Latest Version

November 16, 2025

Web L3b

Finance

Android

0

Free

com.weblab.gold_silver_prices

Report a Problem

More About Gold and Silver Prices

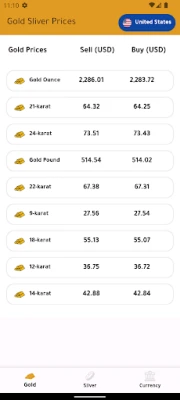

Global Gold, Silver, and Currency Prices: A Comprehensive Overview

Understanding the dynamics of gold, silver, and currency prices across various countries is essential for investors, traders, and anyone interested in the global economy. This article provides a detailed overview of the current prices and trends in precious metals and currencies in key nations around the world.

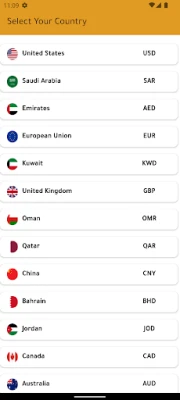

1. United States: A Leader in Precious Metals

The United States remains a significant player in the global market for gold and silver. As of now, gold prices are fluctuating around $1,800 per ounce, while silver is priced at approximately $24 per ounce. The U.S. dollar continues to be a strong currency, influencing global trade and investment.

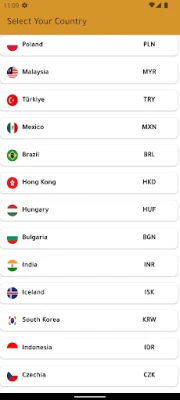

2. Saudi Arabia: Gold and Silver Trends

In Saudi Arabia, gold prices are currently around 7,000 SAR per ounce, with silver priced at 90 SAR per ounce. The Saudi riyal remains stable, supported by the country's oil revenues and economic policies.

3. United Arab Emirates: A Hub for Precious Metals

The Emirates is known for its vibrant gold market, with prices hovering around 6,500 AED for gold and 80 AED for silver. The UAE dirham is pegged to the U.S. dollar, providing stability in currency exchange rates.

4. European Union: Diverse Market Dynamics

Gold prices in the European Union average around €1,600 per ounce, while silver is approximately €22 per ounce. The euro's performance varies by country, influenced by economic conditions and monetary policies.

5. Kuwait: Precious Metals Pricing

Kuwait's gold prices are currently around 5,500 KWD per ounce, with silver at 70 KWD. The Kuwaiti dinar is one of the strongest currencies globally, contributing to the country's economic stability.

6. United Kingdom: Gold and Silver Insights

In the UK, gold prices are approximately £1,400 per ounce, while silver is around £18 per ounce. The British pound's value fluctuates based on economic indicators and Brexit-related developments.

7. Oman: Market Overview

Oman's gold prices stand at about 1,500 OMR per ounce, with silver priced at 20 OMR. The Omani rial remains stable, supported by the country's economic policies.

8. Qatar: Economic Insights

In Qatar, gold prices are around 6,000 QAR per ounce, while silver is priced at 75 QAR. The Qatari riyal is pegged to the U.S. dollar, ensuring currency stability.

9. Egypt: Precious Metals Market

Gold prices in Egypt are approximately 1,000 EGP per ounce, with silver at 15 EGP. The Egyptian pound's value is influenced by various economic factors, including inflation and foreign investment.

10. China: A Growing Market

China's gold prices are around 12,000 CNY per ounce, while silver is priced at 160 CNY. The Chinese yuan's value is affected by trade policies and economic growth rates.

11. Bahrain: Market Trends

In Bahrain, gold prices are approximately 5,200 BHD per ounce, with silver at 70 BHD. The Bahraini dinar remains strong, supported by the country's economic framework.

12. Jordan: Economic Overview

Jordan's gold prices are around 1,200 JOD per ounce, while silver is priced at 15 JOD. The Jordanian dinar's stability is crucial for the country's economic health.

13. Canada: Precious Metals Pricing

In Canada, gold prices are approximately $2,300 CAD per ounce, with silver at $30 CAD. The Canadian dollar's value is influenced by commodity prices and economic conditions.

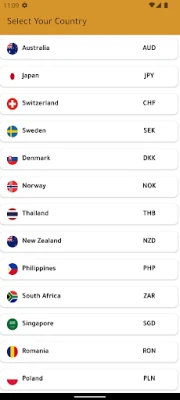

14. Australia: Market Insights

Australia's gold prices are around $2,500 AUD per ounce, while silver is priced at $35 AUD. The Australian dollar's performance is closely tied to global commodity markets.

15. Japan: Economic Landscape

In Japan, gold prices are approximately 200,000 JPY per ounce, with silver at 3,000 JPY. The Japanese yen's value fluctuates based on economic policies and global market trends.

16. Switzerland: A Safe Haven

Switzerland's gold prices are around 1,700 CHF per ounce, while silver is priced at 25 CHF. The Swiss franc is considered a safe-haven currency, attracting investors during economic uncertainty.

17. Sweden: Market Overview

In Sweden, gold prices are approximately 18,000 SEK per ounce, with silver at 250 SEK. The Swedish krona's value is influenced by the country's economic performance.

18. Denmark: Economic Insights

Denmark's gold prices are around 12,000 DKK per ounce, while silver is priced at 180 DKK. The Danish krone remains stable, supported by the country's strong economy.

19. Norway: Precious Metals Pricing

In Norway, gold prices are approximately 15,000 NOK per ounce, with silver at 200 NOK. The Norwegian krone's value is influenced by oil prices and economic conditions.

20. Thailand: Market Trends

Thailand's gold prices are around

Rate the App

User Reviews

Popular Apps

Editor's Choice