Latest Version

Version

9.9

9.9

Update

July 13, 2025

July 13, 2025

Developer

OneTwoApps

OneTwoApps

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

$4.99

$4.99

Package Name

com.onetwoapps.mh

com.onetwoapps.mh

Report

Report a Problem

Report a Problem

More About My Budget Book

My Budget Book helps you manage your money more effectively through easy recording of your income and expenses.

Master Your Finances: The Ultimate Guide to Budgeting with My Budget Book

Managing your finances effectively is crucial in today’s fast-paced world. With the right tools, you can track your spending, set financial goals, and visualize your financial health. My Budget Book offers a comprehensive solution that empowers you to take control of your finances. This article explores the features and benefits of My Budget Book, helping you understand how to maximize its potential for your budgeting needs.Track and Forecast Your Balances

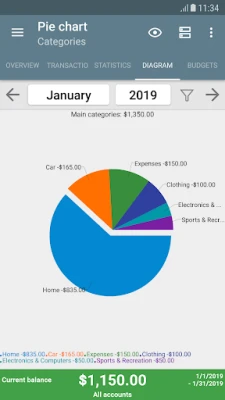

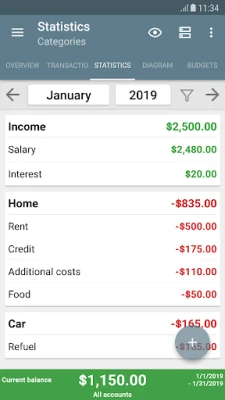

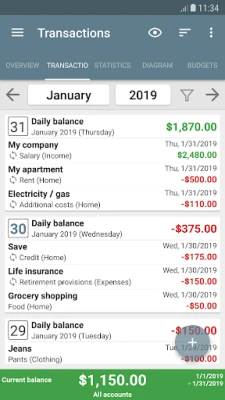

One of the standout features of My Budget Book is its ability to track both individual and recurring transactions. This functionality allows you to forecast your balances accurately, giving you a clear picture of your financial situation. With dynamic charts and graphs, you can visualize your spending patterns and income trends, making it easier to make informed financial decisions.Set Financial Goals with Budget Mode

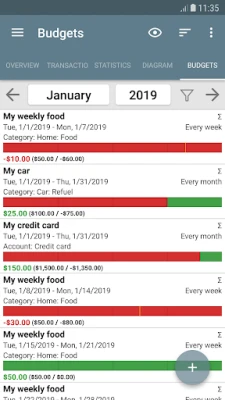

Budget mode is a powerful tool that enables you to set limits and goals over custom periods. Whether you’re trying to curb your clothing expenses, limit your coffee purchases, or save for a dream vacation, My Budget Book allows you to define specific targets. You can set monthly caps for discretionary spending or establish bi-weekly savings goals. Additionally, the rollover feature ensures that every bit of your budget is accounted for, whether it’s money saved or owed.Privacy and Security Features

Your privacy is paramount, and My Budget Book respects that by requiring no internet permissions. This means your financial data remains secure on your device. However, you can easily share backups to the cloud if needed. The app is free from advertisements and hidden costs, relying solely on voluntary donations to support its development.Personalization and User Experience

My Budget Book offers a customizable Material Design layout, including a configurable dark mode for those who prefer a different aesthetic. The app provides comprehensive views with convenient tabs and a variety of sorting options, allowing you to tailor your experience to your preferences. You can visualize your data in tables or graphs, making it easier to understand your income and expenses.Manage Multiple Accounts with Ease

Managing multiple accounts is a breeze with My Budget Book. You can easily transfer funds between accounts and customize categories and subcategories to reflect your unique financial situation. The app allows for sorting that distinguishes specific categories, payment types, individuals, or groups, giving you granular control over your finances.Enhance Your Record-Keeping

To help you remember transaction details and reduce paper clutter, My Budget Book allows you to add photos or receipts to your transactions. This feature is particularly useful for keeping track of expenses and ensuring you have all necessary documentation at your fingertips. Additionally, you can set reminders for pending payments, ensuring you never miss a due date.Flexible Month Start Dates

You can customize the start of your budgeting month based on your regular salary schedule, whether it’s the 1st or the 15th of the month. This flexibility allows you to align your budgeting practices with your income flow, making it easier to manage your finances effectively.Reconcile Expenses with Bank Statements

My Budget Book simplifies the reconciliation process by allowing you to compare your expenses with your bank statements. This feature ensures that your records are accurate and up-to-date, helping you maintain a clear understanding of your financial health.Streamlined Transaction Entry

Creating your own templates for transaction entry can significantly speed up the process of logging expenses. This feature is particularly beneficial for recurring transactions, allowing you to save time and reduce the likelihood of errors.Data Protection and Backup Options

Protecting your sensitive financial data is crucial. My Budget Book offers optional password or fingerprint protection to keep your information secure. The app also supports CSV imports for existing data or bank statements, making it easy to transition to My Budget Book. You can export your data as HTML, Excel, or CSV files for easy viewing or printing.Automatic Local Backups

Never worry about losing your data again. My Budget Book automatically creates local backups, ensuring your financial information is always safe. You can also create manual backups whenever you choose, providing an extra layer of security.Convenient Widgets for Quick Access

The app features four widgets that bring convenience to your home screen, allowing you to access essential information at a glance. This feature enhances your user experience, making it easier to stay on top of your finances.Comprehensive Support and Development

My Budget Book comes with an integrated manual that helps you navigate its features effectively. If you have any questions or need assistance, support is just an email away. The app is under active development, with a focus on improving user experience. You can test the app for a month, and if it doesn’t meet your needs, a simple email will get you a refund.Conclusion

In conclusion, My Budget Book is an invaluable tool for anyone looking to take control of their finances. With its robust features, user-friendly interface, and commitment to privacy, it stands out as a top choice for budgeting. Whether you’re setting financial goals, tracking expenses, or managing multiple accounts, My Budget Book provides the tools you need to succeed. Start your journey to financial mastery today!Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

LINE: Calls & MessagesLINE (LY Corporation)

Rogue SlimeQuest Seeker Games

PrivacyWallPrivacyWall

Roman empire games - AoD RomeRoboBot Studio

CHANCE THE GAMETake Your Chance !

XENO; Plan, AutoSave & InvestXENO Investment

Dot PaintingChill Calm Cute

Nova BrowserJef Studios

Throne WishlistThrone.com

Trovo - Watch & Play TogetherTLIVE PTE LTD

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD