Latest Version

1.0.82

December 13, 2024

Bangkok Bank PCL

Finance

Android

0

Free

com.bangkokbank.cashdigiitcp

Report a Problem

More About iCash–Transaction Banking

Comprehensive Account and Payment Services for Businesses

In today's fast-paced financial landscape, businesses require robust account and payment services to manage their cash flow effectively. This article delves into the essential services offered by Bangkok Bank, focusing on account management, payment solutions, liquidity management, alerts, security, and customer self-administration.

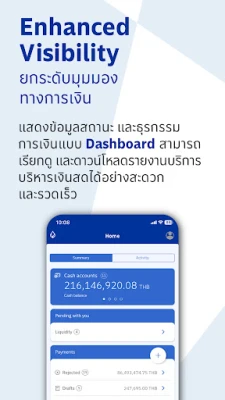

Account Services: A Detailed Overview

Understanding your financial position is crucial for making informed business decisions. Bangkok Bank provides comprehensive account services that include:

- Cash Position Analysis: Gain insights into your cash flow, including details of your loan and investment positions, such as mutual funds and fixed deposits.

- Credit Facilities: Access information regarding available credit facilities and funds.

- Foreign Exchange Rates: Stay updated with counter foreign exchange rates, including special offers and forward contracts available through the bank.

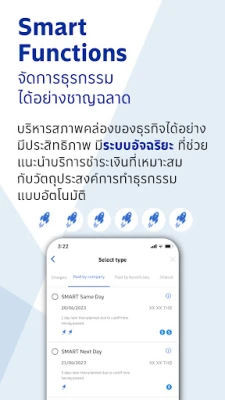

Streamlined Payment Services

Efficient payment processing is vital for maintaining smooth business operations. Bangkok Bank offers a range of payment services designed to meet your needs:

Standard Electronic Payments

- Book Transfers: Easily transfer funds between your Bangkok Bank accounts, whether they are your own or third-party accounts.

- Payroll Services: Simplify employee salary payments with our payroll solutions.

- Direct Credit Payments: Make payments directly to your business counterparts with ease.

- Domestic Fund Transfers: Utilize SMART/BAHTNET for efficient transfers to other banks.

- PromptPay: Leverage this service for quick and easy payments.

- International Outward Fund Transfers: Facilitate global transactions seamlessly.

Smart Payment Advisory Services

Once you specify the details and objectives of your transaction, our system automatically presents the best transaction options, ensuring you make informed decisions.

Customer Self-Service Options

- Stop/Hold Payment Instructions: Manage your payments effectively with self-service options.

- Transaction Advice: Include additional payment information in your payment advice for clarity.

- Beneficiary Validation: Ensure the accuracy of beneficiary account details before processing transactions.

- Counter Foreign Exchange Transactions: Make transactions using competitive counter foreign exchange rates, special rates, and forward contracts.

Effective Liquidity Management

Maintaining liquidity is essential for any business. Bangkok Bank offers several reports to help you manage your cash flow:

- Cash Aggregation Report: Monitor intraday sweeping and end-of-day sweeping for better cash management.

- Intercompany Lending Report: Keep track of lending activities between your company’s subsidiaries.

- Cash Investment Report: Analyze intraday and end-of-day savings account sweeps to optimize your cash reserves.

- Sweep Structure Summary Report: Get a comprehensive summary of all linked accounts within the system.

Alerts and Reports for Enhanced Oversight

Stay informed with timely alerts and reports:

- Transaction Alerts: Receive notifications for transactions requiring approval, ensuring you maintain control over your finances.

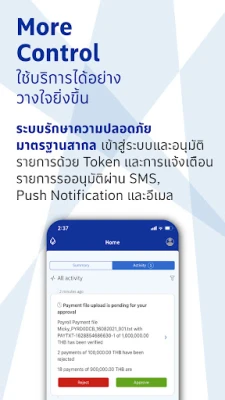

Robust Security Measures

Security is paramount in financial transactions. Bangkok Bank employs advanced security features, including:

- Digital Token: Enhance security with a digital token for secure transactions.

- Advanced Biometric Authentication: Utilize biometric technology for an added layer of security.

Customer Self-Administration Features

Empower yourself with self-administration capabilities:

- Customer Administration Management: Easily manage user logins and reset passwords as needed.

- Customer Preference Management: Customize your experience by selecting your preferred language and updating your profile picture.

Contact Us for More Information

For further inquiries or assistance, please reach out to our Corporate Service Center at 0 2031 7888. Our team is available every day from 08:00 a.m. to 08:30 p.m. to provide you with the support you need.

In conclusion, Bangkok Bank offers a comprehensive suite of account and payment services tailored to meet the diverse needs of businesses. With a focus on efficiency, security, and customer empowerment, you can trust Bangkok Bank to support your financial management effectively.

Rate the App

User Reviews

Popular Apps

Editor's Choice