Latest Version

5.9.13

October 18, 2025

McCoy Federal Credit Union

Finance

Android

0

Free

com.mccoyfederalcreditunion5180.mobile.production

Report a Problem

More About myMcCoy Mobile Banking

Maximize Your Banking Experience: A Comprehensive Guide to Online Banking Features

In today's fast-paced world, managing your finances efficiently is more important than ever. Online banking offers a plethora of features designed to simplify your financial management. This article explores the essential functionalities of online banking, ensuring you make the most of your banking experience.

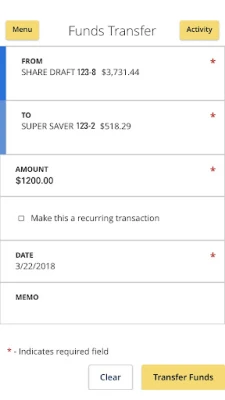

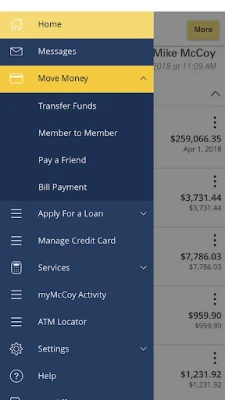

Check Your Balances and Manage Your Accounts

One of the primary advantages of online banking is the ability to check your account balances anytime, anywhere. Whether you’re at home or on the go, you can easily monitor your finances. This feature allows you to:

- Make timely loan payments

- Deposit checks with just a few taps on your mobile device

- Transfer money seamlessly between accounts

With these capabilities, you can maintain control over your financial situation without the hassle of visiting a physical bank branch.

Pay Your Bills Anytime, Anywhere

Gone are the days of writing checks and mailing them. With online banking, you can pay your bills online 24/7/365. This feature provides unparalleled convenience, allowing you to:

- Set up automatic payments to avoid late fees

- Access your payment history for better budgeting

- Manage all your bills from a single platform

Whether you’re at home or traveling, you can ensure your bills are paid on time, giving you peace of mind.

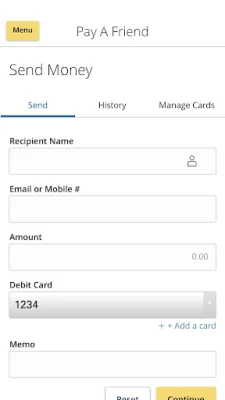

Convenient Peer-to-Peer Payments

Sending and receiving money has never been easier with McCoy P2P payments. This feature allows you to:

- Pay friends and family instantly

- Receive money without the hassle of cash or checks

- Track your transactions effortlessly

With just a few clicks, you can manage your personal finances and settle debts quickly and conveniently.

Consistent User Experience Across Devices

Online banking platforms are designed to provide a seamless user experience, regardless of the device or browser you are using. This means you can:

- Access your account from your smartphone, tablet, or computer

- Enjoy a consistent interface that makes navigation easy

- Utilize all features without compatibility issues

This flexibility ensures that you can manage your finances effectively, no matter where you are or what device you have at hand.

Enhanced Security Features

Your financial security is paramount. Online banking platforms implement multi-factor authentication and Touch ID on compatible devices to protect your information. These security measures help you:

- Safeguard your account against unauthorized access

- Feel confident when conducting transactions online

- Receive alerts for any suspicious activity

With these robust security features, you can focus on managing your finances without worrying about potential threats.

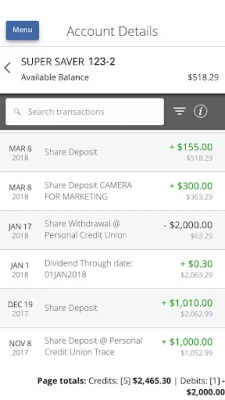

Track Your Transactions and Statements

Keeping an eye on your financial activity is crucial. Online banking allows you to:

- View pending transactions and your complete transaction history

- Access your statements and notices at any time

- Download or print documents for your records

This transparency helps you stay informed about your spending habits and financial health.

Mobile Check Deposits Made Easy

With the mobile check deposit feature, you can deposit checks without visiting a bank branch. Simply take a picture of the check and submit it through your banking app. This feature allows you to:

- Deposit checks quickly and securely

- Access funds faster than traditional methods

- Eliminate the need for physical trips to the bank

Mobile check deposits streamline your banking experience, making it more efficient.

Access Branch Information and Reorder Checks

Need to visit a branch? Online banking provides easy access to branch hours and location information. Additionally, you can reorder checks directly through your banking platform, allowing you to:

- Find the nearest branch or ATM

- Plan your visits according to your schedule

- Order checks without the hassle of phone calls or visits

This convenience enhances your overall banking experience.

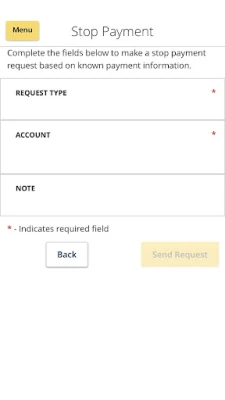

Manage Payments and Alerts

Online banking also allows you to place stop payments on checks and receive account alerts. These features enable you to:

- Prevent unauthorized transactions

- Stay updated on your account activity

- Receive notifications for important account changes

By managing payments and alerts effectively, you can maintain better control over your finances.

Monitor Your Credit Score

Understanding your credit score is vital for financial health. Many online banking platforms provide access to your credit score along with personalized tips to improve it. This feature helps you:

- Track your credit score over time

- Identify factors affecting your score

- Receive actionable advice to enhance your creditworthiness

By staying informed about your credit score, you can make better financial decisions and work towards achieving your financial goals.

Conclusion

Online banking offers a wide array of features designed to enhance your financial management experience. From checking balances and making payments to ensuring security and monitoring your credit score, these functionalities empower you to take control of your finances. Embrace the convenience of online banking and make the most of these essential tools to achieve your financial objectives.

Rate the App

User Reviews

Popular Apps

Editor's Choice