Latest Version

1.1.0

October 22, 2025

ICICI PRUDENTIAL ASSET MANAGEMENT COMPANY LIMITED

Finance

Android

0

Free

com.ipru.distributor

Report a Problem

More About i-Invest iPru Partner

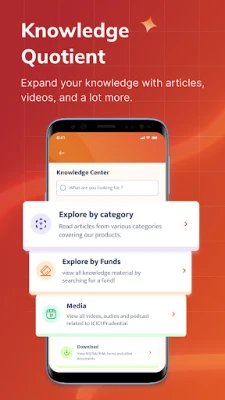

Unlocking the Power of ARN-Based Login for MFDs: A Comprehensive Guide

In the fast-paced world of mutual fund distribution, efficiency and accessibility are paramount. The introduction of ARN-based login systems has revolutionized how Mutual Fund Distributors (MFDs) manage their operations. This article delves into the key features of this innovative portal, designed to enhance the MFD experience and drive business growth.

Seamless Access with ARN-Based Login

MFDs can now enjoy a streamlined login process using their ARN code and password, which they set during registration on the new portal. This feature not only simplifies access but also ensures that MFDs can quickly engage with their accounts without unnecessary delays. The user-friendly interface allows for a smooth transition into the platform, enabling MFDs to focus on what truly matters: serving their clients.

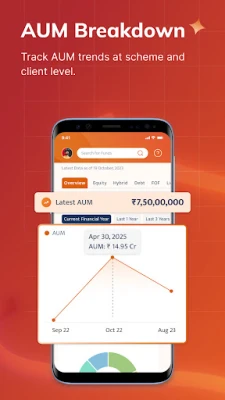

Comprehensive Business Summary at Your Fingertips

One of the standout features of the new portal is the ability for MFDs to view their overall Assets Under Management (AUM) and Systematic Investment Plan (SIP) book. This comprehensive business summary provides valuable insights into performance metrics, allowing MFDs to analyze data at various levels, including fund category, scheme, and client. By having this information readily available, MFDs can make informed decisions that drive their business forward.

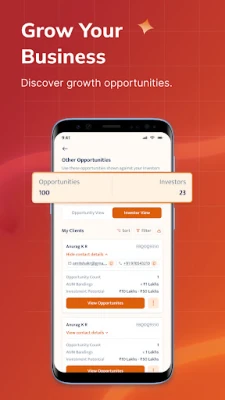

Identifying Growth Opportunities

The portal is designed to empower MFDs to grow their business by identifying opportunities within their client base. By analyzing client portfolios and investment patterns, MFDs can tailor their offerings to meet specific needs, ultimately enhancing client satisfaction and loyalty. This proactive approach not only fosters stronger relationships but also opens doors to new business avenues.

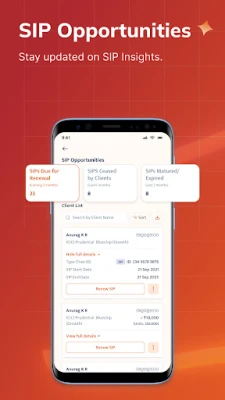

One-Stop SIP Management for Enhanced Client Service

Managing systematic transactions has never been easier. The portal offers a one-stop solution for MFDs to view all active SIPs and existing mandates specific to their investors. This feature allows MFDs to assist clients in modifying or pausing their active SIPs with ease. By providing this level of service, MFDs can ensure that their clients feel supported and informed throughout their investment journey.

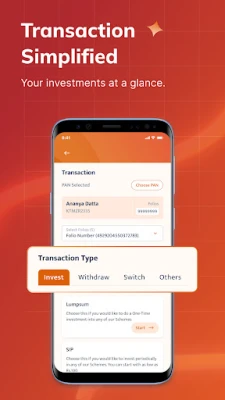

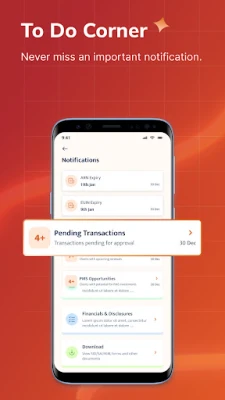

Efficient Transaction History Access

Keeping track of transactions is crucial for MFDs, and the new portal simplifies this process. MFDs can access the current status of all transactions, ensuring they stay updated on pending activities. Additionally, the ability to send reminders for pending transactions helps maintain client engagement and encourages timely decision-making. This feature not only enhances operational efficiency but also strengthens client relationships through consistent communication.

Data Transparency for Multi-Broker Folios

In an era where data transparency is essential, the portal allows MFDs to view portfolios filtered based on their ARN, even for multi-broker folios. This capability ensures that MFDs have a clear understanding of their clients' investments across different platforms, enabling them to provide tailored advice and recommendations. By fostering transparency, MFDs can build trust and credibility with their clients, which is vital for long-term success.

Conclusion: Embrace the Future of MFD Operations

The introduction of ARN-based login and the accompanying features marks a significant advancement in the way MFDs operate. By leveraging these tools, MFDs can enhance their efficiency, improve client service, and ultimately drive business growth. As the financial landscape continues to evolve, embracing these innovations will be key to staying competitive and meeting the ever-changing needs of clients.

In summary, the new portal not only simplifies access and management for MFDs but also empowers them to make data-driven decisions that foster growth and enhance client relationships. By utilizing these features, MFDs can position themselves for success in a dynamic market.

Rate the App

User Reviews

Popular Apps

Editor's Choice