Latest Version

2.5.5

September 25, 2025

RF Mobile Dev

Finance

Android

0

Free

com.republicfinance

Report a Problem

More About Republic Finance

Your Comprehensive Guide to Managing Your Loan with Republic Finance

Managing your finances can be a daunting task, but with Republic Finance, you have access to a range of services designed to simplify your experience. This article will guide you through the essential features of your account, payment options, loan pre-qualification, and more. Let’s dive into how you can effectively manage your loan and make informed financial decisions.

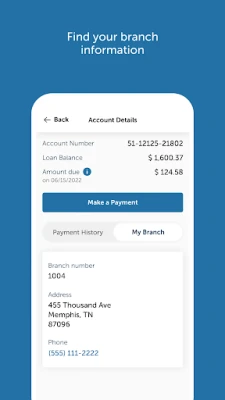

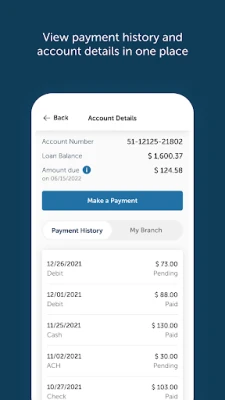

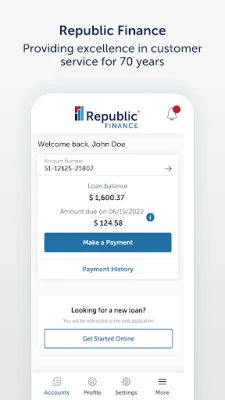

Access Your Account Information Easily

With Republic Finance, viewing your account information and details is straightforward. You can log in to your account anytime to check your balance, payment history, and other essential details. This transparency allows you to stay informed about your financial status and make timely decisions regarding your loan.

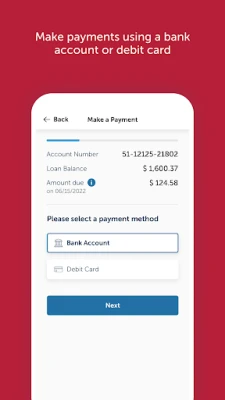

Flexible Payment Options for Your Convenience

Making payments has never been easier. Republic Finance offers multiple payment methods, including bank account transfers and debit card payments. This flexibility ensures that you can choose the option that best fits your lifestyle, making it simple to stay on top of your loan obligations.

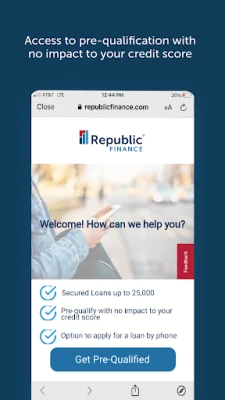

Pre-Qualification Without Credit Score Impact

One of the standout features of Republic Finance is the ability to access pre-qualification for loans without affecting your credit score. This means you can explore your options and understand what loans you may qualify for without the worry of a hard inquiry on your credit report. It’s a risk-free way to assess your borrowing potential.

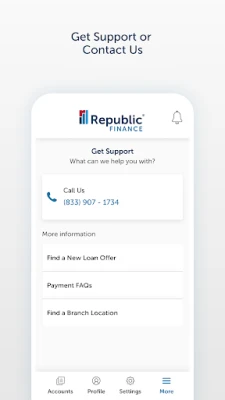

Find a Branch or Contact Us for Assistance

If you need personalized assistance, Republic Finance has over 250 branch locations to serve you. You can easily find a branch near you or contact customer service for any inquiries. Whether you have questions about your account or need help with the loan application process, the dedicated team is ready to assist you.

Understanding Loan Offers and Terms

For typical applicants, Republic Finance provides loan offers with terms ranging from 12 to 60 months. For instance, if you borrow $7,000 at a 30.04% Annual Percentage Rate (APR) over a 60-month term, your monthly payments would be approximately $226.47. The total repayment amount, including principal, interest, and applicable fees, would be around $13,588.20. This example reflects an average customer with good credit, and it’s important to note that APRs will not exceed 35.99%.

Loan terms, including rates, origination fees, and maximum loan amounts, may vary based on your state of residence and your creditworthiness. Not all consumers will qualify for the same terms, so it’s essential to review your specific situation.

Secured Loans: What You Need to Know

For those interested in secured loans, it’s important to understand that applications and closings must be completed with a branch employee. Secured loans require collateral and may have insurance requirements. While purchasing any required insurance from Republic Finance is optional, it’s crucial to ensure that your collateral, such as a vehicle, is properly insured and titled in your name.

Refinancing Options for Current Customers

Current customers looking to refinance should be aware that not all may be eligible for this option. Similar to secured loans, all refinance applications and closings must be conducted with a branch employee. This process ensures that you receive personalized guidance tailored to your financial needs.

Experience and Commitment to Customer Service

With over 70 years of experience in the consumer loan industry, Republic Finance has built a reputation for flexible lending options and exceptional customer service. Currently serving more than 400,000 customers, the company is dedicated to helping individuals achieve their financial goals through tailored loan solutions.

In conclusion, Republic Finance offers a comprehensive suite of services designed to make managing your loan as seamless as possible. From easy access to account information and flexible payment options to pre-qualification without credit score impact, you have the tools you need to make informed financial decisions. Whether you’re considering a new loan or looking to refinance, Republic Finance is here to support you every step of the way.

For more information, visit your nearest branch or contact Republic Finance today!

Rate the App

User Reviews

Popular Apps

Editor's Choice