Latest Version

7.4

April 17, 2025

Banco General, S.A.

Finance

Android

0

Free

com.kinpos.movipagobg

Report a Problem

More About MoviPago BG

Streamline Your Payment Process: The Ultimate Guide to Mobile Payment Solutions

In today's fast-paced digital world, businesses need efficient and adaptable payment solutions to thrive. This article explores the benefits of mobile payment systems that enhance sales and improve customer experience. Discover how easy it is to integrate these solutions into your operations.

Quick and Simple Setup

Implementing a mobile payment system is a straightforward process. With just a few steps, you can have your payment solution up and running, allowing you to focus on what matters most—growing your business. The simplicity of setup means you can start accepting payments almost immediately, reducing downtime and increasing efficiency.

Portability and Adaptability

One of the standout features of modern mobile payment solutions is their portability. These systems are designed to be easily transported, making them ideal for businesses on the go. Whether you’re at a trade show, a pop-up shop, or simply meeting clients off-site, you can seamlessly adapt your payment system to work with smartphones or tablets. This flexibility ensures that you never miss a sale, no matter where you are.

Boost Your Sales with Chip Card Acceptance

Accepting payments via chip cards, including Visa, MasterCard, and Clave, can significantly enhance your sales potential. Customers prefer the security and convenience of chip card transactions, and by accommodating these payment methods, you can attract more customers and increase your revenue. A mobile payment solution that supports these options positions your business as modern and customer-friendly.

Compatibility with iOS and Android

Today’s consumers use a variety of devices, and your payment system should be compatible with both iOS and Android operating systems. This compatibility ensures that you can cater to a broader audience, allowing customers to pay using their preferred devices. A versatile payment solution enhances user experience and encourages repeat business.

Comprehensive Transaction Management

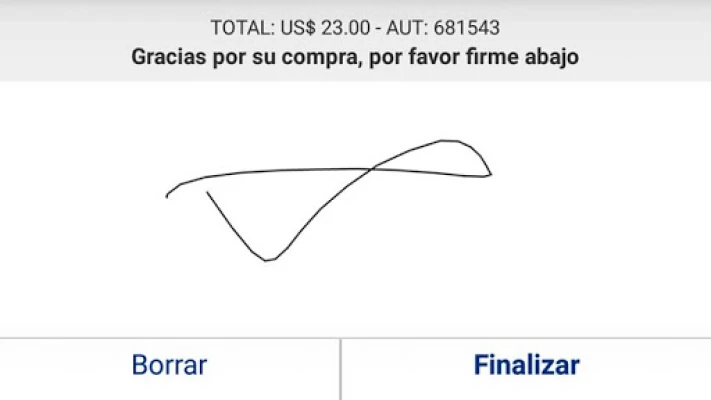

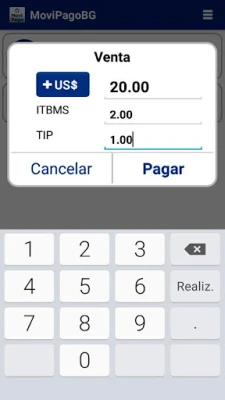

Mobile payment systems offer robust features that allow you to manage transactions efficiently. You can easily process payments, handle cancellations, and perform end-of-day closures with just a few taps. This level of control simplifies your financial management and helps you maintain accurate records, which is crucial for any business.

Email Payment Receipts for Customer Convenience

Providing customers with an email receipt after a transaction not only enhances their experience but also serves as a professional touchpoint. This feature allows customers to keep track of their purchases easily, fostering trust and encouraging future transactions. A mobile payment solution that includes email receipts can set your business apart from competitors who may not offer this convenience.

Access Transaction Reports via Online Banking

Monitoring your sales and transaction history is vital for making informed business decisions. Many mobile payment solutions offer online banking access, allowing you to view transaction reports at your convenience. This feature enables you to analyze sales trends, manage cash flow, and optimize your operations effectively.

Get Started Today!

Ready to enhance your payment processing capabilities? You can request a mobile payment solution at your preferred branch or by calling our dedicated support lines at 800-5000 or 300-5000. Don’t miss out on the opportunity to streamline your payment process and boost your sales!

In conclusion, adopting a mobile payment solution is a strategic move for any business looking to thrive in the digital age. With quick setup, portability, chip card acceptance, and comprehensive transaction management, you can elevate your customer experience and drive sales growth. Embrace the future of payments today!

Rate the App

User Reviews

Popular Apps

Editor's Choice