Latest Version

6.0.00

December 27, 2024

National Westminster Bank PLC

Finance

Android

0

Free

com.natwest.clearspend

Report a Problem

More About NatWest ClearSpend

Unlocking Financial Control: The Ultimate Guide to NatWest ClearSpend

In today's fast-paced business environment, managing expenses efficiently is crucial for success. NatWest ClearSpend offers a comprehensive solution for businesses looking to streamline their financial operations. This article delves into the key features of NatWest ClearSpend, providing you with the insights needed to maximize its potential.

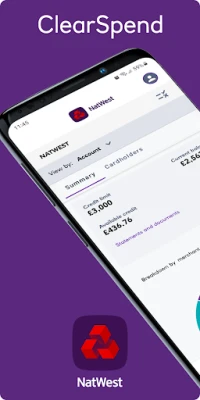

Real-Time Balance Information

Stay on top of your finances with real-time balance information. NatWest ClearSpend allows you to monitor your account balance instantly, ensuring you have the most up-to-date financial data at your fingertips. This feature helps you make informed decisions and avoid overspending, ultimately contributing to better financial health.

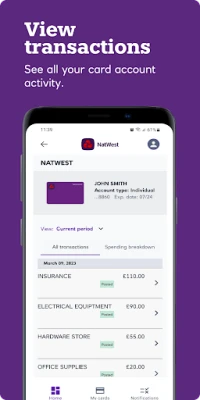

Transaction Management: View Transactions, Pending and Declines

Understanding your spending habits is essential for effective financial management. With NatWest ClearSpend, you can easily view transactions, including pending and declined purchases. This transparency allows you to track expenses accurately and address any discrepancies promptly, ensuring your financial records are always in order.

Access Regular Statements

NatWest ClearSpend simplifies your financial reporting by providing regular statements. These statements offer a comprehensive overview of your spending patterns, making it easier to analyze your financial performance over time. With this information, you can identify trends and make strategic decisions to optimize your budget.

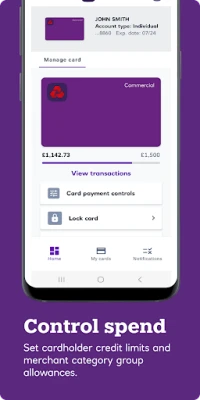

Set Cardholder Credit Limits

Control your business expenses by setting cardholder credit limits. This feature allows you to define spending thresholds for each employee, ensuring that expenditures remain within budget. By implementing these limits, you can prevent unauthorized spending and maintain better control over your financial resources.

Merchant Category Blockings for Enhanced Security

Enhance your financial security by utilizing merchant category blockings. NatWest ClearSpend enables you to restrict cardholder transactions to specific merchant categories, reducing the risk of fraudulent activities. This feature is particularly beneficial for businesses that want to ensure their funds are used solely for approved expenses.

Lock and Unlock Employee Cards

In the event of a lost or stolen card, the ability to lock and unlock an employee’s card provides peace of mind. With just a few taps in the app, you can secure your financial assets and prevent unauthorized transactions. This feature is essential for maintaining the integrity of your business finances.

Receive Instant Transaction Notifications

Stay informed about your spending with transaction notifications. NatWest ClearSpend sends real-time alerts for every transaction made with your business cards. This immediate feedback allows you to monitor expenses closely and respond quickly to any unusual activity, enhancing your overall financial oversight.

Approve Online Purchases with Ease

Streamline your purchasing process by utilizing the approve online purchases feature. NatWest ClearSpend allows administrators to review and approve transactions before they are finalized. This added layer of control ensures that all expenditures align with your business objectives and budgetary constraints.

Create Departments to Segregate Spending

Organize your financial data effectively by creating departments to segregate spending. This feature allows you to categorize expenses by department or project, making it easier to analyze spending patterns and allocate resources efficiently. By having a clear view of departmental expenditures, you can make informed decisions that drive your business forward.

Administrator and Cardholder App for Seamless Management

NatWest ClearSpend offers a dedicated app for administrators and cardholders, making financial management more accessible than ever. The app provides a user-friendly interface that simplifies navigation and enhances the overall user experience. Whether you are an administrator overseeing multiple accounts or a cardholder managing personal expenses, the app caters to your needs.

Quick and Easy Registration Process

Getting started with NatWest ClearSpend is a breeze. The registration process takes just a few minutes. Simply download the app, click on ‘Need to register,’ and follow the on-screen instructions. Keep in mind that your Business or Commercial Card account must be registered and activated before cardholder users can sign up.

Eligibility and Compatibility

NatWest ClearSpend is available to eligible NatWest Business and Commercial Card account customers. To use the app, you need a compatible Android device and a UK or international mobile number from specific countries. Please note that users must be over 18 years old, and other terms and conditions apply.

Conclusion: Empower Your Business with NatWest ClearSpend

In conclusion, NatWest ClearSpend is an invaluable tool for businesses seeking to enhance their financial management. With features like real-time balance information, transaction tracking, and customizable spending controls, you can take charge of your business finances like never before. Embrace the power of NatWest ClearSpend and unlock the potential for greater financial control and efficiency.

Rate the App

User Reviews

Popular Apps

Editor's Choice