Latest Version

1.8.2

December 07, 2025

Elevate CDB, Inc

Finance

Android

0

Free

com.rockymountainreserve.rmr_app

Report a Problem

More About RMR Benefits

Unlocking the Power of Seamless Account Management: Your Comprehensive Guide

In today's fast-paced world, managing your financial accounts efficiently is crucial. Whether you're dealing with Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), Health Reimbursement Arrangements (HRAs), or commuter benefits, having all the necessary tools at your fingertips can make a significant difference. This article explores how to streamline your account management, ensuring you have everything you need in one convenient place.

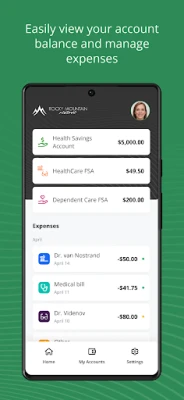

Access Your Account Balances Instantly

One of the most vital aspects of managing your financial accounts is having real-time access to your account balances. With modern technology, you can easily check your balances anytime, anywhere. This feature not only helps you keep track of your spending but also allows you to make informed decisions about your finances.

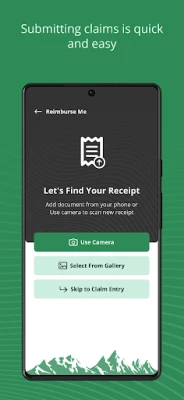

Effortless Claims Submission with Scan-to-Enter

Gone are the days of tedious typing and paperwork when submitting claims. The innovative scan-to-enter feature simplifies the claims process, allowing you to submit your claims quickly and efficiently. Simply scan your receipts, and the system will automatically populate the necessary fields. This not only saves time but also reduces the chances of errors, ensuring a smoother experience.

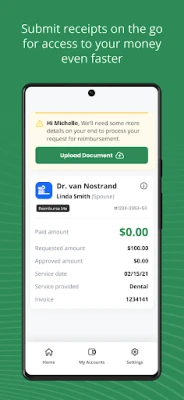

Experience Fast Payments

When it comes to managing your accounts, speed is essential. Fast payment processing means you can access your funds without unnecessary delays. Whether you're reimbursing yourself for medical expenses or utilizing commuter benefits, quick payments ensure that you can manage your finances effectively and without stress.

Receive Instant Notifications

Staying informed about your account activities is crucial for effective management. Instant notifications keep you updated on important transactions, payment confirmations, and any changes to your account status. This feature empowers you to monitor your accounts closely, allowing you to respond promptly to any issues that may arise.

Utilizing RMR HSAs, FSAs, HRAs, and Commuter Benefits

Understanding the various types of accounts available to you is essential for maximizing your benefits. RMR HSAs, FSAs, and HRAs each offer unique advantages that can help you save money on healthcare and commuting costs. By leveraging these accounts effectively, you can enhance your financial well-being and make the most of your available resources.

Health Savings Accounts (HSAs)

HSAs are tax-advantaged accounts designed to help you save for medical expenses. Contributions to HSAs are tax-deductible, and withdrawals for qualified medical expenses are tax-free. This makes HSAs an excellent option for those looking to manage healthcare costs while enjoying tax benefits.

Flexible Spending Accounts (FSAs)

FSAs allow you to set aside pre-tax dollars for eligible medical expenses. Unlike HSAs, FSAs are typically offered through employers and have a "use it or lose it" policy, meaning you must use the funds within the plan year. However, they can be a valuable tool for budgeting healthcare costs.

Health Reimbursement Arrangements (HRAs)

HRAs are employer-funded accounts that reimburse employees for qualified medical expenses. Unlike HSAs and FSAs, HRAs are not owned by the employee, and unused funds may roll over from year to year, depending on the employer's plan. This flexibility can be beneficial for managing healthcare costs over time.

Commuter Benefits

Commuter benefits help employees save on transportation costs. By using pre-tax dollars for commuting expenses, you can reduce your taxable income while making your daily commute more affordable. This benefit is especially valuable for those who rely on public transportation or have long commutes.

Conclusion: Streamline Your Financial Management

In conclusion, having a comprehensive account management system that includes instant access to balances, effortless claims submission, fast payments, and real-time notifications can significantly enhance your financial experience. By utilizing RMR HSAs, FSAs, HRAs, and commuter benefits effectively, you can take control of your finances and make informed decisions that benefit your overall well-being. Embrace these tools and watch as managing your accounts becomes a seamless and stress-free process.

Rate the App

User Reviews

Popular Apps

Editor's Choice