from the pre-login screen. Once logged in, you can request a callback, and our dedicated team will reach out to you promptly.

Personalized Offers Just for You

Receive tailored offers through smart, contextual marketing, ensuring you never miss out on opportunities that suit your financial needs.

What’s New in the RBL MyBank App?

Enhanced User Experience

The app now features continuous vertical scroll-based screens for effortless navigation. Users can enjoy a consolidated view of account balances, fixed/recurring deposits, credit card bills, and utility bills—all in one intuitive dashboard.

Personalized Dashboards

Experience customized dashboards tailored to your accounts, credit cards, loans, and deposits. The app includes custom bottom navigation bars for each product category and segment-wise themes for Insignia, Signature, Aspire, and Mass users.

Smart Features for Seamless Banking

The dynamic bottom navigation bar adapts to your banking needs, making navigation smoother than ever.

Engaging and Informative Elements

Stay informed with a ticker on the pre-login page for important customer communications. The app also features demo videos and tutorial sections to guide you through your banking experience.

Permissions and Disclosures

To enhance your experience, location permissions are necessary to display nearby RBL Bank branches and ATMs. Please note that the application is currently available only in English.

To access RBL MyBank, you must have a qualified bank account with a registered mobile number.

Download the RBL MyBank App Today!

Experience a smarter way to bank by downloading the RBL MyBank app now. Existing RBL MoBank users can log in using their current credentials. Enjoy the convenience and security of managing your finances on the go!

Copyright© 2025-2026 RBL Bank Ltd.

Rate the App

User Reviews

Popular Apps

Editor's Choice