Latest Version

1.5.9

December 30, 2024

U.S. Bank Mobile

Finance

Android

0

Free

com.usbank.SinglePoint

Report a Problem

More About Mobile SinglePoint

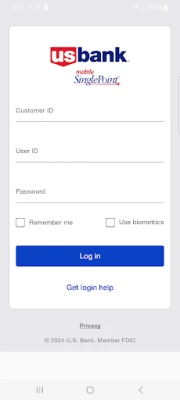

Unlock the Power of Mobile SinglePoint: Your Ultimate Banking Solution

In today's fast-paced business environment, having access to your banking information at your fingertips is essential. Mobile SinglePoint offers a comprehensive suite of features designed to streamline your banking experience. Whether you need to check balances, transfer funds, or manage transactions, this mobile application is tailored for business clients who demand efficiency and security.

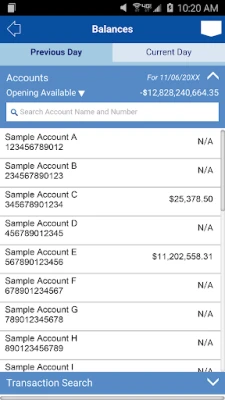

Access Your Financial Data Anytime, Anywhere

With Mobile SinglePoint, you can effortlessly view current and previous day balances or search for transactions within the Information Reporting database. This feature allows you to stay updated on your financial status, ensuring you make informed decisions quickly.

Seamless Fund Transfers Across Accounts

Transferring funds has never been easier. Mobile SinglePoint enables you to transfer funds between DDA accounts, loan accounts, and trust accounts with just a few taps. This flexibility ensures that your financial management is as dynamic as your business needs.

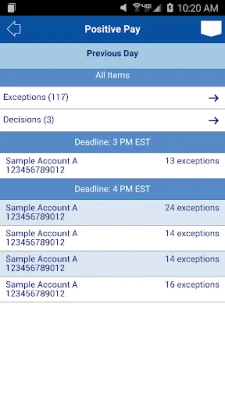

Enhance Security with Positive Pay

Protecting your business from check fraud is crucial. Mobile SinglePoint includes Positive Pay, a powerful tool that helps you make pay or return decisions quickly and confidently. You can review exceptions for multiple accounts and view check images of exceptions, giving you complete control over your transactions.

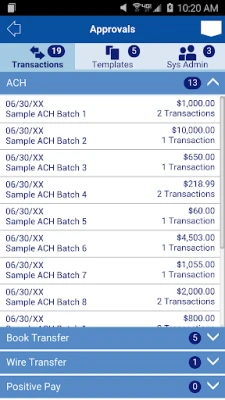

Efficient Approval Processes

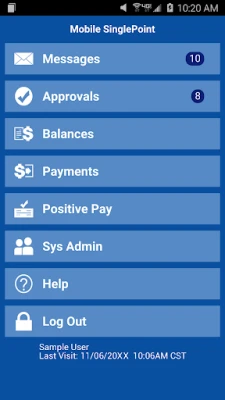

Managing approvals is a breeze with Mobile SinglePoint. You can approve ACH batches and templates, wire transfers, wire transfer templates, and repeat codes. Additionally, you can book transfers and templates, as well as approve Positive Pay decisions, all from your mobile device. This feature streamlines your workflow, allowing you to focus on what matters most—growing your business.

Quick Access to Bank Messages

Stay informed with quick access to bank messages through the Mobile SinglePoint app. This feature ensures that you receive important updates and notifications without delay, keeping you in the loop at all times.

System Administrators: Control and Security

For system administrators, Mobile SinglePoint offers robust control features. You can approve password resets and manage access to the application. The services, accounts, and access entitlements assigned to each user determine the functions available through Mobile SinglePoint, ensuring that your organization maintains a secure banking environment.

Important Notes for Users

The Mobile SinglePoint app is free to download, but be aware that your mobile carrier may charge access fees based on your individual plan. Web access is required to use the mobile app, so check with your carrier for specific fees and charges. Additionally, the app requires Android version 4.4 or later for optimal performance.

Your Security is Our Priority

At U.S. Bank, we are committed to protecting your security. Sensitive account information, including your username and password, is never stored on your mobile device. We utilize secure encryption to protect all transactions, ensuring that your financial data remains confidential and secure.

Designed for Business Clients

While the Mobile SinglePoint app is a powerful tool for business banking, it is important to note that it is designed exclusively for SinglePoint® or SinglePoint® Essentials clients. To use this mobile application, your system administrator must assign the mobile entitlement to you. For personal banking needs, search for U.S. Bank in the App Store.

Get Started with Mobile SinglePoint

For more information about Mobile SinglePoint and how it can benefit your business, contact a U.S. Bank Treasury Management Consultant. You can also send a request to TreasuryManagementSolutions@USBank.com to locate a consultant in your area. Empower your business with the tools it needs to thrive in a competitive landscape.

In conclusion, Mobile SinglePoint is not just an app; it’s a comprehensive banking solution that offers convenience, security, and efficiency. Download it today and take control of your business finances like never before.

Rate the App

User Reviews

Popular Apps

Editor's Choice