Latest Version

1.8.3

July 13, 2025

One Technologies, LLC

Finance

Android

0

Free

com.scoresense.pwa

Report a Problem

More About ScoreSense®

Stay Informed and Secure: Your Comprehensive Guide to Credit Monitoring

In today's fast-paced financial landscape, staying informed about your credit health is more crucial than ever. With the ability to access your latest credit scores and reports from major bureaus like TransUnion, Equifax, and Experian, you can take control of your financial future. This article will guide you through the essential features of credit monitoring, helping you protect your identity and make informed financial decisions.

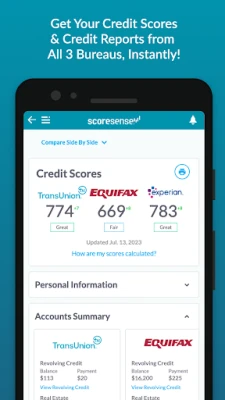

Access Your Latest Credit Scores Anytime

Understanding your credit score is vital for making informed financial decisions. With our service, you can check your latest credit scores at any time without impacting your credit. This means you can see what lenders see, allowing you to prepare for loan applications or credit inquiries with confidence.

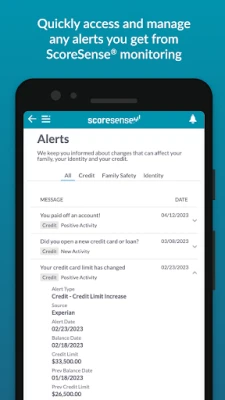

Protect Your Identity with Daily Monitoring

Identity theft is a growing concern, and early detection is key to minimizing its impact. Our Daily Monitoring feature alerts you to any suspicious activity or changes in your credit report that may indicate a threat. By staying vigilant, you can take immediate action to protect your identity and financial well-being.

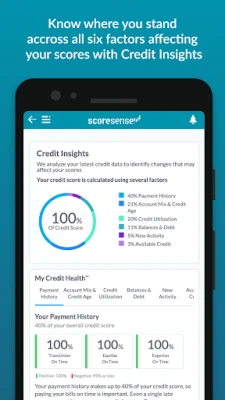

Understand What Affects Your Credit Scores

Knowledge is power when it comes to credit scores. Our platform provides insights into how your scores are calculated and highlights the Score Factors that have the most significant impact. By understanding these elements, you can make strategic decisions to improve your credit health.

Analyze Your Credit Reports Across All Three Bureaus

Credit reports can vary between bureaus, and discrepancies can affect your credit score. Our service allows you to analyze your credit reports side by side, identifying any inconsistencies. This comprehensive view helps you address issues promptly and ensures your credit profile is accurate.

Dispute Errors with Ease

If you find errors in your credit report, it’s essential to act quickly. Our Dispute Center provides a step-by-step guide to filing disputes with all three bureaus. This streamlined process empowers you to correct inaccuracies that could negatively impact your credit score.

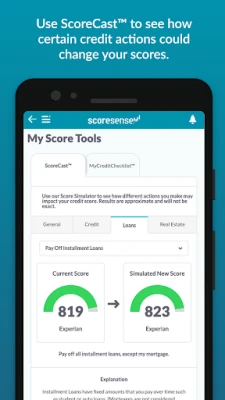

Simulate Score Changes with ScoreCast™

Wondering how certain actions might affect your credit score? With ScoreCast™, you can simulate potential score changes based on different credit actions. This feature allows you to strategize effectively, whether you’re planning to pay down debt or apply for new credit.

Track Your Progress with ScoreTracker™

Monitoring your credit score over time is essential for understanding your financial journey. ScoreTracker™ updates your scores monthly, enabling you to visualize your progress. This tool helps you stay motivated and informed as you work towards your credit goals.

Enhance Your Credit Knowledge in the Learning Center

Boosting your credit IQ is crucial for making sound financial decisions. Our Learning Center offers a wealth of resources, from credit basics to tips on preventing identity theft. By educating yourself, you can navigate the complexities of credit with confidence.

Compare Your Scores with Others

Curious about how your credit scores stack up against others? Our platform allows you to compare your scores with averages in the U.S., your state, or your age group. This comparison can provide valuable context and motivate you to improve your credit standing.

Frequently Asked Questions

Will checking my own credit affect my scores?

No, checking your credit scores through our app or website does not impact your scores. This is known as a soft inquiry, which is different from a hard inquiry that occurs when a lender checks your credit for lending purposes.

Is credit monitoring really that important?

Absolutely! Early detection of identity theft or fraud is crucial. Our daily monitoring service keeps an eye on your credit report and alerts you to any changes that may pose a threat, allowing you to take swift action.

How often should I check my credit scores and reports?

It’s advisable to check your credit scores and reports monthly. Regular reviews help ensure your information is accurate, uncover signs of identity theft, and address any errors that could negatively affect your scores.

Get Started Today

To access the ScoreSense app and all its features, you need a ScoreSense account. If you’re not yet a member, sign up for a free 7-day trial. This trial gives you access to your credit scores, reports, and monitoring services, empowering you to take charge of your financial future.

Stay informed, stay protected, and take control of your credit health today!

Rate the App

User Reviews

Popular Apps

Editor's Choice