Latest Version

2.0.4

November 11, 2025

Screener.in

Finance

Android

0

Free

com.screener.mobile

Report a Problem

More About Screener

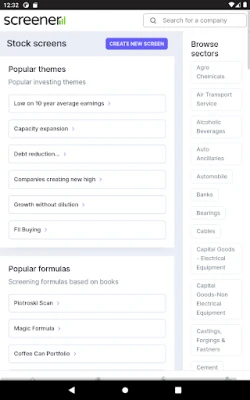

Unlocking Financial Insights: A Comprehensive Overview of Company Performance

In today's fast-paced financial landscape, having access to detailed company performance data is crucial for investors and analysts alike. One powerful tool that facilitates this is a financial screener, which offers a succinct overview of a company's performance over the past 15 years. This article delves into the various features of a financial screener, highlighting its importance in evaluating a company's financial health.

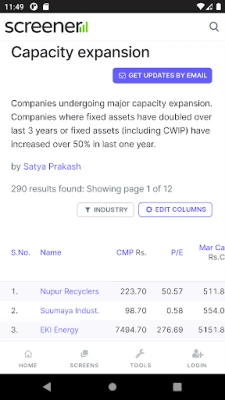

In-Depth Analysis of Profit and Loss Statements

A financial screener allows users to examine profit and loss statements over a decade, providing a clear picture of a company's revenue generation and expense management. By analyzing these statements, investors can identify trends in profitability, assess operational efficiency, and make informed decisions about potential investments.

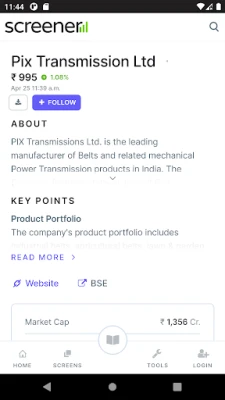

Understanding Balance Sheets for Financial Stability

Balance sheets are essential for evaluating a company's financial stability. A financial screener presents balance sheet data over 10+ years, enabling users to assess key metrics such as assets, liabilities, and equity. This long-term view helps investors understand how well a company manages its resources and obligations, which is vital for gauging its overall financial health.

Cash Flow Statements: The Lifeblood of Business

Cash flow statements provide insight into a company's liquidity and cash management practices. With a financial screener, users can access cash flow data spanning over a decade, allowing them to evaluate how effectively a company generates cash from its operations. This information is crucial for understanding a company's ability to fund growth, pay dividends, and weather economic downturns.

Access to Annual Reports and Analyst Transcripts

Annual reports are a treasure trove of information, offering a comprehensive overview of a company's performance, strategy, and future outlook. A financial screener provides easy access to these reports, along with analyst transcripts that summarize expert opinions and insights. This wealth of information empowers investors to make well-informed decisions based on both quantitative data and qualitative analysis.

Evaluating Credit Ratings for Risk Assessment

Credit ratings are critical indicators of a company's creditworthiness and financial risk. A financial screener includes access to credit ratings, allowing investors to assess the likelihood of default and the overall risk associated with a particular investment. Understanding these ratings is essential for making sound investment choices and managing portfolio risk effectively.

Conclusion: The Power of Financial Screeners

In conclusion, a financial screener is an invaluable tool for anyone looking to gain a deeper understanding of a company's financial performance. By providing access to profit and loss statements, balance sheets, cash flow statements, annual reports, analyst transcripts, and credit ratings, it equips investors with the necessary insights to make informed decisions. Embracing the power of financial screeners can lead to more strategic investment choices and ultimately, greater financial success.

Rate the App

User Reviews

Popular Apps

Editor's Choice