Latest Version

6.6.0

April 27, 2025

Self Financial, Inc.

Finance

Android

0

Free

com.selflender.thor

Report a Problem

More About Self - Credit Builder

Unlock Your Financial Potential with Self: The Ultimate Credit Toolkit

In today's financial landscape, building and maintaining a good credit score is essential for achieving your financial goals. Whether you're looking to secure a loan, rent an apartment, or simply improve your financial health, having a solid credit history can make all the difference. Enter Self, your customizable credit toolkit designed to help you build credit, track your credit score, and apply for credit cards—all in one convenient app.

Why Choose Self for Your Credit Needs?

Self is tailored for individuals with low or no credit scores, making it an inclusive platform for everyone. With Self, you can embark on your credit-building journey today, regardless of your current credit situation. The app offers a variety of features that cater to your unique financial needs.

The Secured Self Visa® Credit Card: No Credit Check Required

- High Approval Rates: The secured Self Visa® Credit Card is designed to be accessible, with no credit check required for approval.

- Control Your Credit Limit: You have the power to set your own credit limit, allowing for better financial management.

- Build Credit Across All Three Major Bureaus: Your responsible use of the card will help you establish a positive credit history with Equifax, Experian, and TransUnion.

- Widely Accepted: Use your Self Visa® Credit Card anywhere Visa is accepted in the United States.

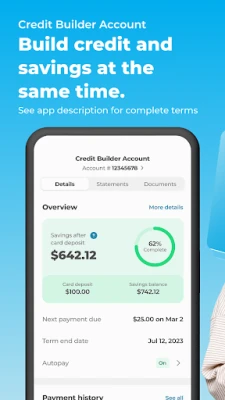

Build Credit and Savings Simultaneously

With Self, you can not only improve your credit score but also save money. On average, users see a credit score increase of 47 points after using the Credit Builder Account for 24 months. Plans start as low as $25 per month, and at the end of your term, you can unlock your savings, minus any interest and fees. This dual benefit makes Self an attractive option for anyone looking to enhance their financial standing.

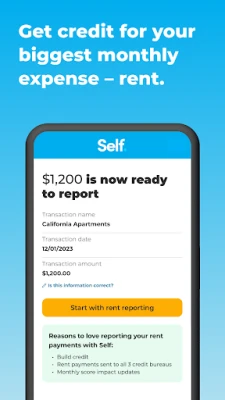

Report Your Rent Payments at No Extra Cost

Did you know that you can boost your credit score by reporting your rent payments? Self allows you to do this at no additional cost. By establishing a positive payment history—one of the most critical factors in credit scoring—you can build credit with all three major bureaus without any hard inquiries or credit checks. This feature is particularly beneficial for renters looking to improve their credit profiles.

Expand Your Credit Profile with Utility Payments

Self also enables you to build credit through everyday payments like cell phone, water, electricity, and gas bills. For just $6.95 per month, you can add up to five payments to your TransUnion credit report each month. This feature not only helps you build credit but also includes credit monitoring by TransUnion, ensuring you stay informed about your credit status.

Transparent Disclosures and Eligibility

It's important to understand the terms associated with the Self Visa® Credit Card and other products. The card is issued by Lead Bank or First Century Bank, N.A., both members of FDIC. Qualification is based on meeting specific eligibility requirements, including income and expense criteria. Additionally, Credit Builder Accounts and Certificates of Deposit are made or held by Lead Bank, Sunrise Banks, N.A., or First Century Bank, N.A., also members of FDIC.

While many users experience an increase in their credit scores, results can vary. A 2024 study by TransUnion found that customers who opened a 24-month Self Credit Builder Account with a starting VantageScore 3.0 under 600 and made on-time payments saw an average increase of 47 points by month 12. However, it's essential to note that late or missed payments on other obligations can negatively impact your score.

Get Started with Self Today

Building credit doesn't have to be a daunting task. With Self, you have a comprehensive toolkit at your fingertips, designed to help you achieve your financial goals. Whether you're looking to improve your credit score, save money, or establish a positive payment history, Self provides the resources you need to succeed.

Don't let a low credit score hold you back. Take control of your financial future with Self and unlock the credit you deserve. Sign up today and start your journey toward better credit health!

For more information, visit Self's official website and explore the various options available to you.

Rate the App

User Reviews

Popular Apps

Editor's Choice