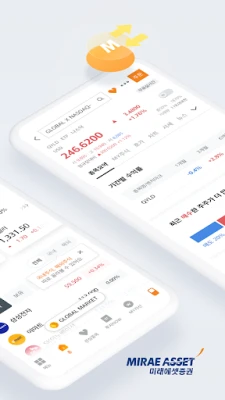

Latest Version

7.6.2

June 21, 2025

Mirae Asset Securities Co., Ltd.

Finance

Android

0

Free

com.miraeasset.trade

Report a Problem

More About 미래에셋증권 M-STOCK

Comprehensive Guide to Investment Products and Features

In today's dynamic financial landscape, investors have access to a wide array of products and features that cater to diverse investment strategies. This article delves into the various investment options available, key functionalities of modern trading platforms, and essential information for investors to consider before diving into the market.

Diverse Investment Products

Investors can explore a multitude of trading options, including:

- Domestic Stocks: Engage in trading local equities that reflect the performance of the national economy.

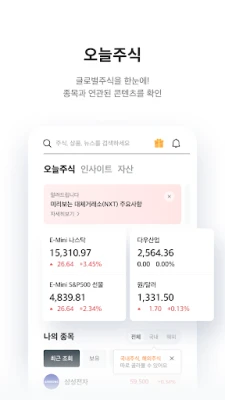

- International Stocks: Access global markets and diversify your portfolio with foreign equities.

- Futures and Options: Participate in domestic and international futures and options trading for hedging and speculation.

- Exchange-Traded Funds (ETFs) and Exchange-Traded Notes (ETNs): Invest in a basket of securities or debt instruments that track an index.

- Warrants: Acquire rights to purchase shares at a predetermined price.

- Gold and Precious Metals: Trade in physical gold and other precious metals as a hedge against inflation.

- Retirement Accounts: Manage personal and corporate pension plans effectively.

- Mutual Funds: Invest in professionally managed portfolios that pool funds from multiple investors.

- Equity-Linked Securities (ELS) and Debt-Linked Securities (DLS): Explore structured products that offer returns linked to the performance of underlying assets.

- Commercial Paper: Invest in short-term unsecured promissory notes issued by companies.

- Repurchase Agreements (RPs): Engage in short-term borrowing and lending transactions.

- Individual Savings Accounts (ISAs): Benefit from tax advantages while saving for the future.

- Bonds: Invest in fixed-income securities that provide regular interest payments.

Key Features of Modern Trading Platforms

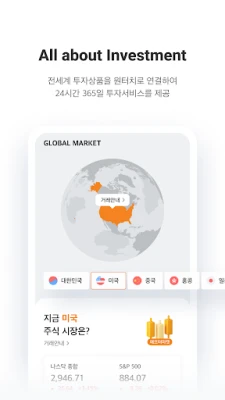

1. Global Investment Platform

Access a comprehensive range of investment products, including domestic and international stocks, pensions, and various financial instruments, all from a single platform. Enjoy 24/7 trading capabilities that empower you to make informed decisions at any time.

2. Light/Dark Mode Design

Experience a user-friendly interface that automatically switches between light and dark modes based on the time of day, ensuring a comfortable trading environment tailored to your preferences.

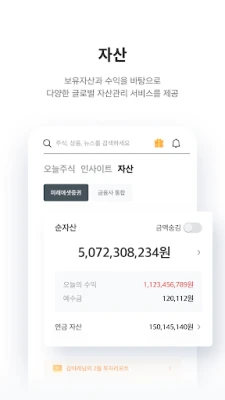

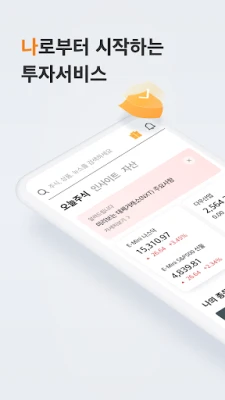

3. Personalized Investment Experience

Utilize the MY screen feature to easily access your investment information, including balances and asset details. Quickly navigate to relevant functions with just a click, enhancing your overall investment experience.

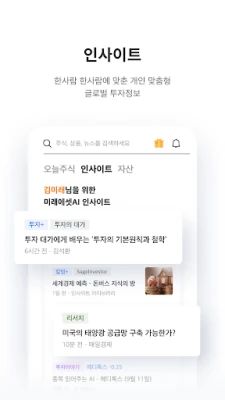

4. Integrated Search and Feed

Streamline your research process with a unified search function that allows you to find desired domestic and international stocks, investment information, and news using a single keyword. Stay updated with a consolidated feed that gathers relevant news and financial insights without the hassle of searching individually.

5. Investor Community

Connect with fellow investors who share your interests. Engage in discussions about specific stocks and exchange investment ideas and insights within a dedicated community forum.

Permissions and Important Notices

When using the trading platform, certain permissions are required:

- Phone (Mandatory): Your phone number is collected for order processing and authentication purposes. It is also used to connect you to customer service within the app.

- Notifications (Optional): Enable push notifications to receive updates and background services.

- Camera (Optional): Use the camera for identity verification during remote account openings and for QR code authentication on the platform.

- Display Over Other Apps (Optional): This permission is used for visible ARS functionality.

Note that failure to agree to mandatory permissions may restrict your access to services. While optional permissions can be declined, certain features may be limited without them. The information provided is based on Android version 14, and access permissions may vary depending on your smartphone's operating system.

Investor Cautions

Before investing, it is crucial to:

- Listen to product explanations and read the product brochures and terms and conditions thoroughly.

- Understand that these financial products are not protected under the Depositor Protection Act.

- Be aware of potential principal losses (0-100%) due to asset price fluctuations, exchange rate changes, and credit rating downgrades, which are the investor's responsibility.

- Review the commission rates for domestic stocks, which range from 0.013% to 0.14% online and 0.49% offline (subject to change; refer to the website for details).

- Examine the commission rates for international stocks, which vary from 0.25% to 0.45% online and 0.5% to 1.0% offline (country-specific fees may apply; check the website for more information).

Understanding the Investment Accounts

The Brokerage-type ISA allows for the protection of up to 50 million KRW for financial products that are managed under the Depositor Protection Act. Taxation criteria and methods may change in the future, and early termination or notification of non-compliance by the National Tax Service may result in tax penalties.

The DC/IRP Retirement Pension is also protected under the Depositor Protection Act, with a limit of 50 million KRW for accumulated funds. Taxation criteria and methods are subject to change, and withdrawals outside of retirement may incur a 16.5% tax on the principal and earnings that received tax deductions.

Investors should be aware that the allocation results for public securities may vary based on the multiple allocation method, and significant principal losses are possible. For online trading of gold, the commission rate is set at 0.15%.

In conclusion, understanding the diverse investment products and features available, along with the necessary precautions, can empower investors to make informed decisions in their financial journey.

Rate the App

User Reviews

Popular Apps

Editor's Choice