Latest Version

4.24.1

November 07, 2025

Driversnote Mileage Tracker

Finance

Android

0

Free

com.driversnote.driversnote

Report a Problem

More About Mileage Tracker by Driversnote

Maximize Your Mileage Tracking with Driversnote: The Ultimate Solution for Business and Personal Use

In today's fast-paced world, efficient mileage tracking is essential for both personal and business purposes. With Driversnote, you can effortlessly manage your mileage without the hassle of manual entry. This comprehensive guide will explore the key features of Driversnote, ensuring you make the most of this powerful tool.

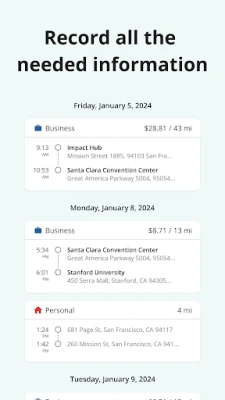

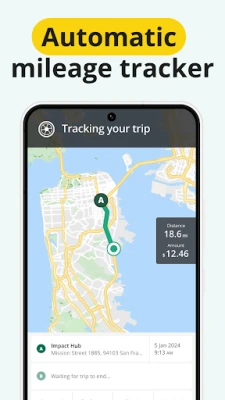

Effortless Mileage Tracking

Driversnote offers a completely automatic mileage tracking system, eliminating the need to open the app manually. Whether you drive multiple vehicles or work at different locations, this app seamlessly records all necessary information for a compliant IRS mileage log. Say goodbye to tedious tracking methods and hello to a streamlined experience.

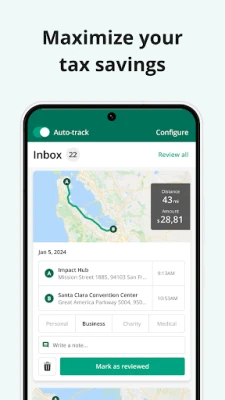

Automatic Trip Classification

One of the standout features of Driversnote is its ability to automatically classify trips as either business or personal based on your work hours. This functionality not only saves time but also helps you maximize your tax savings. Additionally, you can record and categorize medical and charity miles, ensuring you capture every possible deduction.

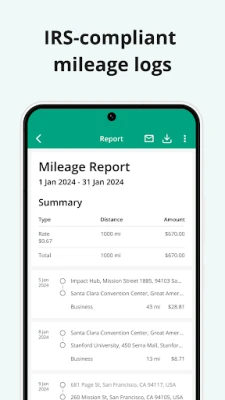

Comprehensive Reporting for IRS Compliance

Generating IRS-compliant mileage logs has never been easier. Driversnote allows you to create detailed reports for employee reimbursement or IRS tax claims. If you prefer claiming deductions using the actual expenses method, you can generate reports that highlight the percentage of miles driven for business purposes. Furthermore, you can create separate reports for different vehicles and workplaces, making organization a breeze.

Customizable Features to Suit Your Needs

Driversnote understands that every user has unique requirements. If you're going on holiday, you can pause auto-tracking for as many days as needed. Additionally, you can customize your reimbursement rate if it differs from the IRS standard. The app also allows you to record odometer readings, set reporting reminders, save frequently visited addresses, and add notes to your recorded trips, ensuring you have all the information you need at your fingertips.

Driversnote for Teams: Streamlined Business Reimbursement

For businesses, Driversnote offers a robust solution for mileage reimbursement programs. Managers can invite and remove users, while employees can automatically track their mileage. The app enables employees to create and share consistent car logbooks with their managers, who can easily review and approve reimbursement claims in one simple overview. Importantly, privacy is maintained, as managers can only see the trips reported by employees.

Access Driversnote from Your Desktop

With Driversnote for web, you can bring all the app's functionality to your desktop. Review your trips, edit details effortlessly, and add any trips you may have forgotten to record. Generating mileage reports is straightforward, ensuring you have everything you need for accurate reporting.

iBeacon Technology: Track Miles with Precision

For those who prefer tracking miles only on specific vehicles, Driversnote offers iBeacon technology. By placing an iBeacon in your car, the app will automatically record miles every time you enter or leave your vehicle. Plus, you can receive a free iBeacon when you sign up for the annual Basic subscription, enhancing your tracking experience.

Privacy and Security: Your Data is Safe

At Driversnote, privacy is a top priority. The company never sells user data, ensuring that your information remains secure within your account. You can use the app with confidence, knowing that your data is protected.

Exceptional Support at Your Fingertips

If you have questions or need assistance, Driversnote provides a comprehensive Help Center accessible directly from the app. Additionally, their dedicated support team is always ready to help you at support@driversnote.com. Whether you need a quick answer or in-depth assistance, support is just a click away.

Conclusion: Elevate Your Mileage Tracking Experience

Driversnote is the ultimate solution for anyone looking to simplify their mileage tracking process. With its automatic tracking, trip classification, comprehensive reporting, and customizable features, it caters to both personal and business needs. Embrace the future of mileage tracking and maximize your tax savings with Driversnote today!

Rate the App

User Reviews

Popular Apps

Editor's Choice