Latest Version

Version

3.0.2

3.0.2

Update

July 18, 2025

July 18, 2025

Developer

KASIKORNBANK PCL.

KASIKORNBANK PCL.

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.kasikornbank.makebykbank

com.kasikornbank.makebykbank

Report

Report a Problem

Report a Problem

More About MAKE by KBank แอปจัดการเงิน

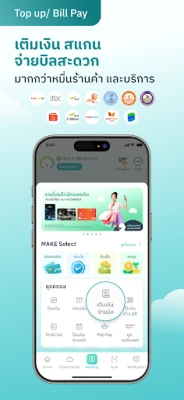

MAKE by KBank แอปพลิเคชันที่รวมการจัดการเงินและการทำธุรกรรมไว้ครบจบในที่เดียว หนึ่งบัญชีแบ่งได้เป็นหลายกระเป๋าไม่จำกัด บัญชีเงินฝากดอกเบี้ยสูง 1.5% ต่อปี สำหรับ 500,000 บาทแรก และ 0.45% สำหรับส่วนที่เกิน 500,000 บาท ดูดอกเบี้ยได้รายวัน ไม่ต้องมีบัญชีธนาคารกสิกรก็สมัครได้ มาพร้อมกับฟีเจอร์มากมายที่ช่วยให้คุณจัดการและเก็บเงินได้ง่ายขึ้น

Master Your Finances with MAKE by KBank: The Ultimate Money Management App

Managing your finances has never been easier. With MAKE by KBank, you can handle all your financial transactions seamlessly. Whether you need to deposit, withdraw, transfer funds, pay bills, top up your account, or link with PromptPay, this app provides a comprehensive solution for all your financial needs.Introducing Cloud Pocket: Simplifying Money Management

One of the standout features of MAKE by KBank is Cloud Pocket, designed to streamline your financial management. You can set goals, assign names, add images, and even invite friends to join you in your savings journey. Cloud Pocket offers four unique types to cater to your specific financial habits:1. Classic Cloud Pocket

The Classic Cloud Pocket is perfect for those who want to set spending limits. You can allocate your budget on a daily, weekly, or monthly basis, allowing you to manage your finances according to your preferences.2. Wishlist Cloud Pocket

With the Wishlist Cloud Pocket, you can automatically calculate how much you need to save each month to reach your financial goals. This feature allows you to add images and messages to a Polaroid frame each month when you hit your savings target, providing motivation and inspiration to keep saving.3. Saving Cloud Pocket

The Saving Cloud Pocket helps you track your savings streak by displaying the number of consecutive days, weeks, or months you have saved. It includes a hidden balance feature and a fun random "Nong MAKE Stamp Collection" to make the saving process more enjoyable.4. Credit Card Cloud Pocket

The Credit Card Cloud Pocket is designed to help you manage your credit card expenses effectively. It allows you to track your spending and prepare funds for timely payments. You will receive reminders to add expenses and make payments, ensuring you never miss a due date.Additional Features for Enhanced Financial Management

MAKE by KBank offers several additional features to help you manage your finances more effectively:Expense Summary

Get a clear overview of your income and expenses each month with the Expense Summary feature. This tool provides insights into your financial habits, helping you make informed decisions.Custom Categories

Create up to nine custom categories to track your spending. This feature allows you to categorize your expenses according to your needs, making it easier to monitor your financial activities.Cloud Chat

The Cloud Chat feature displays your transaction history in a chat format, making it easy to review past transactions. You can attach images and take notes, ensuring you have all the information you need at your fingertips.Get Started with MAKE by KBank Today

Managing your money has never been more straightforward. To start using MAKE by KBank, simply register by verifying your identity through the K PLUS app or at a KBank ATM with your ID card if you don’t have a KBank account. With an attractive interest rate of 1.5% for the first 500,000 Baht and 0.45% for any amount exceeding that, MAKE by KBank also offers an e-Savings account that allows you to earn interest daily without needing a KBank account to sign up.Conclusion: Take Control of Your Finances

In today’s fast-paced world, having a reliable money management tool is essential. MAKE by KBank not only simplifies your financial transactions but also empowers you to take control of your savings and spending. Download the app today and start your journey towards better financial management. Whether you’re saving for a dream vacation, managing daily expenses, or planning for the future, MAKE by KBank is your go-to solution for all your financial needs.Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

LINE: Calls & MessagesLINE (LY Corporation)

Rogue SlimeQuest Seeker Games

PrivacyWallPrivacyWall

Roman empire games - AoD RomeRoboBot Studio

CHANCE THE GAMETake Your Chance !

XENO; Plan, AutoSave & InvestXENO Investment

Dot PaintingChill Calm Cute

Nova BrowserJef Studios

Throne WishlistThrone.com

Trovo - Watch & Play TogetherTLIVE PTE LTD

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD