Latest Version

01.04.171

April 15, 2025

Keeper Tax, Inc.

Finance

Android

0

Free

com.keepertax

Report a Problem

More About Keeper

Maximize Your Tax Savings with Keeper: The Ultimate Tax Solution

In today's fast-paced financial landscape, managing taxes efficiently is crucial for individuals and small business owners alike. With Keeper, you can streamline your tax filing process while maximizing your deductions and credits. This article explores the key features of Keeper and how it can benefit you.

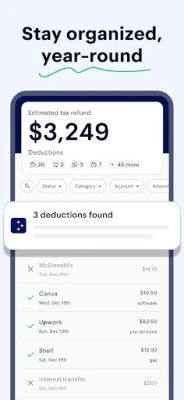

Instant Personalization by Connecting Your Bank

One of the standout features of Keeper is its ability to connect directly to your bank account. This integration allows for instant personalization, tailoring the tax experience to your unique financial situation. By analyzing your transactions, Keeper identifies potential deductions and credits that you may not have considered, ensuring you get the most out of your tax return.

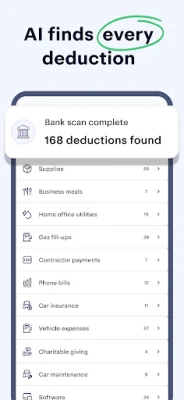

Uncover Tax Breaks Automatically

Keeper goes beyond basic tax preparation by automatically uncovering tax breaks that you qualify for. With over 300 types of credits and deductions available, this tool ensures that you don’t leave any money on the table. Whether you’re a small business owner, a self-employed freelancer, or a 1099 independent contractor, Keeper helps you identify deductible business expenses from your past transactions, maximizing your potential refund.

Comprehensive Filing Support for All States

Filing taxes can be a daunting task, especially when considering the complexities of state and federal regulations. Keeper simplifies this process by supporting filings with the IRS and all 50 states. Whether you have W-2 income, 1099 earnings, or investment income, Keeper provides the necessary tools to file accurately and efficiently.

Smart Audit Protection for Peace of Mind

Tax audits can be stressful and time-consuming. Keeper includes smart audit protection, giving you peace of mind as you navigate your tax obligations. This feature ensures that you are prepared in the event of an audit, providing you with the necessary documentation and support to defend your claims.

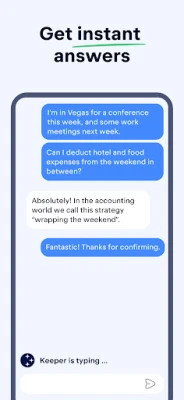

Dedicated Tax Assistant for Personalized Support

With Keeper, you’re not just getting software; you’re gaining access to a dedicated tax assistant. This professional is available to answer your questions and provide guidance throughout the tax filing process. Whether you need clarification on deductions or assistance with complex tax scenarios, your assigned tax assistant is there to help.

Robust Security Measures to Protect Your Information

Security is a top priority for Keeper. Utilizing SSL 256-bit encryption—the same security protocol employed by banks—Keeper ensures that your sensitive personal information is fully protected. Importantly, Keeper does not store your online banking credentials or sell your information to third parties, allowing you to file your taxes with confidence.

Why Keeper is Ideal for Small Business Owners and Freelancers

For small business owners and self-employed individuals, tax time can be particularly challenging. Keeper is designed with these users in mind, automatically identifying tax-deductible business expenses from your transaction history. This feature not only saves time but also maximizes your tax savings, making it an invaluable tool for anyone managing their own business finances.

Disclaimer and Important Links

It’s important to note that Keeper does not represent a government entity. For specific tax requirements, always refer to the official IRS website at https://www.irs.gov as well as your state and local tax authorities.

For more information on Keeper’s terms of use, visit https://www.keepertax.com/terms. To understand how your data is handled, please review the privacy policy at https://www.keepertax.com/privacy.

Conclusion

In conclusion, Keeper is a powerful tool for anyone looking to simplify their tax filing process while maximizing deductions and credits. With features like bank integration, automatic tax break identification, comprehensive filing support, and dedicated assistance, Keeper stands out as a premier choice for small business owners and freelancers. Take control of your taxes today and ensure you’re getting the most out of your financial situation with Keeper.

Rate the App

User Reviews

Popular Apps

Editor's Choice