Latest Version

0.4.818

February 28, 2025

SENSIBULL

Finance

Android

0

Free

com.sensibull.mobile

Report a Problem

More About Sensibull for Options Trading

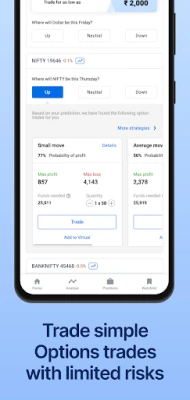

Essential Options Trading Strategies for Beginners and Experts

Options trading can be an exciting yet daunting venture for both beginners and seasoned traders. Understanding the various strategies and tools available is crucial for success in this dynamic market. This article delves into simple and low-risk options strategies for beginners, advanced options strategy builders for experts, and essential tools for trading NIFTY, BANKNIFTY, and NSE stocks, including USDINR options.

Beginner-Friendly Options Strategies

For those new to options trading, starting with simple strategies can help build confidence and understanding. Here are a few low-risk options strategies that beginners can explore:

- Covered Call: This strategy involves holding a long position in a stock while selling call options on the same stock. It generates income from the premium received while providing some downside protection.

- Cash-Secured Put: Selling put options while holding enough cash to buy the stock if assigned can be a great way to enter a position at a lower price.

- Protective Put: Buying a put option while holding a stock can protect against downside risk, allowing traders to maintain their position while limiting potential losses.

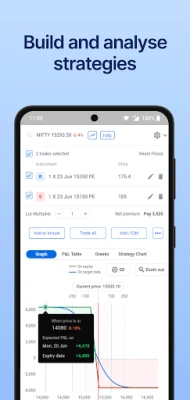

Advanced Options Strategy Builder for Experts

For experienced traders, the ability to build and analyze complex options strategies is essential. An options strategy builder can help in creating tailored strategies based on market conditions and individual risk tolerance. Here are some advanced strategies to consider:

- Straddles and Strangles: These strategies involve buying both call and put options on the same stock, allowing traders to profit from significant price movements in either direction.

- Iron Condor: This strategy combines two spreads, selling an out-of-the-money call and put while buying further out-of-the-money options to limit risk.

- Ratio Spreads: This involves buying a certain number of options and selling a greater number of options at a different strike price, allowing for potential profit in a range-bound market.

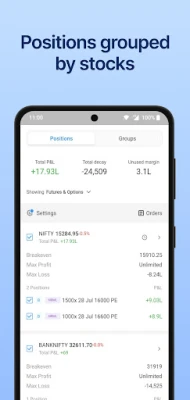

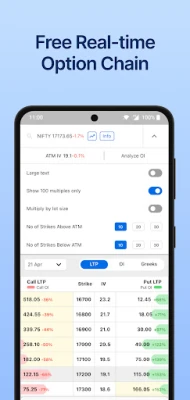

Essential Tools for Options Trading

To navigate the options market effectively, traders need access to various tools and data. Here are some essential resources:

- NSE Option Chain: This provides a comprehensive view of available options, including strike prices, expiration dates, and premiums.

- Open Interest Analysis: Understanding open interest can help traders gauge market sentiment and potential price movements.

- FII and DII Analysis: Monitoring foreign institutional investors (FII) and domestic institutional investors (DII) can provide insights into market trends.

- Option Price Calculators: These tools help traders determine the fair value of options based on various factors, including volatility and time to expiration.

- Implied Volatility (IV) Charts: IV is a critical factor in options pricing, and tracking its changes can inform trading decisions.

- Futures Data: Keeping an eye on futures can provide context for options trading strategies.

Understanding Options Data

Successful options trading relies heavily on data analysis. Here are some key metrics to monitor:

- Option Greeks: These metrics (Delta, Gamma, Theta, Vega, and Rho) help traders understand how different factors affect option pricing.

- Put Call Ratio (PCR): This ratio indicates market sentiment and can signal potential reversals or continuations in price trends.

- IndiaVix: This volatility index measures market expectations of volatility, providing insights into potential price movements.

Real-Time Alerts and Learning Resources

Staying informed is vital in the fast-paced world of options trading. Traders can benefit from:

- Real-Time Price and P&L Alerts: Receiving alerts via WhatsApp can help traders make timely decisions based on market movements.

- Free Options Learning Video Tutorials: Educational resources can enhance understanding and skills, making it easier to navigate complex strategies.

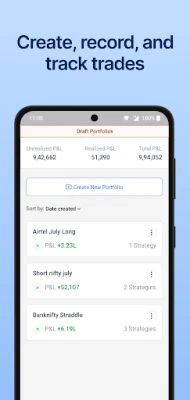

Practice Trading with Draft Portfolios

For those hesitant to trade with real money, practicing with draft portfolios can be an excellent way to build confidence. This allows traders to test strategies without financial risk, ensuring they are well-prepared for live trading.

Ready-Made Options Strategies

For traders looking for quick solutions, ready-made options strategies can save time and effort. These strategies include:

- Call Spreads: A strategy that involves buying and selling call options at different strike prices.

- Put Spreads: Similar to call spreads but focused on put options.

- Iron Butterflies: A combination of a straddle and a strangle, allowing for profit in a range-bound market.

In conclusion, whether you are a beginner or an expert, understanding options trading strategies and utilizing the right tools can significantly enhance your trading experience. By leveraging simple strategies, advanced analysis, and real-time data, traders can navigate the complexities of the options market with confidence.

Rate the App

User Reviews

Popular Apps

Editor's Choice