Latest Version

December 12, 2025

Viva Republica

Finance

Android

0

Free

viva.republica.toss

Report a Problem

More About Toss

Unlock Your Financial Potential with Toss: The Ultimate Fintech Solution

In today's fast-paced world, managing your finances efficiently is crucial. Toss offers a comprehensive platform that allows you to oversee all your financial activities seamlessly. From tracking your income to making hassle-free transfers, Toss is designed to simplify your financial life. Here’s a detailed look at how Toss can transform your banking experience.

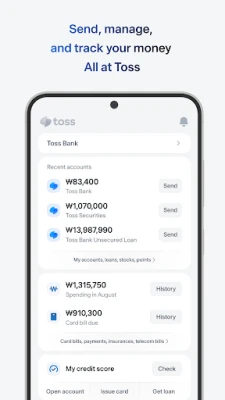

Comprehensive Financial Overview

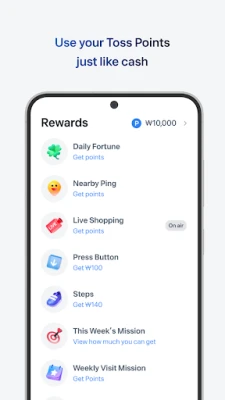

With Toss, you can manage all your financial accounts—savings, installment deposits, housing subscriptions, investments, and loans—conveniently in one place. This all-in-one platform provides a clear snapshot of your finances, enabling you to:

- Monitor your income and spending effortlessly.

- Stay updated on card spending requirements.

- Track monthly bills, insurance payments, and subscriptions without any extra effort.

Safe and Fee-Free Transfers

One of the standout features of Toss is its commitment to providing free transfer services for life, regardless of the bank you use. This means you can send money without worrying about hidden fees. Additionally, Toss prioritizes your security by allowing you to:

- Scan for potential scam and fraud accounts before making transfers.

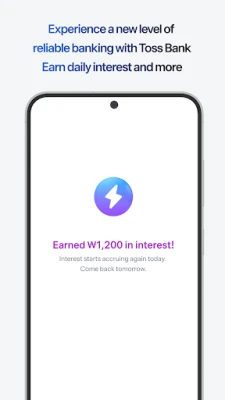

Revolutionizing Banking for You

Toss redefines traditional banking by offering innovative features that cater to your needs:

- Start earning interest with a Toss Bank account in just one day.

- Receive interest in advance, even before your account matures.

- Obtain a debit card that you can use internationally without incurring foreign transaction fees.

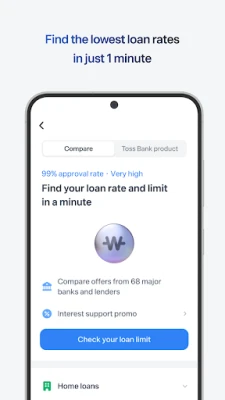

Instant Loan Comparisons

Finding the right loan has never been easier. Toss allows you to compare loan offers from 75 different financial institutions, including 16 from the banking sector, in under a minute. Enjoy exclusive promotions such as:

- One-year interest support and more.

Personalized Insurance Recommendations

Toss goes beyond banking by offering smart insurance recommendations tailored to your unique needs. You can:

- Identify coverage gaps compared to your peers and receive personalized suggestions.

- Submit medical bill claims and receive reimbursements without the hassle of paperwork.

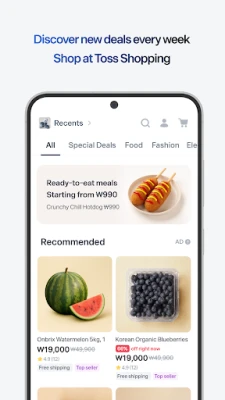

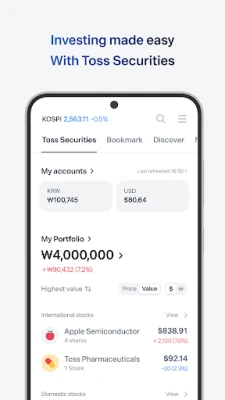

Simplified Investing for Everyone

Investing can be daunting, but Toss makes it accessible for everyone. The platform provides:

- Simple terms that anyone can understand.

- Curated news on stocks you follow.

- A community for sharing information and tips from top investors.

Multilingual Support: Toss in English

Toss is now available in English, making it easier for a broader audience to access its features. To switch to English, simply change your language settings within the app.

Accessibility Features for All Users

Toss is committed to inclusivity, offering various accessibility features to enhance user experience:

- Enable the TalkBack feature for screen reading.

- Increase text size and zoom in for better visibility.

- Utilize high contrast and color-independent display options.

- Enjoy an optimized app experience in Dark Mode.

About Toss and Viva Republica

Toss is operated by Viva Republica, a leading fintech company in Korea. Officially registered as an electronic financial business, Viva Republica has passed rigorous security and monitoring inspections by the Financial Supervisory Service. The company has received accolades, including being ranked 29th on the "Top 100 Fintech Companies in the World" list by KPMG and H2 Ventures in 2019. Today, it boasts more official partnerships with banks and securities firms than any other fintech company in Korea.

Minimal Permissions for Maximum Functionality

Toss respects your privacy by only requesting necessary permissions. While you can use the app without granting optional permissions, some features may be limited. Here’s a breakdown of optional permissions:

- Contact: For contact transfers and profile photo uploads.

- Notifications: To send notifications and receive ARS verification codes.

- Camera: For reading and uploading QR codes, cards, and ID cards.

- Photos: For storing and uploading images.

- Location: To detect your current location and prevent fraudulent transactions.

- Motion & Fitness: For tracking steps (available in Toss Walk).

- Bluetooth: To find and connect to nearby devices.

24/7 Customer Support

Toss is available around the clock, ensuring you have access to support whenever you need it. You can reach out via:

- Phone: 1599-4905

- KakaoTalk: @toss

- Email: support@toss.im

In conclusion, Toss is not just a financial app; it’s a comprehensive solution designed to empower you in managing your finances effectively. With its user-friendly interface, innovative features, and commitment to security, Toss is your go-to platform for all things finance.

Rate the App

User Reviews

Popular Apps

Editor's Choice