Latest Version

10.5.0

December 18, 2024

OneMain Financial

Finance

Android

0

Free

com.springleaf.mobile

Report a Problem

More About OneMain Financial

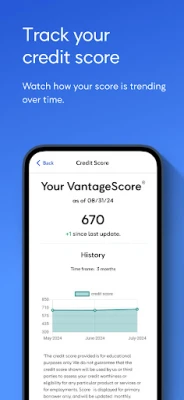

Unlocking the Benefits of OneMain Financial's Mobile App and Personal Loans

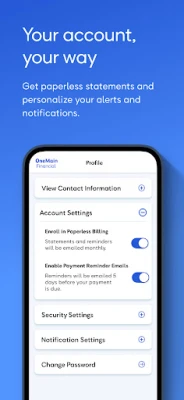

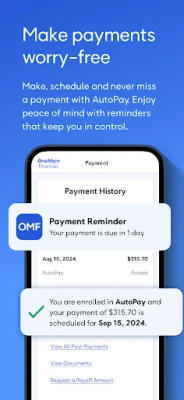

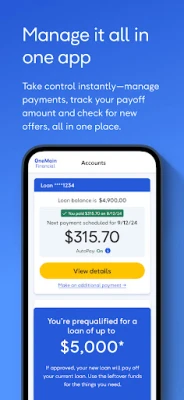

In today's fast-paced world, managing your finances efficiently is crucial. OneMain Financial offers a mobile app designed to help customers service their existing loans and submit applications for refinancing. However, it's important to note that new loan applications cannot be processed through the mobile app. Deleting the app from your device does not affect your OneMain loan account, as we are required by law to retain certain records as a regulated lender and financial institution.

Understanding OneMain Financial's Personal Loans

OneMain Financial provides personal loans with flexible repayment options. The minimum repayment period is 24 months, while the maximum extends to 60 months. The Annual Percentage Rate (APR) for personal loans can reach up to 35.99%. Customers can borrow between $1,500 and $20,000, depending on their qualifications.

Loan Qualification Criteria

Not every applicant will qualify for larger loan amounts or the most favorable terms. To secure a larger loan, you must provide a first lien on a motor vehicle that is no more than 10 years old, meets our value requirements, is titled in your name, and has valid insurance. Approval and specific loan terms are contingent upon your state of residence and your ability to meet our credit standards. This includes maintaining a responsible credit history, demonstrating sufficient income after monthly expenses, and having available collateral. Generally, loans that are not secured by a vehicle will have higher APRs. Highly qualified applicants may be eligible for larger loan amounts and lower APRs.

Restrictions on Loan Usage

It’s essential to understand that loan proceeds cannot be used for certain purposes. Specifically, funds cannot be allocated for post-secondary education expenses, business or commercial ventures, cryptocurrency investments, gambling, or any illegal activities. Additionally, active-duty military personnel, their spouses, or dependents covered by the Military Lending Act are prohibited from pledging a vehicle as collateral.

State-Specific Loan Size Requirements

Loan sizes can vary significantly by state. Here are the minimum loan amounts required in specific states:

- Alabama: $2,100

- California: $3,000

- Georgia: $3,100

- North Dakota: $2,000

- Ohio: $2,000

- Virginia: $2,600

Conversely, the maximum loan sizes in certain states are as follows:

- North Carolina: $11,000 for unsecured loans to all customers; $11,000 for secured loans to existing customers

- Maine: $7,000

- Mississippi: $12,000

- West Virginia: $13,500

Note that loans for purchasing motor vehicles or powersports equipment from select dealerships in North Carolina, Maine, and Mississippi are not subject to these maximum loan sizes.

Loan Origination Fees Explained

OneMain Financial charges loan origination fees, which can vary based on the state where the loan is initiated. In some states, there may be no origination fee, while in others, it could be a flat fee or a percentage of the loan amount. Flat fees range from $25 to $500, while percentage-based fees can vary from 1% to 10% of the loan, subject to specific state limits.

Representative Loan Cost Example

To illustrate the cost of a loan, consider a principal amount of $6,000 at an APR of 24.99% over a 60-month term. This scenario results in a monthly payment of $176.07. The total amount paid for this loan, including principal, interest, and any financed fees, would be $10,564.20. This example is based on a customer with average credit, and actual loan terms will depend on your credit profile, including credit history, income, debts, and, for secured loans, the ability to provide collateral.

Refinancing and Debt Consolidation Considerations

When considering refinancing or consolidating existing debt, it's crucial to understand that the total finance charges over the life of the new loan may exceed those of your current debt. This can occur if the interest rate is higher or if the loan term is extended. Additionally, loans include origination fees, which may reduce the amount available to pay off other debts.

Licensing and Regulatory Information

OneMain Financial Group, LLC (NMLS# 1339418) operates under various state licenses. In California, loans are made or arranged pursuant to the Department of Financial Protection and Innovation California Finance Lenders License. In Pennsylvania, we are licensed by the Pennsylvania Department of Banking and Securities. In Virginia, we are licensed by the Virginia State Corporation Commission under License Number CFI-156. OneMain Mortgage Services, Inc. (NMLS# 931153) is registered as a New York Mortgage Loan Servicer. For more licensing information, visit nmlsconsumeraccess.org and onemainfinancial.com/legal/disclosures.

Need Assistance?

If you require help with a screen reader or have any questions, please call 800-290-7002. Our team is here to assist you in navigating your financial journey.

Rate the App

User Reviews

Popular Apps

Editor's Choice