Latest Version

8.0.227

January 18, 2025

Keepsoft

Finance

Android

0

Free

com.keepsoft.homebuh.lite

Report a Problem

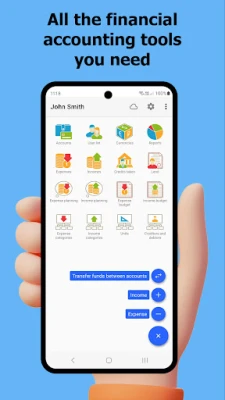

More About Home Bookkeeping Money Manager

Mastering Personal Finance: A Comprehensive Guide to Accounting for Expenses and Income

Managing personal finances can often feel overwhelming, but with the right tools and strategies, you can take control of your financial future. This article delves into effective methods for accounting for expenses and income, ensuring you stay on top of your budget and financial goals.

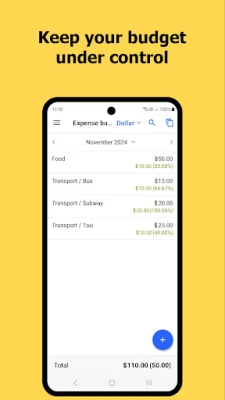

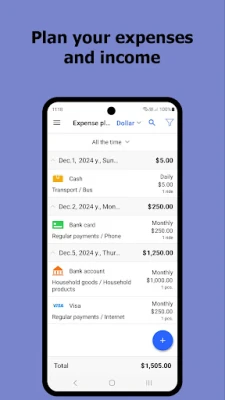

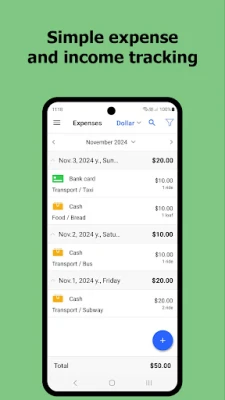

Track Your Expenses and Income Effectively

To maintain a healthy financial life, it’s crucial to record all your expenses and income. This practice not only helps you keep your personal finances in check but also enables you to create a realistic budget and plan for future financial needs. By diligently tracking your financial activities, you can identify spending patterns, uncover areas for savings, and make informed decisions about your money.

Automate Your Financial Tracking with Bank SMS Recognition

One of the most tedious aspects of budgeting is manually entering transactions. Fortunately, many modern applications can automatically recognize and log transactions from bank SMS notifications. This automation streamlines your budgeting process, allowing you to focus on analyzing your finances rather than getting bogged down in data entry. With this feature, you can quickly and efficiently keep your financial records up to date.

Utilize Convenient Widgets for Quick Entries

In today’s fast-paced world, convenience is key. Many financial management applications offer user-friendly widgets that allow you to add new entries with just a single touch. This feature simplifies the process of logging expenses and income, making it easier to stay consistent with your financial tracking. Whether you’re on the go or at home, these widgets ensure that you can manage your finances effortlessly.

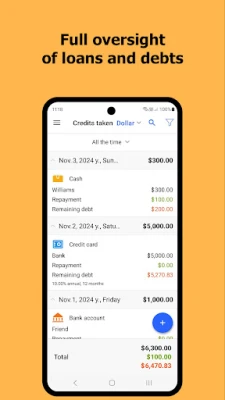

Manage Loans and Debts with Ease

Keeping track of loans and debts is essential for maintaining financial health. A robust financial application can help you monitor your loans and any money you’ve lent out. It automatically calculates payment schedules, taking interest into account, and adjusts for early repayments. This functionality not only helps you stay organized but also ensures that you are aware of your financial obligations at all times.

Access Financial Accounting Across Multiple Devices

In an increasingly digital world, having access to your financial information on various devices is crucial. Whether you prefer using a smartphone, tablet, or desktop computer, a good financial management application allows you to track your budget seamlessly across all platforms. This flexibility ensures that you can manage your finances anytime, anywhere, making it easier to stay on top of your financial goals.

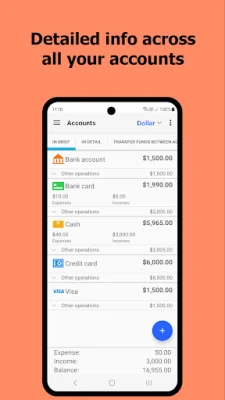

Multi-Currency and Multi-Account Support

In our global economy, managing finances in different currencies and across various accounts is a common necessity. A comprehensive financial application supports all currencies and allows you to manage multiple accounts, including bank accounts, credit cards, cash, and electronic money. This feature is particularly beneficial for individuals who travel frequently or engage in international transactions, as it simplifies the process of tracking and converting currencies.

Visualize Your Financial Data with Reports and Charts

Understanding your financial situation is easier when you can visualize your data. Many financial management tools offer visual reports, charts, and graphs that analyze your expenses and income. By comparing reports from different periods, you can gain insights into your spending habits, track account balances, and make informed decisions about your financial future. This visual representation of your finances can motivate you to stick to your budget and achieve your financial goals.

Ensure the Security of Your Financial Data

When it comes to managing your finances, security is paramount. Reputable financial applications provide robust data protection measures, including backup systems and options for data storage. You can choose to store your information on your device or in secure cloud services like Google Drive or Dropbox. This ensures that your financial data remains accessible only to you, giving you peace of mind as you manage your personal finances.

Account for Precious Metals and Cryptocurrency Investments

As investment options diversify, it’s essential to account for all your assets, including precious metals and cryptocurrencies. A comprehensive financial application allows you to track investments in gold, silver, platinum, and palladium, as well as evaluate your cryptocurrency savings. By incorporating these assets into your financial management strategy, you can gain a holistic view of your wealth and make informed investment decisions.

Conclusion: Take Control of Your Financial Future

Accounting for expenses and income is a vital aspect of personal finance management. By utilizing modern tools and strategies, you can streamline your budgeting process, automate routine tasks, and gain valuable insights into your financial health. Whether you’re managing loans, tracking multiple currencies, or investing in precious metals and cryptocurrencies, the right financial application can empower you to take control of your financial future. Start today, and watch as your financial confidence grows!

Rate the App

User Reviews

Popular Apps

Editor's Choice